However, we never get an establishing shot of the trashcan, so it’s not totally clear whether they are actually discovering these bags on the sidewalk. After all, they are janitors and thus have access to the trash cans inside the bank, and being a union, they probably have an axe to grind (like applying pressure on Chase for higher wages and benefits for custodial staff).

chase

Top 5 Online Banks For Customer Satisfaction

You can’t please all of the people all of the time, but you can try. Here’s a list of the online banks that are trying the hardest.

Reclaim Unnecessary Credit Cards' Unnecessary Foreign Transaction Fees

Several major credit card companies were successfully and recently class-actioned for charging unnecessary fees for overseas transactions.

Chase Refuses To Cash Check Without Thumbprint

Chase refused to let Ramsey cash his check without a thumbprint, even though he had called and verified that two forms of identification would suffice. The teller insisted that a thumbprint was required by a “rule.” How official sounding. Ramsey spoke with Heath, the bank manager.

- “Heath informed me that due to the Patriot Act, all negotiable instruments required a fingerprint as proof of my status as a holder in due course.”

Ah, the Patriot Act, that vague catch-all excuse for every vigilante action under the American sun.

Senate Hearing Attacks Credit Cards' Ridiculous Fees

A Senate hearing today called up executives in the credit card industry to defend their anti-consumer practices, their explanations provoking laughter from the crowd.

Sorry, Chase Does Not Accept $50,000 Checks From God

Police were called to Chase Bank, 1800 E. 80th, about 4 p.m. after Russell tried to cash the check, which was written on an invalid Bank One check with no imprint, White said. Russell had several other checks with him that were signed the same way but made out in different dollar amounts, including one for $100,000.

Who knew that the Lord and Savior had to worry about ID theft?—MEGHANN MARCO

Chase Deactivates Your Savings Account If You Don't Use It For 60 Days

If you don’t use your Chase online savings count for 60 days, it becomes deactivated. Which could be a big problem if you were counting on making a transfer to cover checks that you just wrote. What’s worse is that they don’t send you any notification that they froze your account. At least that’s how it goes according to reader Thomas’ complaint:

Chase Raises Reader’s APR To 148.14%

Chase credit card raised Lee’s effective APR to 148.14%

EXCLUSIVE: CHASE Screws Struggling Card Members Harder

Chase yesterday decided to put the screws harder to its most struggling credit card customers, an insider tells us.

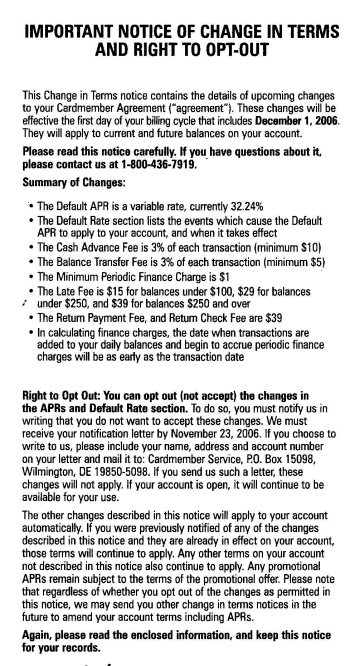

Beat Chase’s New 32.4% Default APR

If you’re a Chase credit card holder and you received a “Change of Terms” notice in your recently mail, congratulations.

How Do You Prove You’re Not Dead?

Continuing our foray into the consumer macabre, a reader complains about being dead.

Tiny Checks, Big Scam

Banks are sharing their member lists — and account information — with unscrupulous third party marketers like the Trilegiant corporation.

Suck My Pricematch, Chase Bank

It certainly didn’t help John’s mood that before reaching the specialist, Chase suspended his account. Chase stopped service because John called in from an “unrecognized number” (his office line) and was disconnected mid-department transfer. [More]

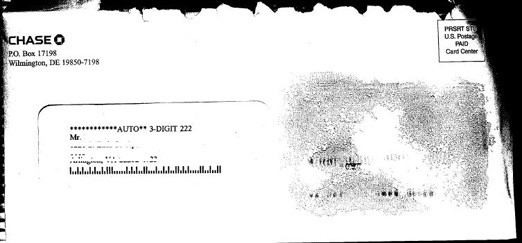

Chase Pitches Imaginary Credit Card

Here’s a great new trick to get consumers to fall for your credit card offer. Smudge the outside of the envelope with the outline of a credit card so they think there’s one inside. Then when they open it, there isn’t one! But hey, you got them to open the envelope, right? And that’s half the battle when you’re pitching 29% APRs.