Charles says he first canceled his Chase credit card in 2008, but was surprised to find it was still open a year later. He canceled it again, but Chase kept hassling him with mailings, and when he called to see what was up he was told the company was keeping in contact with old customers to comply with the CARD act. [More]

chase

Chase Sets Early Payment Trap For Mortgage Customers, Too

Chase’s statement cycle trap isn’t just set for credit card customers. Mortgage and loan customers can be charged a fee for paying too early, too. Serves you right for trying to be proactive and plan ahead! Dana says that Chase punished her for setting up her automatic monthly payment to send on the 30th of the month instead of the 1st, and charged her $52.96 for two months’ transgressions. [More]

Chase Mistakenly Says My Rewards Balance Is In The Negatives

Daniel says Chase promised him to retroactively give him rewards on past purchases after he switched account types, but somehow he ended up with a negative rewards balance. He says he’s got more than $600 in rewards coming to him, but Chase won’t budge and give Dave what he believes he’s entitled to. He writes: [More]

Reach Chase Executive Customer Service

Here’s another Chase Executive Customer Service contact to add to our collection: [More]

Chase Cannot Find A Human Being To Read A Check

Chase has these fancy new ATMs that take checks without envelopes. It scans the check and blah, blah, robots, science, a better tomorrow. The interesting thing about them is that reader Angela says that when the ATM makes an error, Chase mails the check back to you so that you, the customer, can take it to a branch bank and show it to a human being. Apparently, even though Chase already has the check in its possession — it cannot find a human being to read a check. [More]

Chase Gave Me A Credit Card I Didn't Want

Steven writes about how he feels he was tricked into opening a credit card he didn’t want, then still received the card even after he was vehement about canceling his unauthorized application. [More]

JP Morgan Chase Yanks Mandatory Binding Arbitration Clause From Credit Card Contracts

In response to legal and political pressure, JP Morgan Chase is removing the mandatory binding arbitration clause from its credit card contracts. Customers will receive a new member agreement reflecting the change first quarter 2010.

Chase Lost My Paycheck, Won't Pay Canceled Check Fee

Katy is a poster child for the benefits of direct deposit, as well as deposit receipt-keeping.

Chase Raises Interest Rate On Closed Account

David closed his Chase credit card account instead of accepting a rate increase earlier this year. That should have been the end of it, but it turned out Chase later went ahead and increased the interest rate anyway.

Chase Thinks Reader Has Amazing Bilocating Credit Card

Chase’s fraud department apparently thinks that Jake is lying. A few weeks ago, they called him about some suspicious activity on his credit card. Jake and his wife verified that the transactions were neither his nor his wife’s, the Chase representative instructed them to destroy their cards, and that was that. Until a week and a half later, when a fraud specialist called them back to deny their fraud claim, claiming repeatedly that his story “doesn’t jive.”

BofA, Chase To Limit Overdraft Fees

Sometimes lawmakers can cause reform just by threatening legislation. That seems to be the case with Sen. Chris Dodd making Bank of America and Chase flinch by proposing legislation that would force banks to get customers’ permission to charge them overdraft fees.

Banks Introduce Comprehensible Credit Cards Before Reforms Apply

Instead of waiting around for the CARD act, which restricts the ways they are allowed to squeeze money from customers, some banks are introducing simpler, CARD-compliant credit cards meant to be less confusing to consumers, and maybe make us all hate the credit card industry a little less.

Banks Once "Too Big To Fail" Now Even Bigger After Meltdown

Remember those banks that the federal government bailed out because they were “too big to fail?” Well…after mergers and bank takeovers (some encouraged by the government) those banks bailed out because they were “too big to fail” now are much bigger. JP Morgan Chase and Bank of America combined now control more than 20% of all bank deposits in the United States.

![Despite Refinance, Homeowner Evicted And House Sold [Updated]](../../../../consumermediallc.files.wordpress.com/2012/06/082009-005-yard.jpg?w=158&h=158&crop=1)

Despite Refinance, Homeowner Evicted And House Sold [Updated]

Imagine coming home to find the sheriff on your doorstep with an eviction notice, and then being given 3 hours to get the hell off your property, which is no longer yours because your bank mistakenly sold it out from under you for about a third of its value. Oops! Although we initially assumed WaMu/Chase was behind all of it, NCB Miami reports that actually “a mistake in the Miami-Dade Clerk’s Office appears to be behind the mishap, which landed Ramirez homeless for more than 24 hours.”

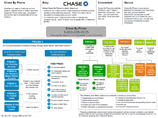

Chase Bank By Phone Telephone Tree Map

Should you ever get lost in the Chase bank-by-phone tree, this function map may help you. Or it may explode your brain all over the receiver. The choice is yours.