Chris writes that while closing a Chase credit card, he had to decide what to do with his leftover rewards credit. He tried to donate his rewards to charity, but learned that $16 isn’t enough to be considered a valid donation. Bwuh? [More]

chase bank

Chase Sets Early Payment Trap For Mortgage Customers, Too

Chase’s statement cycle trap isn’t just set for credit card customers. Mortgage and loan customers can be charged a fee for paying too early, too. Serves you right for trying to be proactive and plan ahead! Dana says that Chase punished her for setting up her automatic monthly payment to send on the 30th of the month instead of the 1st, and charged her $52.96 for two months’ transgressions. [More]

Make Chase Value You For The Great Customer You Are

Do you need some consumer power inspiration? Who doesn’t? Here are two more readers’ success stories about making a ginormous bank–Chase–treat them like the wonderful and valuable customers they are. [More]

Chase Thinks Reader Has Amazing Bilocating Credit Card

Chase’s fraud department apparently thinks that Jake is lying. A few weeks ago, they called him about some suspicious activity on his credit card. Jake and his wife verified that the transactions were neither his nor his wife’s, the Chase representative instructed them to destroy their cards, and that was that. Until a week and a half later, when a fraud specialist called them back to deny their fraud claim, claiming repeatedly that his story “doesn’t jive.”

Chase Sends You Debit Card You Don't Need, Tells You To Activate It

Chase isn’t just acting in shady ways toward their credit card customers. Their latest sneaky move is sending new debit cards that impose fees to their banking customers, hoping that customers will simply activate the new debit cards with no questions asked. Not so fast.

Chase Cancels Your Credit Cards With No Notification

If you have any Chase credit cards, call to make sure they haven’t been canceled out from under you with no notice. Huh? Are credit card companies allowed to do that? Don’t be silly. Of course they are.

Chase/WaMu Changeover Leads To Comical Levels Of Customer Inconvenience

Shawn was a faithful Washington Mutual customer, and by default is now a Chase customer. Sort of. He learned that the transition will take until September (September?!) and he can’t deposit personal checks in his account—even at a branch—without elaborate workarounds. What kind of bank is that?!

WaMu, Chase, And The Case Of The Missing Deposits

Dan’s fiancée mailed a deposit envelope containing $1,150 in checks to her bank, WaMu. Someone lost the checks, but nobody will take the blame, and they simply give her the run-around.

Chase Invites Customers To Skip A Payment, Accrue Finance Charges Instead

Chase is being awfully nice to their customers in tough economic times. Many of their customers received statements this month with a minimum payment of $0, even though they have balances. How nice! Customers take a month off, Chase will just let finance charges accrue for them.

New York ATM Skimmer Crooks Stole $1.8 Million

Four Romanian nationals in Florida have been charged in a series of ATM skimmer frauds that targeted banks in New York City, Cicero (near Syracuse), NY, and Rochester, NY. They are charged with, among other things, aggravated identity theft and conspiracy to commit credit card fraud. According to the Syracuse office of the Secret Service, they stole $1.8 million overall.

Chase Charges You Fees For The Privilege Of Being Charged Fees

Corbin had a very confusing experience with his Chase credit card. Because of a unexplained returned payment by his bank, his $30 automatic minimum payment led to $156 in late fees, overlimit fees, returned payment fees, and a fee charged, as far as I can tell, for being charged fees.

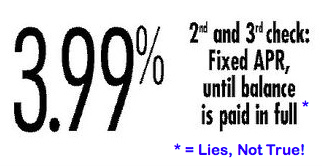

Chase Promises To Honor Promotional APR Until Balance Is Paid Off Or They Change Their Mind—Whichever Comes First

Chase doesn’t want to honor an old promotion promising to lock in a customer’s APR until their balance is paid off, so they’re just ignoring the original terms and jacking up interest rates. The bank wants to hike a promised 3.99% rate to either 7.99%, or 5% of the total balance plus a $10 monthly service charge, terms that are dull enough to put you to sleep until you receive the next month’s bill. Inside, Credit Slips walks us through how this is legal, along with tips for recapturing the stolen promotional rate.

Chase Bank Teller Allegedly Fleeces 86-Year-Old Out Of More Than $300,000 In Savings

A Chase Bank teller who befriended an 86-year-old senior allegedly fleeced the women out of most of her $400,000 in savings, says the Chicago Sun-Times, and even though the bank caught the teller and fired her… they’re taking a long time to repay the stolen money.

Whoever Dies With The Most Logos, Wins

Logos are company’s magic emblems, iconic tokens claiming territory like wolf urine. Copyranter spotted the above exemplar:

Chase to Eliminate 2-cycle Billing

- Last week Chase Card Services announced a few changes in its credit card services. Most importantly, they decided to end double-cycle billing, which calculates interest over a two-month period and can result in higher finance charges.

They point out that while it’s a consumer friendly move, it came a week before “Sen. Christopher Dodd, D-Conn., and the Senate Banking Committee begins its hearings on credit card practices (the hearings begin tomorrow).” Double-cycle billing is bad. —MEGHANN MARCO