Shoppers at Sam’s Club will no longer need to ensure that they have the correct credit card on hand or that they’ve brought cash: as of February 1, 2016, the warehouse club will begin accepting Visa credit cards in its stores, finally making all four credit card networks accepted in its stores. [More]

cards

State Of Indiana Does Not Think Senior Center Card Games Are Secret Gambling Den

Last week, the Indiana Gaming Commission contacted a senior center in Muncie to let them know that a popular activity, thrice-weekly games of euchre (a four-player card game) was possibly breaking the state’s gambling law. The seniors shut down their game, not wanting to run afoul of gambling regulations. When the story hit local news, the state government clarified that this type of card game was not really what they had in mind for a crackdown on informal gambling venues. [More]

Hallmark Pulls Card With Audio Clip Over Accusations Of Astronomical Racism

It’s so hard to understand each other in this life. First there was that unfortunate honey bun mixup, and now Hallmark is trying to prevent a bunch of press conferences from happening (too late!) by pulling a graduation card from shelves. Why? Because either Hoops or Yo-Yo–I don’t know which character is which–spouts shockingly racist insults and threats when you open the card. Well, maybe. [More]

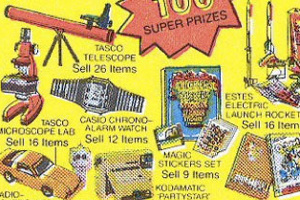

This Is What Kids Did For Fun In The 80s

Josh at GeekSix unearthed a comic book ad that might be familiar to you if you were a kid in the 80s. Olympic Sales Club was one of those door-to-door greeting card companies that enlisted kids across the country to sell crap to neighbors in exchange for merch your parents wouldn’t buy you. [More]

Taking Credit Card Offers Hurts Your Credit

Last week, I wrote about how to turn your good credit into cash. I purposely excluded credit card offers from the list because I wanted things that, should you implement them, wouldn’t hurt your credit. Today, I want to warn to the overzealous.

Let's Perma-Ban Consumer Predators

Regulating consumer predators is a bit like Whac-a-Mole. No matter how many times you put the bad guys out of business, they keep popping up again and again. Maybe it is time to consider a lifetime ban from financial services for the worst offenders. The Consumer Financial Protection Agency proposed by the President may be just the right watchdog for the job of handing out such banishments.

Paper Moments Understands Senior Moments, Reprints Cards For Free

In a post-birth haze, Suzanne accidentally ordered birth announcement cards from Paper Moments listing the wrong birthdate for her two-week old son. The site has a clear policy regarding customer errors: mistakes are worth a 50% discount on reprints, and nothing more. Accepting the policy as immutable, Suzanne called and left a polite message asking Paper Moments to reprint the cards with the right birthdate. The company responded with an unexpected bundle of joy.

Xbox Live Cancels Year-Long Prepaid Account, Demands Another Year's Subscription To Reactivate

Xbox Live has struck again, this time by screwing up the auto-renewal on a customer’s account and ruining the prepaid annual membership he activated just three months ago.

American Express Cancels Your Card Right Before You Were Supposed To Get Your $500 Rebate

Andrea, an American Express member for over 20 years, is upset because AmEx canceled her cash-back card two weeks before her $500 rebate check was supposed to arrive, and declared the rebate forfeit.

AmEx Denies Existence Of A Store Blacklist, Will Slash Your Credit Whenever They Want

Despite sending customers letter saying otherwise, American Express now insists that it never blacklisted cardholders based on where they shopped. Those notes explaining that “other customers who have used their card at establishments where you recently shopped have a poor repayment history with American Express?” Whoops! Just a big misunderstanding! Not unlike the comment they gave to ABC explaining that “shopping patterns” were used as a “contributing factor” in slashing credit lines, a statement AmEx later retracted. So what’s really going on? Let’s explore…

../..//2008/03/17/chase-is-no-longer-increasing/

Chase is no longer increasing the rates of cardmembers based on their credit-bureau information as of March 1, 2008.

Capital One Pockets Traveler's $6000, Ruins Vacation

Mike and his wife are backpacking their way around the world, and like a smart consumer, before they left he looked around for a credit card without a currency conversion charge. Capital One is fee free, which in theory makes it ideal for travel. In reality, there are hidden costs, and they’re called human stupidity and random interpretation of the rules. As a consequence, he’s “pre-paid” $6,000 onto a Capital One card that has been red-flagged and frozen, and Capital One refuses to budge—even though they acknowledge there are notes on the account that indicated he would do this before he did it, and even though they’re the ones who told him to pre-pay.

6 Basic Things Teens Should Know About Credit Cards

Organizations like the Jump$tart Coalition and NFCC have rolled out programs that help you teach your kids about the ins and outs of credit cards, credit ratings, interest rates, etc., but Janet Bodnar at Kiplinger says that there are some basic facts that you should focus on. She thinks too much detail bores a kid; we think it depends on the kid, but agree that at the very least, hitting each point on the following list would give your offspring a decent foundation for making good credit decisions.