New rules announced today will take some of the sting out of those penalties that hit you when you don’t pay your credit card bill on time. Most fees will be capped at $25, regardless of your balance, and can be much lower in some cases. If your minimum payment is $10 and you’re late, your late fee can’t go above $10. [More]

card act

How Card Issuers Sneak Around New Laws

Crafty credit card issuers aren’t going to let a little thing like the law get in the way of their profits. Nope, they’re finding creative ways to get around the pro-consumer CARD act and maintain their grip on your pocketbook. [More]

Late Payments Are Dropping Thanks In Part To The CARD Act

Banks and card issuers warned against the credit card reforms that went into effect a few months back, but so far it’s been a good thing for consumers, according to new delinquency numbers. [More]

Tell Your Senator To Rollback Unfair Interest Rate Hikes

Before a new law went into effect in February to clamp down on their abusive tactics, credit card companies jacked up interest rates, putting the squeeze on already strapped consumers. But that same law can still help as. In it, Congress told the banks to review those spiked rates, and, for responsible cardholders, bring them back down to normal levels. Of course, the banks are working feverishly to make sure they don’t have to live up to the law. As the Senate considers Regulation Z; Docket R-1384, be sure to grab their ear and say hey! Gimmie back my rates! Contact your rep now. [More]

Fed Makes Sure Gift Cards Are Still A Bad Deal

When the CARD Act went into effect in February, it also included new rules designed to limit some of the more egregious practices of gift-card issuers, like early expiration dates and “dormancy” fees. However, Congress put the Federal Reserve in charge of interpreting the new law, and yesterday the agency unwrapped its new collection of rules. Is it too late to return this one? [More]

Credit Card Companies Target Goody Two-Shoes

Like the nerdy girl in the movies who loses her glasses and gets a new haircut and all of a sudden she’s popular, consumers who pay off their credit card bills in full every month may soon find themselves the center of some unexpected courting. [More]

Let's Ask BillShrink About Credit Cards Under The CARD Act

Greg wrote to us and said that he’s in the market for a new credit card: “I canceled my Chase card because they raised my interest rate to 29.99% + prime. What credit card companies should I be looking at for a replacement card? What are their perks, their drawbacks?”

I spoke with Samir Kothari, the co-founder and vice president of products at BillShrink.com, to see what he thinks about the CARD Act and how it will change the credit card marketplace.

Bank Of America Only Lends You Money When You Have No Income

Reader James writes in with a story we hear a lot lately. During the run up to the credit meltdown –Bank of America kept raising James’ limit. He ran up a balance while caring for someone who eventually died — and now that he has paid off his debt, his limit has been cut. In the long run, however, he feels that he’s better off without credit cards. [More]

What Changes Should You Expect From The CARD Act?

After several months of waiting (during which, banks have had plenty of time to jack up your interest rates and cut your credit limits), the Credit CARD Act of 2009 has finally kicked in. If you haven’t been following the news, here’s a quick run-down of what’s changed and what hasn’t. [More]

I Canceled My Chase Account Twice, But They Keep Contacting Me

Charles says he first canceled his Chase credit card in 2008, but was surprised to find it was still open a year later. He canceled it again, but Chase kept hassling him with mailings, and when he called to see what was up he was told the company was keeping in contact with old customers to comply with the CARD act. [More]

How I Learned To Start Worrying And Hate Showing My ID

In response to yesterday’s post about a guy who likes showing his ID to checkout clerks when he makes credit card purchases, Adam rebuts with his explanation of how he used to be OK with the practice, but has now turned against it. [More]

If I Can't Check ID's, How Am I Supposed To Prevent Credit Card Fraud?

We’ve told you that it stipulates in the contract between merchants and credit card companies that stores aren’t allowed to force you to show ID when you buy stuff, but what about the other side of the story? Alex is a 26-year old small business owner and Consumerist lover, but he doesn’t know how he’s supposed to prevent fraud if he can’t check people’s ID’s. Contrary to what some commenters assume, when a stolen credit card is used, the money gets yanked out of Alex’s bank account and he is unlikely to get it or the missing merchandise back. He gets jacked twice: once by the fraudster, and once by the credit card company. What should he do? Switch to cash only? His story, inside… [More]

I'm Happy When Clerks Demand I Show My ID With Credit Card Purchases

James is just fine with companies violating the merchant agreement by checking his ID when he pays via credit card. His rationale is that the practice only increases his sense of security. He writes: [More]

Citi Socked Me With Fee, Rate Increase Because I Lost My Card

Justin says he couldn’t pay his Citibank credit card balance because he lost his card and couldn’t log into the system because he hadn’t yet received his replacement. As a result, he was stuck with an interest rate hike and a missed payment fee. [More]

Starbucks Told Me It's Corporate Policy To Check My ID With $27 Credit Card Purchase

Steph says Starbucks violated her credit card’s merchant agreement by forcing her to show her ID while buying $27 worth of coffee. She writes: [More]

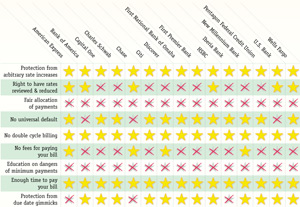

CARD Act: Who's With It, Who's Not

The CARD act is supposed to go into effect next week, Feb 22. As we get close to the deadline, is your credit card complying with the rules? Courtesy of BillShrink, this giant infographic is here to tell you the answers. Teaser: absolutely zero issuers are doing fair allocation of payments. [More]