“Keep track of your bank balances!”—pretty much every week on Consumerist either we or our readers say something like this.

budgeting

Intuit Planning To Launch "iPhone-Friendly" Version Of Quicken Online For $3/Month

Would you pay $36 a year to access Quicken on your iPhone? What the hell, why not, right? You already paid for the iPhone! That’s probably what Intuit is hoping—and the zillion-dollar iPod accessories market proves there’s a lot of “blue ocean” for businesses that want to fish in Apple waters. It launches the product as a web service on January 8th, 2008, with an iPhone-friendly flavor also available then. There are plans to roll out “tweaked” versions for other mobile devices at an unspecified point in the future.

The Best Personal Finance Ideas Of The Year

Nothing say Christmas like a list, so here’s another one. Here are some of the best personal finance ideas blogged this year, chosen by Mrs. Micah: Finance for a Freelance Life. Her top pick is the “debt snowflake” from the blog PaidTwice—it describes the act of finding lots of little ways to supplement your standard income, so that you can add mass to your “debt snowball” to make it more effective.

"Checkbook Math" Being Phased Out Of High Schools

We may indeed have a nation of financially illiterate youths, but despite cries for increased financial education in public high schools, the one program that’s historically addressed this—“checkbook math”—has never enjoyed a reputation as a “real” math class because the actual math skills involved are so basic, and it’s being phased out as most students avoid it because, as one student says, it “doesn’t look good for colleges.”

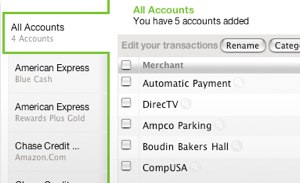

A Casual Review Of Mint.com

Michelle Slatalla, the Erma Bombeck-David Pogue hybrid who writes casual articles about the Internet for the average person (she’s the mom who pestered her daughter on Facebook this past summer), has published a Chatty Cathy review of personal finance site Mint.com. Her verdict: it’s nice to not have to go to multiple sites; the aggregated information is a good feature; security worried her at first, but she’s okay now that she knows Mint is a read-only site and they don’t have her account numbers, just user names and passwords; and she has actually used the ads that Mint displays—not to open new lines of credit, but to negotiate lower interest rates for existing accounts.

Cheap Ideas For Holiday Parties

Kiplinger set itself three basic rules to follow for affordable holiday entertaining: “make it a team effort” by splitting hosting duties or having guests bring food, “borrow what you don’t have,” and ” be creative.” Following these rules, they came up with ten ideas for holiday get-togethers that even people on tight budgets can pull off. Here are the first three.

10 Great Finance Books

Trent at The Simple Dollar read a new finance book every week for a year, ranking them according to how original and useful they were, and now he’s compiled a list of his top ten picks. According to Trent, if you read these ten books (and maybe the ones coming in at #11 and #12), “You’ll have absorbed basically all the useful material in every book on the list.”

His top pick is “Your Money or Your Life,” by Joe Dominguez and Vicki Robin, a “big picture” book that looks at how and why you spend your money.

Buying A Home? Don't Rack Up Debt Between Approval And Closing

Don’t open any new lines of credit or go crazy with the credit card purchases between your home loan’s approval and the actual closing date, warns Ilyce R. Glink (doesn’t it look like we just tapped a bunch of keys at random to spell that name?) at Inman Real Estate News. Your lender will pull a second credit report before closing to make sure that you’re still capable of paying your loan—so if you’ve done anything in the interim that could impact your ability to pay, rest assured it will show up.

6 Ways To Save Money This Season

All Financial Matters offers six interesting ways to cut costs between now and the end of the year, and although we don’t completely agree with a couple of suggestions, we still think it’s worth a look.

1. Actually look at the price tag before you buy each and every thing for the rest of the year.

2. Avoid items marketed for the season. Their example: red and green candles work fine—you don’t need “Christmas” candles.

How $100/Barrel Oil Will Affect You

Oil is poised to break the century mark, and SmartMoney has a short article that examines the effects it will have on the average American’s budget. A couple of reasons why we haven’t felt more of these effects so far is that the rising cost has largely been eaten by oil refining companies and their gas stations, and because consumers have actually begun to reduce their gas consumption. However, if the price-per-barrel continues to rise, the U.S. faces a cold winter, and the dollar continues its anemic performance, you can look forward to the following consequences:

Don't Wait Too Long To Get Help With Money Problems

Too many people wait until they hit rock bottom before seeking help from credit counseling agencies, says a New York credit counseling service. The consequence is that consumers end up limiting “the options available to them without having to make major, and often very difficult lifestyle changes. If they wait too long, debt repayment plans become unaffordable—leaving them more vulnerable to losing assets or having to file bankruptcy.”

So how do you know when it’s time to ask for help? If your monthly payments are exceeding your monthly income, it’s probably a good time. To find an agency, check out wikiHow’s How To entry, and use this list provided by Bankrate to ensure the agency will be able to provide the services you need.

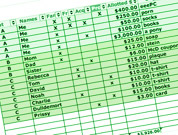

Use A Spreadsheet To Plan Your Gifts

This professor of finance proposes you take all the fun out of wildly overspending on last-minute gifts for friends and family, and replace it with the measured, predictable joy of a spreadsheet. However, if you follow his advice, the odds will be much better that you’ll end the year with healthier checking and credit card accounts.

Put Impulse Spending To Work As A Savings Builder

If you’re the type of person who thinks “discretionary spending” means “I can buy what I want, when I want,” read this person’s idea for how to create an Impulse Buy Savings Plan. It gives you a methodology where you can effectively trap your impulse purchases in a cooling-off period, while also seeing how that money would look if it were saved instead.

4 Online Budgeting Services Reviewed

SmartMoney reviews four of the most popular, or at least best-publicized, online budgeting and finance-tracking services: Clear Checkbook, Mint, Wesabe, and Yodlee Money Center. They’ve created a simple chart comparing features, to help you decide which best meets your needs—for instance, whether you want text message alerts, or the ability to manually enter transactions, and so on. The most robust offering of the four is Clear Checkbook, although it’s missing a couple of nice features that the otherwise paltry Mint offers (specifically, text message alerts and merchant-based spending breakdowns).

How To Have A Low-Budget Halloween

Are you too broke to go trick-or-treating this year? Good! More candy for the rest of us! But even though Halloween brings out the competitive sweet-tooth in us, we want to share Kiplinger’s tips on how to have a cheaper Halloween.Two of them—”get creative on costumes” and “follow a…

Budget For A 10% Increase In Heating Costs This Year

Colder temperatures and higher fuel prices are going to hit consumers in the wallet this winter, according to estimates from the government. Depending on your fuel of choice, heat could cost from 4%-22% more, though most households will see an increase of 9.5%.

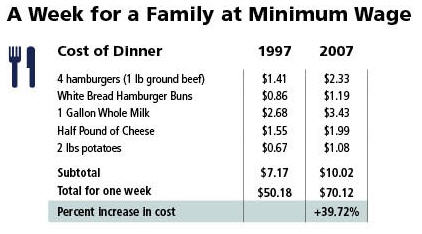

Basic Costs Have Increased Dramatically In The Last Decade

The Center for American Progress has a article explaining how costs have risen since the last minimum wage increase. According to their numbers, “dinner” has gone up 39.72%, electricity is up 25.02%, and gasoline up 135.20%.

Nickel And Dime Your Way To Home Ownership

Today’s New York Times tells the story of seven people who squirreled away enough money to afford a New York apartment; no small feat, considering the average price for a Manhattan studio is approaching $450,000. The seven people, all folks of regular means, realized their dreams of home-ownership with a variety of strategies that are applicable to anyone trying to save extra cash.