Seven months after launching its credit card complaint portal, the Consumer Financial Protection Bureau has started taking complaints from checking and savings account customers — and actually expects banks to respond. [More]

banks

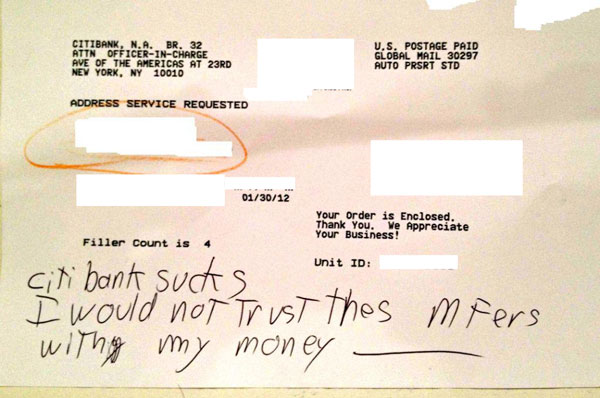

Helpful Stranger Delivers Your Mail, Curses Out Your Bank

It’s just plain heart-warming when a stranger does something nice for you. When Efrem’s box of new checks from Citibank went astray, the person who did receive them brought them by, with a helpful note about Efrem’s choice of financial institutions. “Citibank sucks,” the Good Samaritan wrote. “I would not trust [these] MFers with my money.” [More]

Spin The Wheel, Get A Different Story About Why Wells Fargo Flagged Your Card

Craig’s Wells Fargo debit card was flagged for fraud because he was trying to buy a speaker at a high-traffic Apple Store. A merchant he made a recent purchase from has been hacked, and he will receive a new debit card soon. He’s finally receiving an “upgraded” Wells Fargo card for his former Wachovia account, even though the account changed over more than a year ago.

Each of these stories has been told to Craig on separate interactions with Wells Fargo. The problem is, he doesn’t know which one is true. And neither does anyone at Wells Fargo, apparently.

I Don't Want Ads In My Online Bank Statement!

Dave normally likes his bank, PNC, but they recently made a change that annoys him. There are little ad snippets underneath some of the transactions on his online statement. Do we really need more ads in our daily lives? “I get enough advertising smashed into my skull on a daily basis; I don’t need it from my bank,” writes Dave. That’s true. But at least these ads aren’t hard to banish. [More]

Bank Of America Thinks I'm My Own Dad, Turns Me Away During Emergency

When Bank of America issued Jorge’s credit card in 1998, for some reason that remains unclear, the card was issued in the name of “Jorge [Lastname] Sr.” Jorge doesn’t have a son named Jorge Junior, and there’s no reason why the account should be set up that way, but Bank of America assured him that this wouldn’t be a problem. And it wasn’t. Until he needed an emergency cash advance, and couldn’t prove to the unfamiliar branch’s satisfaction that he hadn’t, say, stolen his dad’s credit card. [More]

New Banking Service Says It Won't Treat You Like Those Big Bad Banks Do

As widespread distrust and dislike for big banking spreads across the country, a new online service called Simple is aiming to woo those disgruntled customers with no-hassle, no-fee banking. Its goal? To be everything those other banks aren’t. [More]

Armored Car Sprinkles $200K In Cash On Pennsylvania Highway

Pennies may not actually fall from heaven (and if they did, we would advise that you not try to catch them, because… ouch) but paper money does fall out of the back of an armored car. [More]

Wells Fargo Tries To Predict The Future, Sucks At It

A few months before her wedding, Megan bought her bridesmaids’ dresses at J. Crew, and opened a store credit card account to get 20% off. She scheduled a payment through her bank, Wells Fargo, to pay off the balance, then panicked weeks later when she saw a large chunk of money leaving her bank account that she didn’t remember authorizing. She called to cancel, remembered what the payment was for, then canceled the cancellation. This led Wells Fargo’s fraud-flagging systems to believe that the next time Megan opened a store credit card and paid the bill, they should just go ahead and cancel the payment. [More]

The New Sneaky Fees Banks Are Adding

Just because the monthly debit card fee battle has been won doesn’t mean banks are gonna stop trying to squeeze more profit off basic checking accounts. Here’s a bunch of the recent fees banks have invented: [More]

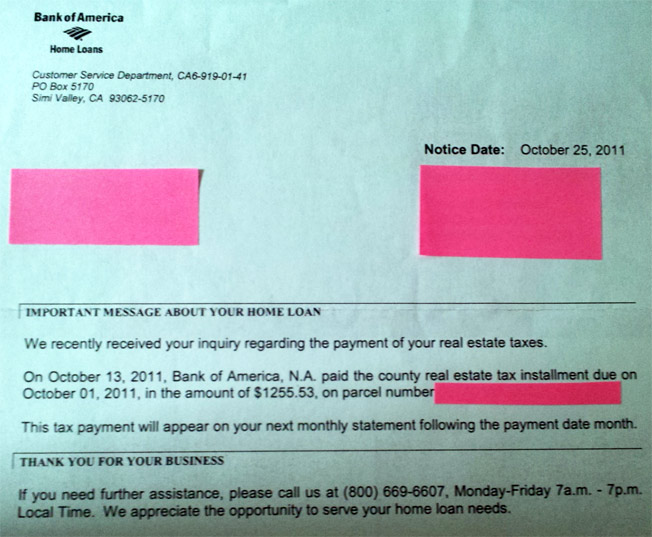

BofA Says "Sorry" For Paying Your Real Estate Taxes Late

Banks are happy to jump all over you and ratchet up the fees when you’re late. But when they’re late, not so much. [More]

New Wave Of Mortgage Defaults On Horizon

Some of the crappiest mortgages ever made were issued in 2006, and right now those 5-year introductory teaser periods are expiring. That’s leading to a 300% increase in monthly payments for already strapped borrowers, and it’s what’s driving the first increase in delinquent mortgages since 2009, a banking expert tells Credit.com. [More]

Judge Approves BofA's $410M Overdraft Settlement

To settle a class-action suit over reordering transactions to maximize overdraft fees, Bank of America agreed to pay out $410 million months ago. A judge has now approved the settlement, and the bank has coughed up the money into an escrow account from which it will be distributed to customers who were part of the suit. Those who had a Bank of America debit card between January 2001 and May 24, 2011 will automatically receive a payment of at least 9 percent of the fees they paid. [More]

BofA Charges Man $39.23 On A $0 Balance

Bank of America charged Roger $39.23 in interest on his credit card, even though he had a zero balance. How could that be? [More]

Video: Occupy Portlanders Open Credit Union Accounts On Bank Transfer Day

Saturday was the fifth of November, and many remembered to take a stand and shut down their big retail bank accounts, transferring their cash to a new credit union account. Here’s a video out of Occupy Portland covering what happened on Bank Transfer Day. Interviewees talk about why they’re switching to a credit union, and how this is just the beginning. [More]

Proponent Of Costing Banks More Money By Mailing Back Weighted Business Reply Envelopes Defends His Cause

Earlier this week I wrote about a viral video that promised you could “Keep Wall Street Occupied” by sending back credit card business reply envelopes stuffed with anti-corporate messages and wooden shims. The video said this would increase mailing costs for the banks and force them to engage in a dialogue with their customers. Responding to my review where I called this idea “terrible,” the video’s maker sent me a note defending his campaign. [More]

Credit Card Bumper Crop Boasts Low Teaser Rates, New Snags

After being such prudes for so long, credit card companies are raising their hemlines and lowering their standards. They’re actively deluging customers with credit card offers and using low teaser rates as a crooked finger. However, they’re also coming with new hidden baggage you need to watch out for, like cash back rewards that are high, but have to be opted in again every few months. [More]

Video Of People Closing Down Their Accounts At Big Banks

Tomorrow is Bank Transfer Day. By this date, people all across America are shutting down their accounts at large, costly, name-brand banks and transferring their funds to new bank accounts at their local credit union or community bank. Here is an excellent video made in Portland that follows along with several different people as they close their bank accounts and give their reasons for doing so. One person wants to save money, another disagrees with the bank’s foreclosure practices, a third is mad about the bailouts, and the last is a union withdrawing its funds to show solidarity with holding Wall Street accountable. [More]