Thanks for calling, please go away [Seth Godin’s Blog]

banks

Failure: H&R Block Shuts Down Subprime Lending Operation

H&R Block has decided to admit defeat after a plan to sell its troubled subprime lending operation to Cerberus Capital Management LP finally unraveled.

Who Has A Subprime Mortgage? People With Good Credit

The Wall Street Journal analyzed more than $2.5 trillion in subprime loans made since 2000 and found that as the number of subprime loans grew, the loans were being issued to borrowers with better and better credit scores—borrowers who could have qualified for traditional loans with more reasonable terms.

../../../..//2007/12/03/washington-mutual-forecloses-on-man/

Washington Mutual forecloses on man who made every single mortgage payment, but the banks somehow misplaced his check and papers so oops we’re going to foreclose on you anyway. [Baltimore Sun]

E*Trade Raises Rates On Online Savings Accounts, CDs

E*Trade increased the rates on a variety of banking products this week in an effort to woo back depositors spooked by their recent troubles. Here’s how they’re looking:

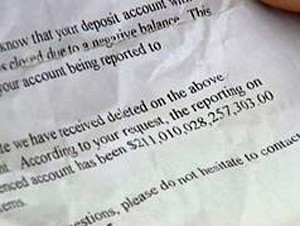

Wachovia Tells Man He Owes $211,010,028,257,303.00

Joe Martins of Georgia got a surprise letter from Wachovia telling him he owed $211,010,028,257,303.00 on his account with them. That’s two-hundred and eleven trillion, ten billion, twenty-eight million, two-hundred and fifty-seven thousand, three-hundred and three dollars, and zero cents. The letter also said Wachovia was reporting him as a risky bank customer. When contacted by a local news station, the bank apologized and blamed it on a “word processing error.”

Citibank Charges Student Loans Late Fee From 2005

Sean writes:

When I went to check the statement on my wife’s student loan through CitiBank for November, I noticed a late fee listed. As we signed up to pay via direct debit for the interest rate deduction, we get no paper statements. I checked my records, and our last payment had been processed for the full amount, on the due date. I asked my wife to call and find out why we were being charged a late fee. The representative told her that it was to correct an error from 2005. There is no explanation on the site, and when my wife asked to speak to a supervisor, the supervisor told her that there were no plans to notify people being charged these fees. My wife had to specifically request that a letter be sent detailing these fees.

../../../..//2007/11/30/a-reader-notes-that-while/

A reader notes that while his E*Trade bank-to-bank transfers usually take 2-3 days, now they’re taking 5. Hm, in light of their recent stock plummeting, could they be trying to scrape up a little extra interest?

Citibank's Charge Dispute Forms Have Two Different Addresses

Helen writes:

I’m challenging a charge on my Citibank card right now and have to fill out paperwork for their records. The second page of the form I’m filling in tells me to mail the form back to PO Box 6035, The Lakes, NV, 89163-6035. The self-addressed envelope they provided me with to mail the form back in? It has an address of PO Box 6013, Sioux Falls, SD, 57117-6013. A bit different, don’t you think? I’m just going to copy the form and mail it to both. I have 10 days to get this back to them, so I’m sure that having two separate addresses helps to deny claims i.e. “We never got your paperwork.”

Maybe sneaky, maybe honest mistake, either way, just another reason you definitely gotta scrutinize every line of fine print when you’re dealing with a bank.

../../../..//2007/11/27/the-fed-infuses-money-supply/

The Fed infuses money supply to banks with $8 billion. Come on boys, we know you can avoid a recession, put your nose to the grindstone and win one for the Gipper! [NYT]

Guide To US Bank Service Fees

If you’re a customer of US Bank and would like to know if any fun fees apply to your region, like 25 cents every time you buy something with a debit card and punch in your PIN code, here’s a handy guide. 23 states and smaller zones, like “California Metro” and “Council Bluffs, IA” have unique fees, all other fall under the rubric of “Minnesota and All Other States Not Within U.S. Bank Footprint.” It certainly is expensive to run a bank, and everything being electronic has only increased fees. Hey, the electrons have to travel on, like, gold conductors, don’t you know.

Mortgage Related Losses Could Reach $300 Billion

The Organization for Economic Cooperation and Development is predicting that mortgage-related write-offs could reach $300 billion, says the New York Times. Although major U.S. financial institutions have placed their estimates at around $50 billion, the OECD says that “a rougher period may yet await financial markets.”

../../../..//2007/11/16/always-scrutinize-your-bills-us/

Always scrutinize your bills: US Bank charges customer 25 cents every time she buys stuff with a debit card and punches in her PIN. The fee applies to US Bank customers in Colorado, Indiana, Kentucky, and Ohio. [Red Tape Chronicles]

Credit Card Grace Periods Keep Shrinking

The Kansas City Star reports the amount of time people have to pay their credit card bills keeps getting smaller, increasing the likelihood of incurring late fees, late fees which have been rising in cost over the years. Consumers used to have 30 days. Then it was 25. Now companies are moving towards 20. Furthermore, the date starts when they issue the bill, and it can then take 2-4 days to reach you. Cattle prods towards customers using online bill pay, death by a thousand fees. Keep an eye on those due dates, you never know when they’ll magically shrink again.

HSBC Says Subprime Meltdown Spreading Into Credit Cards, Other Loans

HSBC warned today that the subprime meltdown is spreading into credit cards and other types of consumer loans, says the NYT. The bank announced that it will be taking a larger write down than it forecast, due to the spreading delinquencies.

That $3000 Was Fraud? Chase Doesn't Care, It Only Wants Money

Brandon writes:“In January 2007, I was traveling in Mexico and was mugged, having my wallet and passport stolen. By the time I got back to the hotel and began calling my credit card companies to cancel, the criminal had charged close to $3,000 on my CHASE Circuit City Visa card. I explained to CHASE that the charges were fraud, and they sent me a fraudulent charge affidavit to complete and have notarized. As I couldn’t take care of this until I returned from my trip, and had more important things like a passport to worry about, I waited a few weeks before completing the paperwork and during those weeks received about 2 calls a day from CHASE urging me to send the documents.”

../../../..//2007/11/14/deutsche-bank-tried-to-foreclose/

Deutsche Bank tried to foreclose on 14 properties in Ohio, but the federal court judge determined that the bank couldn’t sufficiently prove that it actually owned the mortgage notes, and dismissed the case. [IamFacingForeclosure]