Chase will reset everyone’s marketing preferences under the guise of providing “more options to specify which mail offers you do not want.” Remember when you originally opted-out? They didn’t quite understand. What about their Value Added Products And Services and Used Vehicle Financing? Unless you opt-out again by January 24, Chase will acknowledge your implied change of heart. Read their notice after the jump.

banks

5 Bank of America Executive Email Addresses

A former Bank of America employee provides these email addresses and says they’re the people to complain to about getting fee’d to death (or any other customer service related issue you want to escalate).

Foreclosures Up 68% From Last Year

Foreclosure tracking firm RealtyTrac has announced November’s foreclosure numbers and, while foreclosure activity is down 10% from last month’s number, the news isn’t happy. Foreclosures are up 68% from November 2006, with 201,950 foreclosure filings—up from 120,334 this time last year. Also worth mentioning, last year’s numbers weren’t exactly low—they were up 68% from 2005.

Fed Approves Plan To Curb Irresponsible Lending

The Fed has unanimously approved a new plan to tighten provisions designed to prevent predatory mortgage lending, as well as help to decrease the number of consumers who irresponsibly take on debt that they cannot afford to repay.

As Foreclosures Increase, Renters Suffer

Stephen O’Brien wants to buy a foreclosed apartment building on Warwick Street in Roxbury. He wants to keep the ground-floor tenant, James Evans, 77, who is partially blind and living on Social Security.

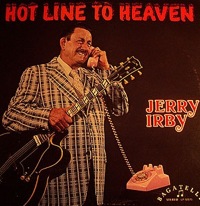

Hotline Proposed For Banking Complaints

Consumers with banking complaints reflexively complain to the FDIC or their state Attorney General, even though five federal agencies regulate the banking industry. A bill introduced by Carolyn Maloney (D-NY) wants to connect aggrieved consumers to the right agency by establishing a hotline to handle all banking complaints.

../../../..//2007/12/13/a-private-student-loan-company/

A private student loan company agreed to change its ways after being sued by the NY AG for deceptive marketing practices. The company licensed school colors, logos, team names, and and designed its materials to look like the University itself was making the loans. [NYT]

Bank Of America Plans To Lose An "Unknowable" Amount Of Money

Losses from the subprime meltdown are going to hurt Bank of America, but they won’t say how badly. They just want investors to be prepared when the 4th quarter numbers come in, says the NYT.

Highest-Yielding CDs With Reasonable Minimum Deposits

The fed rate cut means yields on money market accounts and online savings accounts are more than likely going to fall, making it a good time to look to switch money to certificates of deposit, as long as you don’t mind the illiquidity. Here are the best 3, 6 and 12-month CD rates right now with reasonable minimum deposit requirements.

Freddie Mac Will Be Losing A Few Billion More, Decides To Stop Buying So Many Bad Loans

“If I were you, I would want in this time period someone running one of these companies (Fannie Mae and Freddie Mac) to err on the side of pessimism rather than optimism,” he said.

Hey, good point.

The Subprime Meltdown From The Perspective Of A Housing Counselor

Coppedge saw it coming in slow motion. Around this time last year, she was mostly dealing with renters who were behind on payments. Rarely did she counsel at-risk homeowners. When she did, they were usually suffering a one-time setback such as job loss.

../../../..//2007/12/10/washington-mutual-will-lay-off/

Washington Mutual will lay off over 3,000 people. Sub-prime meltdown continues at brisk pace. [Seattle Post-Intelligencer]

../../../..//2007/12/08/credit-cards-and-banks-are/

Credit cards and banks are starting to let people charge their rent or mortgage on your credit card. Great for earning rewards points or frequent flyer miles, but it’s only a good idea if you can pay off your credit card in full every month. [NYT]

Citibank Sends You Letters To Let You Know Your Paperless Statement Is Ready

Corey writes:

I have a lovely Citi Mastercard with lots of rewards. I hate having to deal with paper statements, so I signed up for paperless statements (like I’ve done with all my accounts), available for viewing online at their website.

Commerce Bank Wins Lobby Pen Wars

If you want to compare how much a bank cares about its customers, you need look no further than its lobby. On the left, we have Chase’s limp, and probably, dried-out-pen. On the right, Commerce Bank’s veritable champagne bucket of pens. Now if Commerce could just update their online banking system so it doesn’t look as poorly designed as some boiler room e-commerce scam site, then they’d really have something going on.

../../../..//2007/12/06/did-you-know-you-can/

Did you know you can upgrade your credit card with the issuer without losing your credit history? [Bankrate]

ING Direct: Oops You Don't Have Any Money

When Netbank went belly-up, all its customers and their accounts got converted to ING Direct customers, but reader Nate says they bungled his conversion and left him without funds, days before he was supposed to complete a cross-country move. He writes…