../../../..//2007/11/12/call-it-the-golden-boot/

Call it the “golden boot:” Citigroup’s deposed CEO to get $12.5 million cash bonus. [NYT]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2007/11/12/call-it-the-golden-boot/

Call it the “golden boot:” Citigroup’s deposed CEO to get $12.5 million cash bonus. [NYT]

“I talked to you briefly on 10-29-07 about my Chase credit card and having the late fee forced onto my account due to them changing the due date on my bill and an article was written about my success. I had spoken with a CSR and I had thought I got my late free removed, and my due date changed. Only to find out this months statement to have my due date again on the 26th but now my minimum payment was jacked up to over 3x the normal because THEY HAD NOT REMOVED THE LATE FEE.”

“I took your advice a while ago on asking your credit card company politely for a lower APR. I asked Discover Card to give me just that.

“Got a charge on my credit card from “Member Services” for $19.23. This is a card I use for 3 specific bills, and I pay them off the day after the charge shows. I know it’s coming so this stood out.

Bankrate shares three ways consumers can take advantage of the recent federal interest rate cut.

../../../..//2007/11/05/could-credit-cards-be-the/

Could credit cards be the next subprime meltdown? [Fortune]

../../../..//2007/11/05/citigroup-said-to-announce-announce/

Citigroup said to announce announce another 8-11 billion in losses due to bad investments based on subprime mortgages tomorrow. Ouch. [CNNMoney]

Citibank’s chairman and CEO Charles Prince announced his resignation Sunday, citing the subprime meltdown as the reason for his departure.

Dan writes: “I was scammed big by JP Morgan Chase Credit Cards. They apparently have “floating due dates” that we had not encountered in our 10+ years as customers but somehow February of 2007 was the magic month. They moved our due date up by 3 days, our payment was two days late. They raised our interest rate from 3.99% to 29.99%…Amazingly enough, on our March bill the due date is exactly the same as January. They claim they sent us a notification letter, but I never received one. I spoke to the worst customer service person ever, Dennis Broyles, who claimed that no one in the company had the power to change my interest rate back and that he had no supervisor I could speak with. It was outrageous.”

../../../..//2007/10/30/merril-lynch-ceo-resigns-interim/

Merril Lynch CEO resigns, interim nonexecutive chairman chosen. Sub-prime meltdown spares none. [NYT]

Chase is giving college students free rides in special marketing rickshaws. Reader Ben reports seeing some, which look like the one pictured, on the campus of his North Carolina State University. Apparently the whole ride around the driver tries to sell you on the “Plus 1” credit card with its super-dope 23% APR. There’s also pitches for Bee Movie. The card gives you “karma points” which you can cash in for crap, share with friends or donate to “causes.” College kids go love to feel socially aware and responsible, and if it can be accomplished without leaving the dorm, all the better. Chase is also marketing the card on Facebook, the social networking site for people who go to college. The Plus 1 card earned a lemon award from creditcards.org.

David went online last night to pay his Chase VISA bill and was shocked to see a late fee. For 18 months, the bill has been due on the 31st. This month, Chase arbitrarily decided to change it to the 26th.

A Washington Mutual insiders tells us that the bank will refund overdraft fees for victims of the California wildfires, if they couldn’t get to an ATM, as well as ATM surcharges if they were forced to use non-WaMu machines. WaMu customer service confirmed the report. Victims can claim their refund by calling or visiting a branch location. A small but noble gesture, certainly better than AT&T | Dish asking customers if they remembered to pick up their receiver on their way out of the house and charging them $300 for not.

The insider who tipped us off about US Bank allowing customers to opt-out of courtesy overdraft protection wrote in again. He further describe how overdrafts and courtesy overdraft protection works, and why he thinks you should avoid them both and their stupid fees too…

216-222-2000 to speak to secretary of Daniel Frate (EVP of Retail Services)

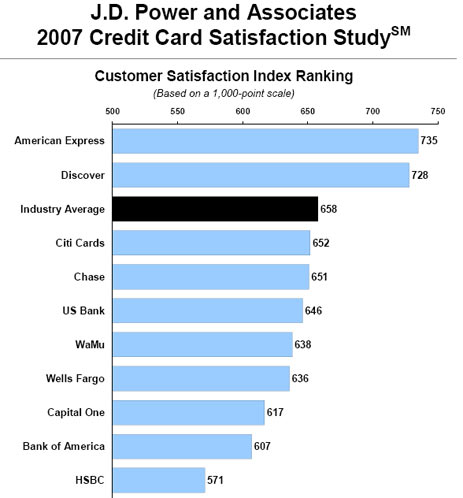

American Express ranks highest in customer satisfaction in the J.D. Power and Associates 2007 Credit Card Satisfaction Study. They said there’s two types of customers. One is transactors, who pay their bill off in full each month and for whom membership benefits are the most important drivers of customer satisfaction. The other is revolvers, who don’t pay their bill off in full each month, and for whom APR and fees are the most important drivers of customer satisfaction. So if we flip this survey over….

I have had a Capital One Mastercard for about 10 years. My interest rate has been 4.99% for as long as I can remember. I received my statement for October to find that my interest rate had jumped from 4.99% to 13.5%.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.