Tsk tsk, Wells Fargo. You should’ve known that stealing Citibank’s unspoiled bride at the alter was going to draw a bitter legal challenge. Late last night, Citibank’s team of repo-lawyers claimed a partial victory, announcing that a New York judge has agreed to block Wachovia’s sale. Citibank is also demanding $60 billion from Wells Fargo for interfering with the deal.

banks

Giddyup! Wells Fargo Rides In And Steals Wachovia From Citibank!

Attention Wachovia customers: Wells Fargo just rode on on that stagecoach thing of theirs and stole your bank from Citibank, says the NYT. Rather than pick apart the pieces of Wachovia, Wells Fargo is going to buy the whole darn thing.

../../../..//2008/10/03/surprise-wells-fargo-is-buying/

Surprise! Wells Fargo is buying Wachovia, even though Citibank said at the beginning of the week that it was going to. (Check out the full post here.) Unlike Citibank, Wells Fargo will absorb all parts of Wachovia, including its securities and retail brokerage biz, in a “$15.1 billion all-stock merger.” [DealBook] (Thanks to Stephen!)

UBS Uses Markets, Not Goverment, To Deal With Sub-Prime Crisis

Instead of sucking off the blood of taxpayers, Swiss banking giant UBS is weathering a financial crisis wrought by investing in bad mortgages by aggressively selling off its U.S. commercial and residential mortgage-related assets. Reports Forbes:

Happy Ending: Always Look A Gift Check In The Mouth

There’s a happy ending to our story, “Always Look A Gift Check In The Mouth” about the guy who opened up a new bank account just to deposit a check he thought might be fraudulent and indeed, turned out to be. Fred writes:

WaMu And Wachovia Weren't On Texas-Ratio Deathwatch List

Back in July, after IndyMac went under, we posted a list of ten banks that could be “the next to go under.” Interestingly enough, as reader Irene noticed, neither Washington Mutual or Wachovia, two major, sub-prime mortgage saddled, banks that got taken over recently, made the list. The list was based on analyzing the banks’ “Texas-Ratio,” basically the ratio of loans they’ve made to capital they had on hand. None of the banks on the Texas-Ratio watch list, like “The State Bank of Lebo” of Lebo, KS, or “First Priority Bank” of Bradenton, FL, can be found on another list either: the list of banks you’ve heard talked about in the news. Well here’s a newsflash that the media elite passed over while buffing their loafers with their fancy college degrees: The State Bank of Lebo now has an ATM. It’s inside Casey’s General Store. Put that in your pipe and smoke it!

The 10 Cities With The Most Crazy Expensive Loans

The Chicago Reporter took a look at some recently released mortgage data with an eye to how many successful refinances there were last year. In addition to concluding that people who most needed a refinance (those with crazy expensive loans) were also the least likely to get one, the Reporter also found that Chicago lead the nation in the total amount of high-cost loans for the fourth year in a row. High-cost loans are loans that are at least 3% above the U.S. Treasury standard.

WaMu CEO Could Get $18 Million+ For 3 Weeks Work

For three weeks, Alan Fishman was the CEO of WaMu before it went bust. For his excellent stewardship during these turbulent times, Fishman is eligible for at least $18 million, thanks to his signing bonus. Not blaming the guy, the place was screwed well before he got there, but, man, $6,000,000 a week, not a bad gig, eh?

../../../..//2008/10/01/word-is-sovereign-bank-and/

Word is Sovereign Bank and National City Corp are “next on the FDIC’s to-do-list.” [Clusterstock]

March Madness-Style Bracket Makes Bank Mergers Fun

TechCrunch has posted this “March Madness” style bracket of the recent financial meltdown. It was reportedly created by a general partner at Sansome Partners named Mark Slavonia, says TC.

Make Converting Bank Transactions Easier With Sites Like Wesabe Or Mint

One unpleasant surprise about switching to USAA from Washington Mutual is that I could no longer download all my transactions in .CSV format. When I was with WaMu, this made it very easy to import all my banking into my tricked out Excel sheet I use to manage my finances. USAA only lets you download in Quicken or Microsoft Money’s proprietary formats. Cutting and pasting the transactions as they appear on the website, even in Print mode, still is less than perfect. What I found out though is you can use a personal finance management site like Mint or Wesabe to do most of the grunt work for you. UPDATE: Reader Stephen pointed out there is a handy link at the bottom of the USAA page that lets you export as .CSV. I didn’t see this link because I was looking at the “download fund activity link,” which doesn’t have a .CSV option.

What Wachovia Customers Need To Do Post-Citigroup Takeover (Hint: Nothing)

What do Wachovia customers need to do now that Citigroup owns your ass? Absolutely nothing. You can do all your online and offline banking just like nothing happened. No temporarily held funds, no chained and locked bank branches. Everything is the same. Even your bank’s regulator remains the Office of the Comptroller of Currency. Down the road there will likely be a few alterations, most of them cosmetic. Read our post “Insiders: Probable 1-Year Timeline For Customers In WaMu To Chase Transfer” for some of the changes you can expect.

Citigroup Buys Wachovia

Part of Wachovia will remain independent — including its massive brokerage business which ballooned after it purchased AG Edwards in 2007, as well as its Evergreen investment management division.

VIDEO: WaMu Ad Has New, Dark, Meaning

Now that Washington Mutual completely imploded on its garbage-pile avalanche of home mortgages, this old WaMu commercial from August 2006, starring Scott Adsit pre-30 Rock, takes on a new, darker, meaning…

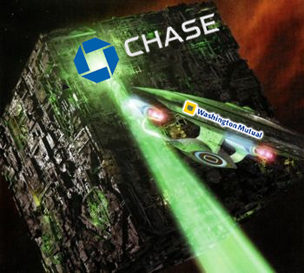

Insiders: Probable 1-Year Timeline For Customers In WaMu To Chase Transfer

One of our commenters, mavrick67, who says they have over 20 years banking experience and have witnessed 8 takeovers throughout the years, provided a timeline as to what you can expect.

WaMu Customers, Office of the Comptroller of the Currency Is Your New Regulator

As an aside, WaMu’s charter was under the Office of Thrift Supervision (OTS). Chase’s bank regulator is the Office of the Comptroller of the Currency (OCC). Whether being a Chase customer was your choice or not, if you ever have a major complaint about Chase regarding what you feel is on the bank’s part malfeasance, you’ll want to send it to the OCC.

Now That The Largest Bank Failure In U.S. History Is Over, Is Wachovia Next?

The collapse of Washington Mutual and the FDIC-engineered fire sale to JPMorgan Chase has people worried — about Wachovia. Wachovia’s stock is down 45% for the week, and 27% today as bailout talks stalled in Washington and WaMu held a garage sale at the FDIC.