The Feds seized Washington Mutual and JP Morgan bought it, but don’t fret, all your accounts ok. Online banking is completely functional. If you held WaMu stock, on the other hand, it’s now effectively worthless. Depositors began fleeing WaMu on September 15, the day Lehman Brothers filed for bankruptcy. In all, they took out about 9% of WaMu’s deposits, or $16.7 billion. Regulators say this left WaMu without enough capital to keep functioning. The shakedown and bailout continues apace. What new surprises will the government bring us today, Monday, or even over the weekend? At least this one didn’t require taxpayers to foot the bill.

banks

Poll: Do You Support The Bailout?

Lawmakers are hashing out the details of a huge taxpayer-funded bailout of Wall Street in an attempt to keep afloat the system of banks whose willingness to lend drives this economy’s growth. Constituents have flooded their representatives phone lines and inboxes with with their heated reactions. What do you think?(Photo: Getty)

What Else Can $700 Billion Buy?

A while back the New York Times was concerned about the cost of the Iraq War and published some estimates of what else we could have bought with that money. We didn’t find that very interesting at the time, but now, while trying to wrap our minds around just how effing huge the $700 billion proposed bailout of Wall Street really is, we decided to revisit that article. Here’s what you can buy for less than $700 billion, according to the New York Times.

Executive Customer Service Info For 7 Banks

I was just on CNBC’s “On The Money” and heard from one homeowner who was frustrated that no one at Washington Mutual would return her calls or letters in her attempts to renegotiate her mortgage. I told her it was time to contact executive customer service and/or launch an EECB. I received a few emails after the show from other homeowners in the same situation, so here is all the executive customer service contact info we have for various banks.

Contact Info For Wells Fargo CEO John Stumpf And Friends

Here’s some info we dug up that can help you contact some higher ups at Wells Fargo if you’ve tried regular customer service and escalating to supervisors and it’s not working out.First read this post about how to contact and conduct yourself when using executive customer service. [More]

Finance Officials Beg Congress To Give Them $700 Billion

Treasury Secretary Henry M. Paulson Jr. was not warmly received at today’s bailout hearing when he stared down an angry and disenchanted Senate Banking Committee. Federal Reserve chairman, Ben S. Bernanke, who appeared with Mr. Paulson, warned that unless Congress gave Mr. Paulson $700 billion that “inaction could lead to a recession.” Oooh, they said the “R” word….

Reach Wachovia Auto Loan Executive Customer Service

The number for Wachovia Auto Loan Executive Customer service is 877-250-2265.

Bankofamerica.com Is Down

Bank Of America’s site has been down for several hours today. Coincidence? Related to its purchase of Merill Lynch? Outcome of market turmoil? Uncertain, but it is certain that BoA customers can’t do any online banking right now. UPDATE: It’s back up, but so slow as to make it practically nonfuctional. [cNet]

What Will The Largest Government Bailout Of Private Industry In US History Look Like?

A bailout of some kind is coming, but no one seems to know what it will look like and who it will help. The Wall Street Journal says that Senate Banking Committee Chairman Christopher Dodd of Connecticut has some ideas that might not go over too well with the Treasury Department.

Always Look A Gift Check In The Mouth

My brother who is a junior at college sent out a bunch of applications for college grants and other sources of funding to pay for his education. Late this summer he received a check in the mail sent to him from one of the organizations that he sent an application to. The check wasn’t huge, but the $3500 would come in handy, and certainly would have been a huge help in paying for his books, and housing. When the check actually came in the mail it was just a check, nothing else, no letter of congratulations, explanation or anything else telling him why he had received the money…

Favorite Comment Of The Day

laserjobs: The way things are going the FDIC will probably end up with WaMu. So as long as you are under the FDIC limits you will probably be with the safest bank around soon: WaMu Federal.

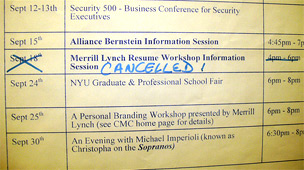

Nobody Gave A Crap About The FDIC Until Fairly Recently

Spend a little time looking at Google trends and you’ll notice that no one really gave a crap about the FDIC until fairly recently.

Morgan Stanley Ponders Wachovia Merger

The Morgan Stanley investment bank is considering merging with the Wachovia commercial bank. The point is for the investment bank to have lots of capital on hand in the form of consumers’ deposits. This would return the two back to their structure during the Great Depression, when the two split. Uh, oh, there’s the D word, and we’re not even officially allowed to say the R word yet! Let’s just say Wall Street is getting completely rewritten this week, and while it’s way too early to tell what this means to the average consumer, there will be repercussions. Blood, too, probably.

WaMu Begins To Sell Itself

WaMu has begun to try to sell itself. So far, no takers. If no one buys it, one of two things will happen. Either it will be placed into a conservatorship, like IndyMac, or form a bridge bank, a kind of temporary bank. So the question for depositors is: wait to find out who your new masters are, or pull out now and decide for yourself?

Regulators Seek WaMu Suitor

Regulators are trotting around Washington Mutual trying to get banks interested in buying it. It’s sort of like in the old days when the local beauty queen, last scion of the largest landowner in the county, would get maimed in a horrible combine accident and the town elders would trot her catatonic body around to arrange a marriage so all her fields wouldn’t turn fallow and destroy the local economy for years to come. Wasn’t that given treatment in Faulkner? As I Lay Hemmoraghing Equity?

Capital One Mails Fraud Claim To The Person Committing Fraud

“Lisa” writes, “I recently found out that I was a victim of identity theft.” What shocked her, and us as well, is that after Capital One notified her that they’d approved the card with another address, they followed up by sending their fraud claim to the criminal’s address instead of Lisa’s.

WaMu's Stock Bumps Upwards

WaMu’s stock is up this morning after the new CEO said the S&P rating downgrade to junk was based on “market conditions” and not their financial condition, and an unsourced Daily Mail article said Chase was going to bid for the beleaguered thrift.