A misinformed bank teller at a Wells Fargo in Arizona was determined to explain how desert life worked to a woman who just wanted to buy some GPB (pounds sterling, aka British money).

banks

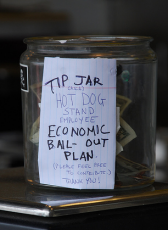

Banks To "Earn" $38.5 Billion From Overdrafts This Year

Consumers aren’t the only ones looking to save money and gain a little extra cash on the side. Banks are people too, you know! In the face of toxic assets and credit card delinquencies, they’ve come up with a plan to increase their revenue: New fees! Higher fees! Higher minimum balance requirements! Trickier overdrafts!

Study Of Credit Unions Indicates CARD Act Will Benefit Consumers

Two Harvard doctoral students in economics compared how credit unions and banks operated their credit card divisions, and concluded that the recent CARD act “is likely to bring about moderate, and even positive, changes,” as banks begin to emulate parts of the fairer business model of credit unions. Specifically, they say, all the doom and gloom from the banking industry about how consumers will get shafted by the new rules is mostly fearmongering.

Ally Bank Delivers Lower CD Rates Than Promised; Also No Pony

A few weeks ago, we posted about the rebranding of and promising new start for Ally Bank, formerly GMAC. But one new customer isn’t very enthusiastic about their services.

Commerce Bank/Metro Bank Shows How Not To Handle A Bank Changeover

Commerce Bank in central Pennsylvania is changing its name. Former Commerce Banks in that area will now be called Metro Bank. Yawn, right? Banks merge and change names all the time. What they don’t normally do is cancel ATM cards with no notice, and lock customers out of their accounts due to those changes. Maybe this is a new trend.

Wells Fargo Keeps Hanging Up On Your Deaf Grandmother

Rachel’s 86-year-old grandmother was a loyal Wells Fargo customer for more than thirty years. She’s been forced to take her business to a new bank because Wells Fargo representatives refuse to talk to her.

../../../..//2009/06/12/so-now-theres-a-compensation/

So now there’s a “Compensation Czar” to oversee the executive pay packages at banks that took TARP money. Here’s an interview with the man behind this thankless job. [Marketplace]

Bank Of America CEO: We Had To Acquire Merrill Lynch To Save The Economy

Are you a Bank of America shareholder who is angry at CEO, (and former chairman of the board) Ken Lewis for going ahead with the Merrill Lynch deal? Well, you’re just mean. It wasn’t his fault. At least, that’s what he’s just testified before the House Committee on Oversight and Government Reform.

Woman Hides Life Savings In Mattress, Mattress Taken To Dump By Helpful Daughter

A woman in Israel hid her life savings—she says nearly $1 million dollars—in her mattress. Her daughter bought her a new mattress as a surprise upgrade and threw it out. Dump employees are now searching on behalf of the family while security has been hired to keep out treasure hunters, but they don’t know which of the two city dumps it was taken to. We imagine it’s the one where the rats are all wearing tiny gold rings and toasting each other with little glasses of champagne.

WaMu Saddles Credit Card Theft Victim With Thousands In Fraudulent Charges

Someone stole reader A’s WaMu credit card number and racked up thousands in fraudulent charges, and now WaMu wants A to pay for it. The fraudsters also made a PIN request for a cash advance over the phone, and WaMu said that phonecall orginated from A’s parents house. Because of this, which A says is impossible, WaMu demands A be responsible for the charges. He’s written letters and called executive customer service and it’s gotten him nowhere. His crappy story, inside…

../../../..//2009/06/10/bond-traders-say-stock-traders/

Bond traders say stock traders are wrong, the Fed will not increase interest rates this year. [Bloomberg]

Here's Where Your Overdraft Fees Are Going: Banks Are Paying Government Back For Bailouts

Several banks are doing just what they’re always bugging customers to do — paying back money that was lent to them.

Insiders: Countrywide Made Racist Sub-Prime Loans

The Wells Fargo racist sub-prime mortgage lawsuit reminded me of an old post we did where an ex-Countrywide employee alleged that that loan company had racist practices too. Here’s the insider email we posted back in February, 08:

Interest Rates Will Rise Within The Year, Markets Bet

As growing global economic optimism begins to build, the market is betting that the Fed will raise interest rates by the end of this year. This will mean mortgages will get more costly and credit card APRs will rise, but the interest you make off your savings account will go up. [Bloomberg] (Photo: Ben Popken)

2.5% Online Savings Accounts At Ally Bank (The Rebirth Of Gmac)

Even though GMAC spun off from GM years ago, they recently changed their name to “Ally” in a re-branding, stain-of-association-removing effort. Their whole game seems to be a USAA for civilians, advertising “No minimum deposits. No fees. No min balance. No sneaky discalimers.” Ally Bank is also offering very juicy APYs, like 2.25% for an online savings account, more than double the national average…

$100 For Opening Chase Checking Account

Who couldn’t use an extra $100 these days? Chase is giving $100 if you open a new Chase checking accounts. Just go here, enter an email address, take the coupon they send you to a nearby branch, and open a new checking account. Of course, there are a few caveats: 1) You have to deposit $100 into it. 2) The $100 can’t come from another Chase account or an affiliate. 3) Within 60 days, you have to either make 5 debit card purchases, or set up direct deposit. 4) You have to keep the account open for 6 months or they take the $100 back. 5) If you don’t set up direct deposit and you don’t make at least 5 debits a month, you get hit with a fee. Still, a hundred bucks is a hundred bucks.

Repo Man: Borked Chrysler Site Can't Take Your Money, But Can Rack Up Late Fees

Late last Thursday night, two guys rang reader Sean’s doorbell and asked if he’d like to get anything out of his 2007 Jeep Compass before they repossessed it. Since then, Sean has tried to get current on his payments, but Chrysler’s web site snafus have kept him from getting the cash to Chrysler, which won’t let him get his car back unless he forks over hundreds of dollars in fees. Oy. Sean’s story, inside..

updated: WaMu Accounts Become *Almost* Totally Chase July 24

Starting July 24, 2009, WaMu accounts will get fully transitioned to Chase. After that, ex-WaMuers will be able to fully enjoy the benefits of Chase banking, like making deposits into Chase ATMs, the full range of Chase branch banking services, and the luxury of paying Chase’s service fees which are higher than WaMu’s were.