New Jersey resident Daniel had a checking account he used for eBay, but he forgot about it and sure enough his bank had to go an empty out the account because his money spoiled and had to be tossed out like sour milk. You know, due to inactivity fees.

banks

Banks That Reap Fees From Bad Loans Won't Want To Help Beleaguered Homeowners

The White House has asked mortgage executives to come up with the manpower to stop precarious loans from becoming foreclosures, but a New York Times story says finance experts say a lack of bodies isn’t the problem. It’s greed.

For Some Reason, People Don't Like Being Fingerprinted At The Bank

If you’re not a Bank of America customer, but visit one of their branches to cash a check, you’ll need to be fingerprinted. No, check cashing is not a crime, and the bank is trying to protect itself against fraud, but some people still don’t like the idea of giving up their prints for cash.

3 Big Banks Sued For Overdraft Fee Practices

Banks don’t believe in first come, first served, when it comes to processing your transactions. Instead, it’s biggest appetite, first served. In other words, they process a batch of debits on your account by order of largest to smallest. The result, critics, and now, several lawsuits, charge that it maximizes the overdraft fees they can harvest.

Victim Of Mystery Shopper Scam Arrested, Spends Night In Jail

Here’s one more reason to avoid mystery shopping scams: you could be the one who ends up in jail. A woman in Minnesota answered a “mystery shopper” email (that she found in her spam folder, sigh) and signed up. It turned out to be the old check fraud scam—they sent her a $2700 check and told her to deposit it and keep $300 a payment, then use the rest to make mystery shopper purchases. She took the check to her bank, and her bank called the police.

Mortgage Mod Scams Using Paperthin Lawyers As Legit Front

“Let me put it this way. It’s like food stamps,” said the mortgage modification telemarketer trying to talk consumer advocate and Red Tape Chronicles blogger Bob Sullivan into a new loan. Following the trail of who this guy works for lead Sullivan to discover a new kind of mortgage modification scammer.

Two Men Charged With Placing Skimmer On Maryland ATM

Two men “of no fixed address” were charged in Maryland earlier this month with tampering with an ATM and skimming funds. The men, currently in custody in Oklahoma for similar crimes, allegedly added a skimmer and camera to an ATM at a Maryland PNC bank in April, but police weren’t notified of the tampering until May 20th.

WaMu/Chase Doesn't Believe Your Card Was Stolen, Despite The Fact That The Thief Was Arrested

Reader Stephen says that a NYC Taxi driver tricked him into using an ATM skimmer-like-device instead of the normal credit card machine and made off with his card and PIN. The NYPD made an arrest, but Stephen says he’s still battling with Chase/WaMu.

Enlightened Nation To Banks: Either Explain Excessive Fees Or Eliminate Them

Australian consumers will soon be able to challenge any bank fee that they consider “unreasonable,” thanks to a new law that could save consumers up to $1 billion. Banks that want to keep levying excessive fees for late payments and overdrafts will need to prove that the charges are reasonable by revealing the true processing costs behind the fee.

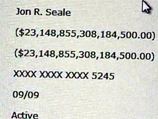

The Real Reason Behind The $23 Quadrillion Errors

The secret of the $23 quadrillion VISA debit errors looks like a specific and not uncommon programming error. Take the insanely large number, if you convert 2314885530818450000 to hexadecimal, you end up with 20 20 20 20 20 20 12 50. In programming, hex20 is a space. Where a binary zero should have been, there were spaces instead. What made this instance special is that it wasn’t caught in time. A Slashdot commenter identifying himself as working in the industry explains more about what very likely happened:

The $23 Quadrillion Meal

I hope he cleaned his plate. Jon Seale was another of several VISA customers who were charged $23 quadrillion for mundane purchases. This time it was his July 13th meal a Dallas restaurant, reports KXAS. VISA said a temporary programming error affecting prepaid accounts was responsible for the error . Jon spent the rest of the day calling between Wachovia and VISA to try to clear the $23,148,855,308,184,500 charge.

VIDEO: What Happened To All Of Those Toxic Assets?

Hey, remember the TARP program? If banks are now paying back TARP funds, then what happened to those toxic assets? Are they sitting in a canyon in Wyoming for the next 10,000 years? Not exactly.

Chase Sends You Debit Card You Don't Need, Tells You To Activate It

Chase isn’t just acting in shady ways toward their credit card customers. Their latest sneaky move is sending new debit cards that impose fees to their banking customers, hoping that customers will simply activate the new debit cards with no questions asked. Not so fast.

Banks Consider Running TV Spots Against Proposed Consumer Financial Protection Agency

Remember Harry and Louise? I don’t, but apparently they were a fictional couple in an early-90s TV commercial, produced by the insurance industry to help sway opinion against the Clinton health plan. Now banks and other financial companies may be pooling resources to create a new “Harry and Louise” style ad to convince Americans that Obama’s proposed agency to monitor abusive financial practices will limit choice and ruin lives.

7 Places Around The House To Stash Your Cash

Banks are great and all, but everyone should keep a little bit of emergency cash stashed somewhere at home. Frugal Dad offers up a list of seven hiding spots that should beat all but the most determined thieves.