../../../..//2009/03/26/treasury-secretary-geithner-is-testifying/

Treasury Secretary Geithner is testifying before Congress, if you are interested. [CSPAN]

Thanks for visiting Consumerist.com. As of October 2017, Consumerist is no longer producing new content, but feel free to browse through our archives. Here you can find 12 years worth of articles on everything from how to avoid dodgy scams to writing an effective complaint letter. Check out some of our greatest hits below, explore the categories listed on the left-hand side of the page, or head to CR.org for ratings, reviews, and consumer news.

../../../..//2009/03/26/treasury-secretary-geithner-is-testifying/

Treasury Secretary Geithner is testifying before Congress, if you are interested. [CSPAN]

Here is a resignation letter sent on Tuesday by Jake DeSantis, an executive vice president of the American International Group’s financial products unit, to Edward M. Liddy, the chief executive of A.I.G. It was published in the New York Times.

A.I.G. is suing the government to recover over $300 million in tax breaks that the insurance company says were improperly denied. What sort of tax breaks? The sort otherwise known as illegal Cayman Island tax shelters.

Last year’s Worst Company in America winner, Countrywide Home Loans, has sued AIG for not paying their claim on losses from failed real estate loans that they had insured with the company.

AIG has complied with Andrew Cuomo’s subpoena and turned over the names of the bonus recipients. The NY AG has released a statement about the issue, which you can read inside.

Andrew Cuomo has written a letter to AIG in which he explains that they will turn over the names of those employees from the Financial Products subsidiary (that’s the division that brought down the company) who are receiving bonuses by 4:00 pm today or they are coming at them with subpoenas. Yes, ladies and gentlemen, it’s another awesome Andrew Cuomo letter after the jump.

So, those guys at AIG who underwrote trillions of dollars worth of credit default swaps backed by securitized mortgages? The ones the Times says were “at the very heart of A.I.G.’s worldwide conflagration?” They’re taking $165 million of our bailout money for bonuses. Because if we don’t pay them, these people—described by AIG’s government-appointed Chairman Ed Liddy as the “best and brightest talent”—will apparently leave to go ruin some other country’s financial system, and we can’t have that. Liddy acknowledged that the bonuses were “distasteful and difficult” before saying that he had “grave concern about the long-term consequences” of not paying up.

Here’s what you can expect from a nationalized Citibank, courtesy of Funny or Die. NSFW warning: this thing is full of f-bombs, and even an r-mine. (Full video after the jump.)

New York Attorney General and House Financial Services Committee Chair Barney Frank have written a letter to Bank of America CEO Ken Lewis demanding the names of the nearly 700 executives who received bonuses in excess of one million dollars.

Fed Chairman Ben Bernanke told the Senate Budget Committee he was “angry” at A.I.G. for exploiting a loophole in the regulatory system in order to run what was essentially a hedge fund tied to an insurance company.

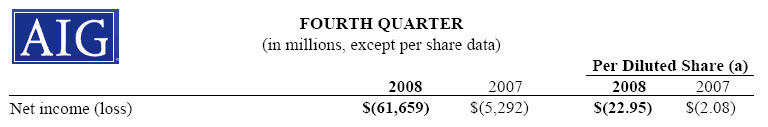

The government is taking steps to revamp the AIG bailout, after the company lost a mindbogglingly huge amount of money, $62 billion, in a single quarter.

Did you know that private jets are actually quite practical? We didn’t. The Wall Street Journal says that private jet manufacturers are angry at the backlash against private jets and are speaking out to “counter business aircraft misinformation.”

../../../..//2009/02/10/treasury-secretary-timothy-geithner-has/

Treasury Secretary Timothy Geithner has announced a new website, financialstability.gov, to increase transparency in the financial stability program.

../../../..//2009/02/10/senate-approves-838-billion-economic/

Senate approves $838 billion economic stimulus bill 61 to 37. C-Span says three Republicans broke ranks to vote for it: Senators Susan Collins, Olympia Snowe, and Arlen Specter.

The New York Times has details about the new bailout plan Treasury Secretary Tim Geithner is scheduled to talk about later today. Here’s a rundown of what’s on the menu:

../../../..//2009/02/09/want-to-know-what-the/

Want to know what the latest version of the stimulus package looks like? “We’ve trimmed the fat, fried the bacon, and milked the sacred cows,” Sen. Ben Nelson said in a statement. [Consumer Reports]

../../../..//2009/02/05/according-to-friend-of-the-blog-and-now/

According to Friend-of-the-Blog and now chairwoman of the Congressional Oversight Panel examining the Troubled Asset Relief Program, Elizabeth Warren, our Treasury Department overpaid banks by as much as 30% for their assets.

President Obama and Treasury Secretary Tim Geithner have announced a $500,000 maximum wage for employees of companies that receive taxpayer support. The rule will only apply to companies that receive future bailout funds. Oh, also, you’re going to be bailing out more companies.

![]()

Part of ![]()

Founded in 2005, Consumerist® is an independent source of consumer news and information published by Consumer Reports.