Nearly four years ago, as America was still crawling out of the crater left by the collapse of the economy, a former CEO of AIG — a company whose name had become synonymous with the crash — sued the federal government over the bailout, alleging that the government had violated shareholders’ Fifth Amendment rights. Today, a court sided with wealthy investor Maurice “Hank” Greenberg, but he won’t be getting any damages because the company would have gone bankrupt without the bailout. [More]

bailout

Fresh Off Paying Back Bailout Money, AIG Thinks About Suing U.S. Government

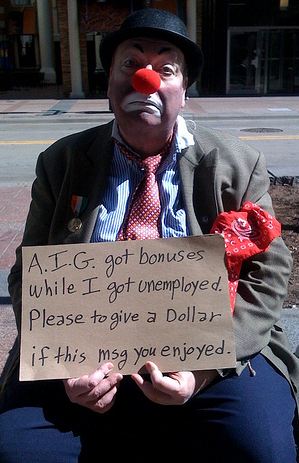

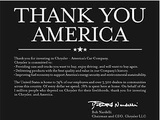

At the same time as AIG thanks America, quite literally, in new ads boasting about the company’s repayment of its $182 billion bailout by the taxpayers, its board is reportedly getting ready to decide whether or not to jump on a $25 billion lawsuit filed by AIG’s former CEO against the U.S. government. [More]

GM Wants To Be Able To Pay Executives More Money

General Motors Co. Chief Executive Daniel Akerson says he’d like a little more leeway on executive compensation from the Obama administration because the company is having trouble attracting quality executives. [More]

GM CEO Won't Guarantee Stock Sales Will Repay Bailout Cash

Something a little more important than the newest Chevy went on sale at GM today — new shares of the company hit the market at $35 this morning and appeared by lunchtime to be doing a healthy business. And while today’s IPO will likely put a sizable dent in the company’s debt, CEO Dan Akerson isn’t as eager as his predecessor to make promises that future stock sales will guarantee taxpayers are repaid in full. [More]

Wait — So GM Didn't Pay Back All The Bailout Money?

Last spring, now-former General Motors CEO Ed Whitacre ruffled a lot of feathers in Washington by airing a TV commercial where he claimed that the bailed-out car company had repaid “government loan in full, with interest, five years ahead of the original schedule,” without mentioning that taxpayers still owned 61% of GM. Today, new GM CEO Dan Akerson opted for a more honest approach, not only admitting that his company still owes billions to the government, but that it’s going to take “several years” to pay it back. [More]

Men Behind AIG Collapse Prove Why They're The Biggest A-Holes On The Planet

Back in 2007, we were all living in our 8-bedroom homes paid for with adjustable rate mortgages. And AIG’s Financial Products unit was selling credit-default swaps like there was no tomorrow. Then we all woke up in our parents’ basements with no job and AIG was owned by the taxpayers. But Joseph Cassano, the former head of said Financial Products division, thinks he could have done a better job of bailing out the banking industry he helped lead to ruin. [More]

Congress To GM: Please Stop Destroying Documents While We Still Own You

Though General Motors has made a big deal about allegedly paying back their bailout loan to the federal government, the fact is that most of the bailout money was turned into equity, which means the government — and ultimately the taxpayers — are the majority shareholder in the car maker. That’s why some members of Congress are a little upset about GM’s continued practice of destroying important documents. [More]

Senate Agrees To Ban Taxpayer-Funded Bailouts

An amendment to the financial overhaul bill banning the use of taxpayer funds for bank bailouts has been agreed upon in the Senate, says the LA Times. [More]

AIG Chief Believes They'll Pay Back Bailout Billions Before Deadline

$182.3 billion is a hefty tab to pay off, but the CEO of AIG says he feels “pretty comfortable” that his company will be able to get that all back to the government between now and the Sept. 2013 deadline. [More]

Treasury Dept. Selling Its 7.7 Billion Shares Of Citigroup For Big Profit

The Treasury Dept. announced today that it plans to sell off all of the 7.7 billion shares of Citigroup it acquired as part of the bailout of the bank. This could mean a profit of upwards of $8 billion for the federal government in just a few months. [More]

Pay Czar Cuts Exec Pay 15% At AIG, GM And Others

Kenneth Feinberg, better known as the Obama administration’s pay czar, announced yesterday that he’d cut salaries on top executives at 5 companies that are still using bailout cash. [More]

Government Orders Pay Cuts For Bailed-Out Firms

The huge salaries and bonuses paid to executives of banks and other firms that received government bailout funds have been the subject of a lot of taxpayer rage. The Obama administration listened, and will order pay cuts.

Taxpayers Unlikely To See Much Auto Bailout Money

A new report by the Congressional Oversight Panel — an independent, yet totally powerless, group appointed by the Senate to review the results of the recent government bailouts — states that we’ll get a few bucks back from the automakers, but shouldn’t count on it to cover our car payments:

Bank Of America Wants To Begin Paying Back Bailout Money, Avoid Government "Fee"

The Wall Street Journal says that Bank of America is interested in paying back a portion of the bailout money it received, with the goal of getting out from under the purview of the salary czar and reduce a “layer of federal involvement in its affairs.”

Government Has Made $4 Billion On The Bailout, So Far

The NYT says a little less than a year after the economic meltdown, the government is starting to see a profit from banks repaying bailout money.

Banks Once "Too Big To Fail" Now Even Bigger After Meltdown

Remember those banks that the federal government bailed out because they were “too big to fail?” Well…after mergers and bank takeovers (some encouraged by the government) those banks bailed out because they were “too big to fail” now are much bigger. JP Morgan Chase and Bank of America combined now control more than 20% of all bank deposits in the United States.

VIDEO: What Happened To All Of Those Toxic Assets?

Hey, remember the TARP program? If banks are now paying back TARP funds, then what happened to those toxic assets? Are they sitting in a canyon in Wyoming for the next 10,000 years? Not exactly.

AIG Asks Federal Permission To Pay $2.4 Million In Executive Bonuses

A hush fell over the AIG conference room on the day that their Worst Company in America 2009 trophy was unveiled. The eyes of every executive in the room sparkled with just a bit of pride. “Well done, everyone,” said the man at the head of the table. “But we mustn’t rest on our gilded-feces laurels. It’s time to begin our work for next year’s competition.”