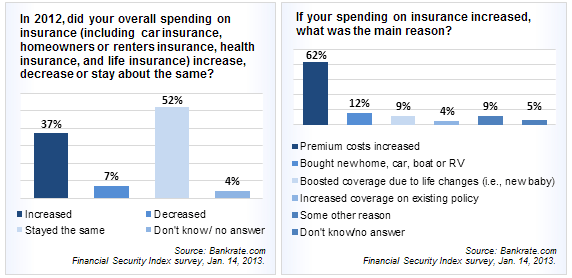

More Than 1/3 Of Americans Paid More For Insurance In 2012

The survey, done by the folks at Bankrate, found that a slim majority of respondents (52%) paid the same amount for insurance coverage as they had in 2011.

For 62% of the people who paid more for insurance, the increase was due to higher premiums. Another 12% pinned the increase on additional coverage for a new home, vehicle, boat or RV. And adding humans to your account increases the bill, with 9% saying their increase occurred because of a change in their family situation. Only 4% paid more because they chose to increase coverage on a current policy.

So why are premiums going up? Depends who you ask.

A spokesman for the Insurance Information Institute blames the streak of natural disasters going back to Hurricane Irene and the Joplin, MO, tornado.

“While homeowners rates don’t move significantly in just one year, when you look at how some of the costliest natural disasters in U.S. history have all occurred in the last decade, this is not a surprise,” he explains.

But the director of insurance for the Consumer Federation of America points to rising health insurance costs as the likely culprit.

“That’s one that people recognize because a lot of times it comes through their employer,” he says, “so they have an opportunity to look at various options and think about that policy a little more.”

He also believes that there were more people paying higher insurance rates last year who just didn’t realize it:

“Consumers are buying insurance in six-month pieces instead of annually, and insurance companies have taken advantage of that. Instead of raising rates 10 percent every two years, they raise them 2.5 percent every six months, and people don’t notice that.”

The CFA director also says that insurance companies are taking advantage of consumers’ fears that something bad will happen if they change carriers.

“People are afraid if they move from a company after 20 years and then have an accident, the company might cancel them, so they pay the occasional $50 (increase) and stay put,” he explains, adding that shopping around for a less-expensive policy “is the key” to saving money on insurance.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.