According to a tale, possibly apocryphal, we picked up while visiting Charlotte, Bank of America’s home base, BoA CEO Ken Lewis was once standing behind some customers having trouble with a malfunctioning BoA ATM.

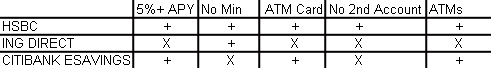

atms

The Potentially Apocryphal, Yet Well-Worn, Story Of Ken Lewis' Personal Dedication To Customer Service

Oh, Your Mom Might Know Your PIN? Then You're Not Getting Your $300 Back

Samantha, pictured holding a log more customer friendly than Capital One, had $300 stolen from her Capital One account, even though her debit card was still in her pocket. When she filed a claim with CapOne, not only did it take numerous contradictory phone calls with employees not knowing their ass from their elbow, her claim was denied. Why? Because she said on her claim form that her mother might know her PIN. Oops.

How Crooks Steal or "Skim" Your ATM Card

Why do we suddenly want to watch The Departed? Anyway, after talking with the detective the Today show set up their own skimming operation in Times Square. Just about 1/2 of the people who used the ATM fell for a skimming box located just outside the door where the swipe pad that unlocks the door would normally be. Sad.—MEGHANN MARCO

Publix's "Awesome Response!"

Red_eye and his wife shop at Publix, but the ATM outside the store seems to break on a weekly basis. He asked Publix to look into the situation:

Hello,

Part 3: I Was A Cybercrook For The FBI

Part 3 of Dave Thomas’ story of working as a cybercriminal for the FBI story is up on Wired, The Boards Come Crashing Down.

I Was A Cybercrook For The FBI

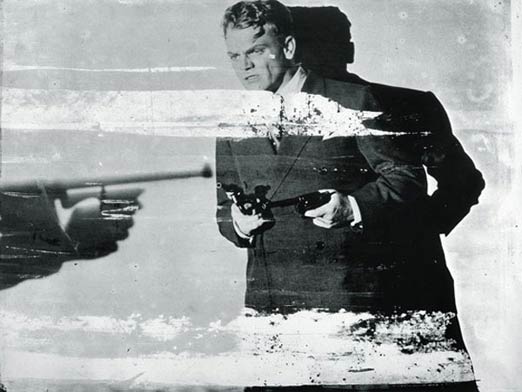

Parts 2 and 3 of the Dave Thomas Cybercrook story are up on Wired. The excellent report by Kim Zeter, two years in the making, offers a fascinating insight into the world of identity thieves, credit card scammers, phishers and all sorts of electronic fraud. Follow along as Dave transitions from petty thief, to cyber-crime master under the name “”El Mariachi” and with a James Cagney online avatar, to informant on the noose for the feds.

35 Most Outrageous Fees and How to Avoid Them

CNN has broken down ” the most outrageous” fees levied on consumers and how to avoid them. Unsurprisingly, quite a few have to do with travel, banking, and airlines. Paper ticket fees, flight change fees, ATM fees, etc. Some good travel tips are to be had: Southwest airlines doesn’t charge to change a flight, and JetBlue only charges $25-$30.

New ATM Increases Reader’s Likelihood Of Being Riddled With Bullets

Garth used to be able to jump out of his car and deposit his checks in under a minute. That changed when his Bank of America installed a new ATM.

Out Damned Spot! Help A Reader Clean His Citibank Credit

Ben — a man with perfect credit — needs help. Not Ben Popken, editor of this Mickey Mouse pajama publication. Ben A. — one of our most prolific tipsters.

WaMu Adds Chinese and Russian to ATMs

We have yet to independently verify this, i.e., we’ve been putting off going to the bank for a few days, but it seems that WaMu added Russian and Chinese to its ATM languages.

Cali Dollar Trees Source of ATM Hacks

Shopping at the Dollar Tree could end up costing you a lot. Hundreds of California patrons of the discount store report having money jacked from their debit accounts, reports KCRA. Most likely, this was through the use of cloned ATM cards.

Online Fraudster Interviewed

SmallWorldPodcast interviewed El Mariachi, a man who commits online fraud and identity theft. The interview reveals details about another scammer, Dillinger, who was involved with the ATM hacks of the ill-fabled “Russian Connection” scandal.

John Dillinger Was a Bank Robber Who Walked Through Walls

Last week, we linked to an excellent interview where Bazooka Joe at Small World Podcast spoke with an individual going by the name of “John Dillinger” who participated in the big ATM PIN block crisis. His involvement was to embed blank cards with the hacked PINS, withdraw the money from ATMs, and send back a percentage to his uplink. John Dillinger commented on the post to make sure we got the story straight:

Citigroup Gets Around to Addressing PIN Compromises

Hey, remember all those debit cards and PINs that got stolen and stuff? Where hackers got into Office Max, made off with debit card accounts and encrypted PIN codes, decrypted the PINs, made counterfeit ATM cards, and withdraw lots of money and large amounts of people were forced to get their ATM card changed without anyone telling them the real reason why? Well, apparently Citigroup remembers too. Eventually.

OfficeMax says, “No Evidence of Security Breach”

“Following an extensive review of its security systems, OfficeMax says it has no reason to believe it was the company that suffered the data breach that resulted in thousands of cases of debit card fraud,” in a CNET report pointed to us by reader John.

Many More ATM Attacks Forthcoming

“The banking industry is less than halfway through this latest scam, which will continue to affect large numbers of cardholders.”

Consumers with Forced Debit Card Reissues Step Forward

More signs point to OfficeDepot/OfficeMax and Sam’s Club/Wal-Mart as being the retailers suspected of letting thousands of customer’s debit cards and PINs to be stolen (see ATM Fraud UPDATE: Wal-Mart, OfficeMax, Sam’s Club, Office Depot Suspected).