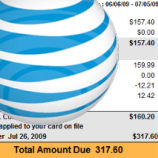

We think AT&T just stole about $157 from commenter Spoco. They applied the payment as always via his Amex card, but then said that it was declined and auto-debited it a second time a month later (+ late fees, of course). The only problem is, it wasn’t declined, and Spoco has proof. He just can’t get anyone at AT&T to care.

AMEX

Beware The Costco And American Express Membership Fee Double Dip

Last week we mentioned that Costco has a habit of backdating the starting date for lapsed membership renewals, which prompted Monica to write in and let us know of another issue they seem to have with billing. If you renew your executive membership with Costco but then apply for the Costco American Express card, Amex will charge you the membership fee a second time. Monica says the Amex CSR who fixed the problem told her it happens all the time.

9/11 Ruins Another Customer Experience

Angela can’t get a new American Express card because Amex can’t verify her Social Security number. They have to verify it because of 9/11. Since they can’t, they’ve canceled her application. Because of 9/11.

American Express Keeps Emailing Sensitive Customer Info To A Random Stranger

We’re starting to think Amex doesn’t take this whole “data security” thing very seriously. First they confused a customer, and us, a few months ago with their random confirmation phone call, where they demanded a customer turn over bank account information over the phone without giving him a way to verify they were really Amex. Now a reader says the company has “for years” been sending him someone else’s account info via email, including the customer’s name and the last 5 digits of his account number. J.R. writes, “Seriously, I’ve seen better security on a video game forum.”

Don't Be Alarmed By Zombie American Express Bills

A system error at American Express led to their computers kicking out bills with $0.00 balances for accounts that were long ago closed…or never activated in the first place. If you receive one, don’t be alarmed. Annoyed, maybe.

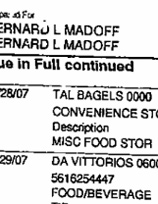

See Madoff's AMEX Bills

Wanna see the Maddoff clan’s AMEX statements? They’re online here. 2 grand Giorgio Armani in Paris, 8 grand at a hotel, 10 grand to charity, $441 at a bagel store, the garners of unlawful gains really know how to live it up. But you gotta give the guy some credit: he did pay his bills on time. [Scribd] (Thanks to Chris!)

Don't Move House If You Have An Amex Card

Here’s a cautionary tale from a Consumerist reader whose credit card company contacted his out-of-date phone number and got authorization for a $4000 spending spree. withdrew thousands of dollars from his bank account for a payment he had supposedly scheduled and then OK’d over the phone. The problem? He hadn’t scheduled it, that wasn’t him on the phone, and that wasn’t his phone number.

Amex Hikes Rate, Drops Balance, Then Tries To Bribe Customer To Pay Off Debt Early

Courey Gouker’s recent experience with American Express encapsulates every trick the company has pulled in the past few months to drive away their customers, including dropping the credit limit, hiking the rate, and even offering him a cash bonus to pay off his balance in full. In addition, the company’s CSRs made promises to him that they didn’t keep, and notes on his account have gone missing. About the only thing they haven’t done is email a photo of the CEO flipping him the bird.

Apple Sells You The Wrong AppleCare Package, Then Loses Your Refund

Apple sold reader Melody the wrong AppleCare package, but instead of switching her to the proper coverage, they issued a refund and told her to re-purchase the warranty extension. They even gave her American Express transaction reference numbers so she could track the refund, but AmEx says the numbers are invalid and that they have no record of a refund posting. Melody’s been out $195 since February, and thinks it’s time for Apple to cough up her money.

Woman Who Missed Obama's Inauguration Starts $10,000 AmEx Chargeback

American Express has given her an “interim” refund in full, pending a review that will involve the credit card company presenting to PIC officials all of Blessman’s documentation on the services she feels she was denied.

Worst Company In America: Peanut Corporation Of America VS American Express

We’re doing two a day in the first round, people. It’s madness! Stretch out your quads and get ready for #16 Amex VS #17 Peanut Corporation of America.

Make Sure Your Replacement AmEx Gets Overnighted

Traditionally, AmEx will send you a replacement credit card via overnight, but an insider tells us that as a cost-saving move, they’ve been trying to cut back on this. If you have low-balance, low-usage or are not an annual fee payer, they might not offer the overnight right off the bat, or may even deny it. Our tipster says there are some key phrases you can use to make sure you get your card lickity-split:

15 American Express Executives' Email Addresses

Here are the email addresses for 13 American Express execs, in case you need to send them an eecb.kenneth.I.Chenault@aexp.com, kenneth.Chenault@aexp.com, daniel.t.henry@aexp.com, alfred.kelly@aexp.com, l.kevin.cox@aexp.com, ashwini.gupta@aexp.com, john.d.hayes@aexp.com, judson.c.linville@aexp.com, louise.m.parent@aexp.com, louise.parent@aexp.com, thomas.schick@aexp.com, steve.squeri@aexp.com, douglas.e.buckminster@aexp.com, douglas.buckminster@aexp.com, william.h.glenn@aexp.com [More]

Internal AmEx Doc On $300 Bribe To Zero Account And Leave Program

Here’s an internal AmEx doc with what customer service reps should say when people call up asking about the $300 to pay off and close your account program, or, as they term it, the “Balance Down Initiative.” The sheet was obtained exclusively by creditcarforum.com. My favorite part is the answer for if people who weren’t chosen to participate ask if they can join. The correct response is, “We apologize, but we can only honor this offer for selected cardmembers. However, if you’re interested in paying down your balance, I can help you with that.” Full doc inside…