American Express is so desperate to clean liabilities off its balance sheet that it’s paying some customer $300 if they will pay off their balance in full and close their credit card. The offer is only good if you get a card in the mail from them about it with a 14-digit RSVP code. Thanks for playing, don’t let the door hit your ass on the way out.

AMEX

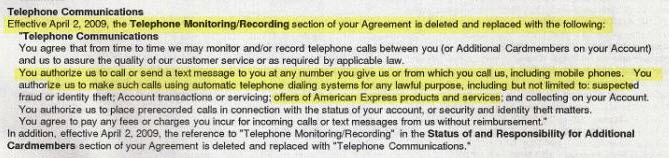

Amex: "We're Gonna Text Message Your Cellphone And You're Gonna Pay For It"

Several readers have pointed out that American Express has made some changes to its contract “in response to the challenging environment” — the most offensive of which seems to be a new clause that gives them the right to call — or text message — any phone you use to contact them including cellphones, for the purposes of offering you American Express products and services.

US Airways And Delta Duel Over The Phone For Most Incompetent Airline Ever Award

Want a great example of the broken state of airline customer service in this country? Try a four-way conference call between yourself, Amex Travel, US Airways, and Delta. You’ll see firsthand how CSRs from the two airlines can play the “it’s not our responsibility” so well that even a devoted Amex Travel rep can’t get them to solve your problem.

Before Traveling, Make Sure AmEx Hasn't Canceled Your Card

Ronnie Sue’s recent trip to Germany was a financial nightmare. Though she warned her bank she would be traveling to Germany, when she arrived, she couldn’t withdraw needed cash. The bank gently suggested that Ronnie Sue draw cash from her credit card, and even offered to refund any cash advance fees. It wasn’t until Ronnie Sue whipped out her AmEx that she learned it had been silently canceled two days before she left…

AmEx Denies Existence Of A Store Blacklist, Will Slash Your Credit Whenever They Want

Despite sending customers letter saying otherwise, American Express now insists that it never blacklisted cardholders based on where they shopped. Those notes explaining that “other customers who have used their card at establishments where you recently shopped have a poor repayment history with American Express?” Whoops! Just a big misunderstanding! Not unlike the comment they gave to ABC explaining that “shopping patterns” were used as a “contributing factor” in slashing credit lines, a statement AmEx later retracted. So what’s really going on? Let’s explore…

NewCreditRules Asks, Which Of These Stores Will Get Your AMEX Card Reduced?

Last month we posted about Kevin Johnson, a 29-year-old self-employed businessman with excellent credit and an established history with American Express, who had his credit limit cut by 65% because AMEX said he was shopping at the wrong sorts of stores. Johnson has created a website called NewCreditRules.com to try to uncover what, exactly, he did wrong to fall under AMEX’s high risk category.

AMEX Surprises Traveler By Canceling Card Without Warning

It looks like American Express is still in the throes of its “risk management” craziness and closing accounts without visible reason. Did Chris, who was just left stranded while on a business trip, shop at the wrong store? Did he fail an internal financial review that nobody told him about? Whatever the reason, it’s a good example of why you should have more than one credit account when traveling, so you don’t have to rely on the whims of any single faceless corporation.

AMEX Lowers Your Credit Limit If You Shop Where Deadbeats Shop

AMEX is now cutting people’s credit limits for shopping at the wrong store.

Credit Card Squeeze Is Pushing Consumers Toward Foreclosure

USAToday says that panic by the credit card industry is squeezing customers who ordinarily would be able to pay their bills — pushing them toward financial ruin and foreclosure.

AMEX Cuts You Off Unless You Show Them Your Tax Returns

The credit crunch is affecting all of us differently. Right now its affecting Nick as he sits in a hotel 3,000 miles from home.

Don't Worry About AMEX's Bank Yank Clause

CreditMattersBlog explains why that new AMEX contract language we wrung our hands over this morning is nothing to fret about.

American Express Becomes A Bank… And Wants Bailout Money

American Express won U.S. Federal Reserve approval to become a bank holding company — giving it access to the bailout party as credit card defaults climb. Bloomberg News says that the Fed waived the usual 30 day waiting period because (in the words of Fed Chairman Ben Bernanke) we’re experiencing “unusual and exigent circumstances affecting the financial markets.” Today, American Express has requested $3.5 billion in taxpayer-funded capital from the federal government, says the WSJ.

What To Do When A Store Sells You Box Of Crap And Won't Take It Back

We get a lot of complaints about people buying things from stores like Best Buy and Target and finding that once they get them home — there’s a bunch of bathroom tiles in the box instead of the item, or that the item is used, broken or smashed. When they try to return the thing, the store tells them that they’re out of luck. When you ask why they think they can get away with selling you a paperweight instead of an XBOX, they point to some bullsh*t policy and send you on your way. You don’t have to put up with this. In this post, we’ll tell you a) How to keep this from happening to you in the first place. b) How to equip yourself with tools that will help you in the event that this does happen to you. c) How to take advantage of these tools so that you never get stuck with someone’s old broken PS3.

Which Credit Cards Have The Best Rental Car Insurance?

One of the tricks that seasoned travelers know is to always deny the insurance when renting a car. Why? Because the credit card that they are using already comes with insurance that they are familiar with, and because you are required to deny coverage from the rental car company in order to take advantage of your credit card’s insurance. But how do you pick a credit card that has good rental insurance?

American Express Helps You Even If You Screw Up The Paperwork

Joe wants to thank American Express for fixing an incorrect charge on his bill even though he completely forgot to send in the paperwork. Aw!

Sears Is Now Officially Too Incompetent To Even Take Your Money

Gregg wants us to know that Sears has just hung up on one of the last people in America who hasn’t totally given up on them. He’s spent quite a lot of time lately trying to give them $1500 for a lawn tractor, but they just couldn’t figure out how to complete the transaction. Yes, Sears has finally gotten to the point that they can’t take your money even if you want to give it to them.

Rogue Charges Resurrect Expired Amex Card

Patricia closed her company’s American Express Delta Sky Miles card six months ago, but the expired card unexpectedly sprang to life thanks to a supplier’s accidental charge. American Express laughed off the matter, saying “this happens all of the time,” adding that it’s Patricia’s responsibility to ensure that all vendors destroy her outdated billing information.