Americans and Europeans love “super premium” single malt scotch whiskies—sales were up 14% last year, even while sales for value and premium scotch fell. If you helped contribute to that number, you’ll appreciate this list of 10 terrific single malt and blended whiskies from a fellow scotch lover, with detailed descriptions of what you can expect from each bottle.

advice

Saving Money The Lazy Way

If you’re like approximately 25% of the writers at The Consumerist, then prolonged talk of budgeting makes your eyes glaze over with boredom as you imagine yourself somewhere else doing something fun, like playing a video game or looking at pornography. Here, then, is a list of 10 so-called “easy” ways to save money, none of which require that you read a book or finally open that Quicken box your parents bought you two years ago. Many (or most) of the ideas may be of dubious value, but nobody said being lazy was profitable.

Roasting Pan Tips From Some Butterball Lady

Mary Clingman, the director of Butterball’s help line, gave Newsday some advice on finding a good roasting pan for your Thanksgiving dinner. Her advice: get a shallow pan 2 to 2 1/2 inches deep that’s large enough to place a rack inside to sit the turkey on. You can buy a new, reusable one at a restaurant supply store or Sur La Table for between $35 and $200, but the next best thing is a cheap disposable aluminum one from the supermarket: “Place four-five whole carrots on the bottom and rest the turkey on them. Put a cookie sheet underneath the foil pan for extra support.”

Cheap Ideas For Holiday Parties

Kiplinger set itself three basic rules to follow for affordable holiday entertaining: “make it a team effort” by splitting hosting duties or having guests bring food, “borrow what you don’t have,” and ” be creative.” Following these rules, they came up with ten ideas for holiday get-togethers that even people on tight budgets can pull off. Here are the first three.

10 Great Finance Books

Trent at The Simple Dollar read a new finance book every week for a year, ranking them according to how original and useful they were, and now he’s compiled a list of his top ten picks. According to Trent, if you read these ten books (and maybe the ones coming in at #11 and #12), “You’ll have absorbed basically all the useful material in every book on the list.”

His top pick is “Your Money or Your Life,” by Joe Dominguez and Vicki Robin, a “big picture” book that looks at how and why you spend your money.

10 Ways To Make Traveling With Children Tolerable

And by “tolerable” we just mean “nobody has to die this year.” Kiplinger offers 10 ways to prepare yourself for traveling with kids now that cough syrup is frowned upon. We think one of the best is “team boarding”—don’t pre-board an airplane, because all it really does is increase the time your children are stuck in their seats getting all bouncy. Instead, if you’ve got another adult with you, one of you should board early and get the luggage stowed, pillows arranged, etc., while the other stays in the airport for as long as possible trying to run the kids ragged enough that they’ll promptly fall asleep once they’re settled in.

Buying A Home? Don't Rack Up Debt Between Approval And Closing

Don’t open any new lines of credit or go crazy with the credit card purchases between your home loan’s approval and the actual closing date, warns Ilyce R. Glink (doesn’t it look like we just tapped a bunch of keys at random to spell that name?) at Inman Real Estate News. Your lender will pull a second credit report before closing to make sure that you’re still capable of paying your loan—so if you’ve done anything in the interim that could impact your ability to pay, rest assured it will show up.

6 Ways To Save Money This Season

All Financial Matters offers six interesting ways to cut costs between now and the end of the year, and although we don’t completely agree with a couple of suggestions, we still think it’s worth a look.

1. Actually look at the price tag before you buy each and every thing for the rest of the year.

2. Avoid items marketed for the season. Their example: red and green candles work fine—you don’t need “Christmas” candles.

Protect Yourself From Being Bumped Off A Flight

Kiplinger’s “Win the Bumping Game” offers some advice on how to minimize the chances you’ll get left behind when your airline overbooks a flight. The main thing you can do is arrive early—it’s the last-minute arrivals, or worse, those who buy their tickets a half hour before departure, who are most likely to get bumped. The other thing you can do is avoid Delta, Comair, or Atlantic Southeast, which have the worst records of bumping passengers, and stick with JetBlue, which has the best. And make sure you have a seat assignment if at all possible.

Watch Out For Fees With Gift Cards

Like candy canes and drunken family dinners, gift cards have become a Christmas staple. Bankrate has reviewed a wide number of them and published the results to help you pick the best one for your needs. To avoid fees, you should stick with “closed-loop” cards—that is, a card issued by a specific retailer for use only with that retailer. Almost all retailers now offer cards that don’t expire and don’t charge maintenance fees, with the notable exceptions of Macy’s and Bloomingdales, whose cards both expire two years after purchase. However, several retailers—CVS, for example—still charge “dormancy” fees on cards that have been inactive for anywhere from 6 to 24 months, so be sure to check the fine print to see how this is addressed.

Share Money Problems With Today Show, Get Famous, Buy Gold Mansion

NBC’s TODAY show has a new series called “Make Your Life Better TODAY,” and they’re asking viewers to send in their personal finance questions so they can address them on-air: “Whether you’re single or married; young or old, we want to know your concerns about debt, retirement, investments, savings and more.” If you fit one of the following scenarios, they might even want to bring you on the show to find out who your baby daddy is. Or maybe so Ellen can cry at you? Something like that—all that daytime TV sort of blurs together.

Call For Advice: Reader Wants Discount Brokerage Recommendations

Onoodles writes, “I’ve managed to put away 20k into a Roth IRA. I started it directly through one mutual fund and now I’m looking to move it to a discount brokerage firm to diversify. So my question is, which one is the best?!” For a general overview and comparison of leading brokerages, we suggest looking into SmartMoney’s 2007 Broker Survey from a few months ago. And note that by going with a discount brokerage firm, you’ll likely be trading better customer service, research tools, and trading tools for cheaper fees.

How To Pick A Good Doctor

“Most people spend more time picking out a can of beans than a new doctor,” says one expert in a Chicago Tribune article about how to find a properly licensed doctor that you’ll get along with. He and other experts recommend you arrange for a “first date” sort of interview, so you can ask general questions and get an overall feel for both the doctor and the practice, before the time comes when you need a doctor and don’t have the luxury of shopping around.

Don't Wait Too Long To Get Help With Money Problems

Too many people wait until they hit rock bottom before seeking help from credit counseling agencies, says a New York credit counseling service. The consequence is that consumers end up limiting “the options available to them without having to make major, and often very difficult lifestyle changes. If they wait too long, debt repayment plans become unaffordable—leaving them more vulnerable to losing assets or having to file bankruptcy.”

So how do you know when it’s time to ask for help? If your monthly payments are exceeding your monthly income, it’s probably a good time. To find an agency, check out wikiHow’s How To entry, and use this list provided by Bankrate to ensure the agency will be able to provide the services you need.

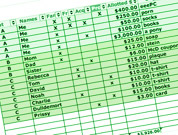

Use A Spreadsheet To Plan Your Gifts

This professor of finance proposes you take all the fun out of wildly overspending on last-minute gifts for friends and family, and replace it with the measured, predictable joy of a spreadsheet. However, if you follow his advice, the odds will be much better that you’ll end the year with healthier checking and credit card accounts.

6 Financial Demons And How To Exorcise Them

If you keep trying to save money and failing, there’s a good chance you’re possessed… by “financial demons,” says Kiplinger. Here’s a list of six common ones and how to exorcise them, before your credit rating goes all Linda Blair on you.

SmartMoney's 5 Strategies For When Regular Customer Service Fails

At the risk of turning into an echo chamber, we want to point out that SmartMoney has a good list of five ways to escalate your customer service issue when the normal CSR route fails. Sure, we’re all about the executive email bomb here at Consumerist, but there are other viable paths you should consider as well—like turning to your local government, and not just for local businesses: “A problem with your communications provider, for example, may be resolved with a complaint to a common, but little-known town board — the cable access committee, which acts as a liaison between the government and the cable suppliers for that area. “

5 Ways To Prepare For A Surprise Layoff Or Firing

If it’s truly going to be a surprise, there’s not much you can do on the day it happens, other than roll with the punches and maybe meet up with some friends after work for a beer. However, you can take some important steps to insure that you’re well-protected if you ever find yourself in this situation, so that you can improve your odds of landing another job quickly, before that creepy desperation sets in and you start to make recruiters and HR specialists uncomfortable. Consumerism Commentary describes 5 ways to prepare yourself for unexpected “career mobility.”