In the wake of the FCC’s vote to adopt the new net neutrality rule, Americans of every stripe have bombarded their lawmakers with feedback. Some applaud the rule; others condemn the action. And that is all well and good: it’s the American system of democracy at work, exactly as designed. [More]

Government Policy

![The CFPB's electronic version of its Know Before You Owe Mortgage Toolkit includes interactive forms to help consumer find the right mortgage for them. [Click to Enlarge]](../../../../consumermediallc.files.wordpress.com/2015/03/screen-shot-2015-03-31-at-2-08-15-pm.png?w=300&h=225&crop=1)

CFPB Releases Mortgage Toolkit Aimed At Making The Home Buying Process Easier

In January, the Consumer Financial Protection Bureau released a report suggesting that many homebuyers spend more time looking for a TV than shopping around for the right mortgage. In an attempt to make things a little less daunting for prospective borrowers, the Bureau today released the “Know Before You Owe” mortgage shopping toolkit. [More]

Current, Former Corinthian College Students On “Debt Strike” Plan To Meet With Gov’t Officials

Last month, we told you about the Corinthian 15, a group of current and former students at crumbling Corinthian College Inc.’s WyoTech, Heald College, and Everest University campuses who were refusing to pay their federal student loans in protest of the government’s support of the for-profit college company. Now that group has grown to what could be called the Corinthian 100+, and it’s made plans to take its case to several government agencies this week.

“Bad Check” Debt Collector Deceptively Used Prosecutors’ Letterhead To Intimidate Consumers Into Paying High Fees

Late last year, Consumerist reported on a string of debt collectors paying to use prosecutors’ letterheads as a way to intimidate consumers into paying their debts. While the company facing the wrath of the Consumer Financial Protection Bureau today didn’t exactly pay to use the letterhead, they allegedly used the documents in a deceptive manner to get consumers to enroll in costly financial education programs. [More]

FCC Chair: Net Neutrality Is “Right Choice” Because Big ISPs Want “Unfettered Power”

The net neutrality rule hasn’t yet taken effect, but it’s been under heavy political fire for the past few weeks. Lawmakers hauled FCC chairman Tom Wheeler and other FCC commissioners in before a series of Congressional committees to justify (or, for dissenting commissioners, to vilify) the open internet rule. Those hearings, in large part, were heated and adversarial. But in a speech at Ohio State’s law school today, Wheeler took the chance to say everything that committee members cut him off from. [More]

FTC Shuts Down Credit Repair Business Masquerading As The Federal Trade Commission

Fraudsters have been known to scam unsuspecting consumers by claiming to be agents with the federal government. So, in a bit of poetic justice, the Federal Trade Commission had a hand in shutting down a business calling itself the “FTC Credit Solutions.” [More]

White House Acknowledges Health Risk Of Antibiotics Overuse; Critics Say It Fails To Fully Address Problem

In a new White House report on antibiotic resistance, the Obama administration acknowledges the serious public health risk posed by the over-prescription and overuse of antibiotics, and details multi-agency plans to combat the problem. However, many critics of the report say that these plans fail to close a loophole that will allow farmers to continue using medically unnecessary antibiotics on farm animals (who consume 80% of all antibiotics sold in the U.S.) primarily for the purpose of growth promotion. [More]

Outline For Payday Lending Rules A Good Start, But Not Enough To Fully Protect Consumers

Today, the Consumer Financial Protection Bureau released the first details of long-awaited regulations governing payday loans and other small-dollar lines of credit known to thrust consumers into a devastating cycle of debt. While consumer advocates were quick to applaud the Bureau’s work, and those in the financial industry to voice displeasure with aspects of the potential rules, both groups agreed that the coming months will involve more time and effort to craft meaningful protections for both sides of the issue. [More]

Truck Full Of Salmon Turns Over On Highway, Blocks Traffic For 9 Hours

The creatures of the sea are rising up to…snarl our traffic and then get eaten anyway. First, a tractor-trailer in Maine overturned, but its cargo of 30,000 pounds of live lobsters were fine and survived to be loaded on another truck. Now a truck full of salmon turned over on a highway in Seattle, messing up traffic everywhere from down the road to in the sky. [More]

American Apparel Founder Dov Charney Under Investigation By SEC

Any hope founder of American Apparel Dov Charney had of returning to the company may have gone out the window this week, after it was revealed that the Securities and Exchange Commission opened an inquiry into the circumstances leading to his departure. [More]

Can New Payday Loan Rules Keep Borrowers From Falling Into Debt Traps?

Nearly one in four consumers continue to turn to high-cost, short-term financial products like payday loans, auto-title loans and other pricey alternatives when struggling to make ends meet, even though research shows these expensive lines of credit often leave consumers worse off than when they began. After nearly three years studying the issue, the Consumer Financial Protection Bureau is now announcing its first attempt to protect consumers from predatory lenders. [More]

House Committee Asks Same Net Neutrality Questions As The 4 Previous Committees

FCC chairman Tom Wheeler was once again called before Congress today. His task: to justify the commission’s vote to protect consumers from the potential, likely harms of monopoly ISPs out to make a buck in any way they can. Or, in other words, to defend the agency’s recent vote on net neutrality. [More]

Another 130,000 Consumers Tell FCC: Don’t Allow Robocalling To Our Cellphones

Federal law currently bars companies from making automated, pre-recorded calls to your cellphone without obtaining explicit prior consent, but banks want to kick down that legal barrier so they can robocall without fear of penalties. In February, 60,000 consumers asked the FCC to just say no to opening this loophole, and today another 130,000 Americans are adding their voices in opposition to robocalls. [More]

Can’t Pay Your Student Loans? In Some States It Might Cost You Your License To Drive Or Work

In addition to causing irreparable damage to their credit scores, student loan borrowers who default on their debts face a much more devastating and counter-intuitive danger: the lost of their driver’s or occupation licenses, including those used by nurses, doctors, teachers and emergency personnel [More]

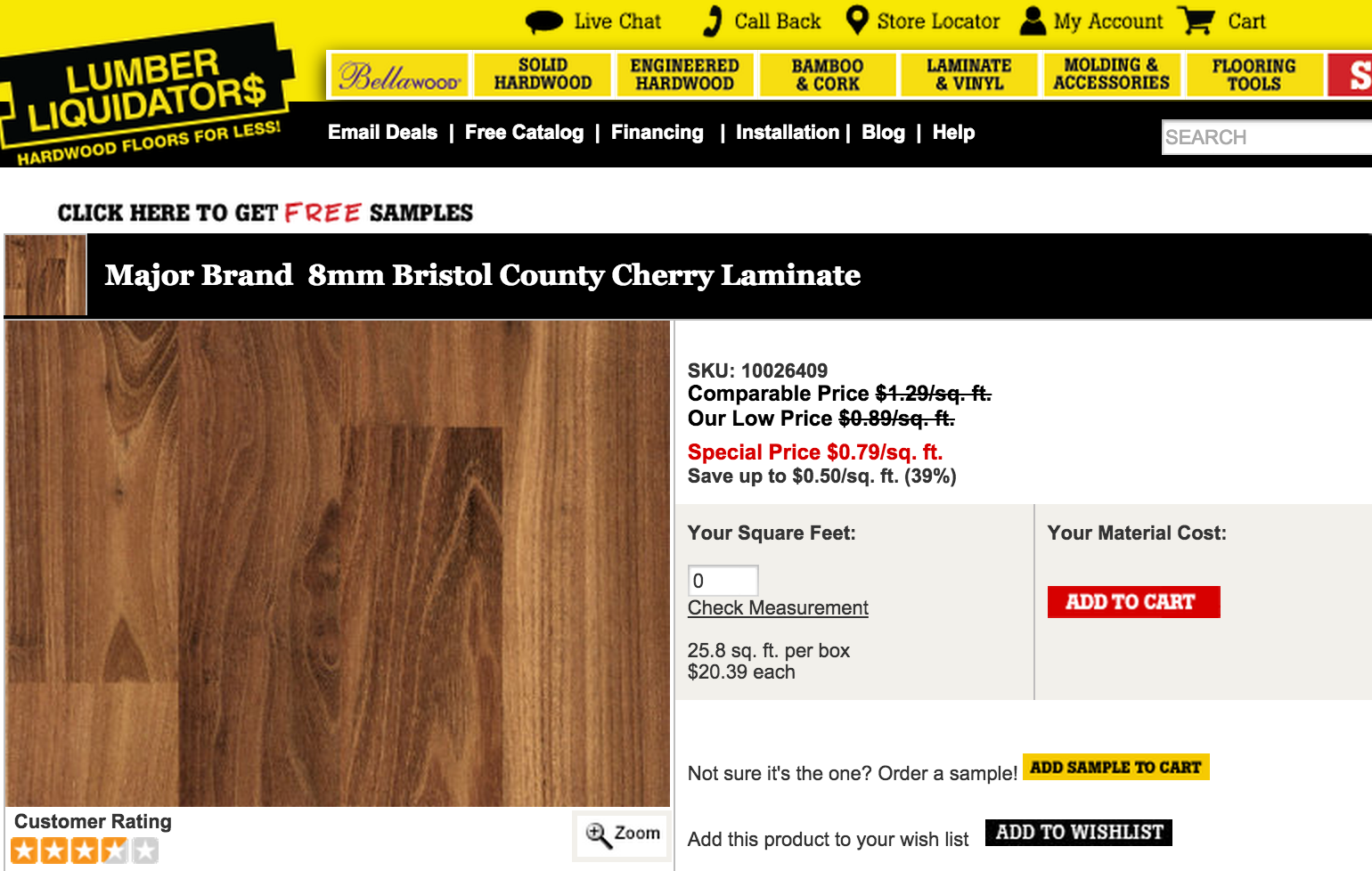

Feds Investigating Lumber Liquidators Over Formaldehyde Allegations

In the wake of a primetime news report alleging that some flooring sold by Lumber Liquidators contained excessive amounts of formaldehyde, federal regulators at the U.S. Consumer Product Safety Commission have confirmed the agency is investigation the lumber company. [More]

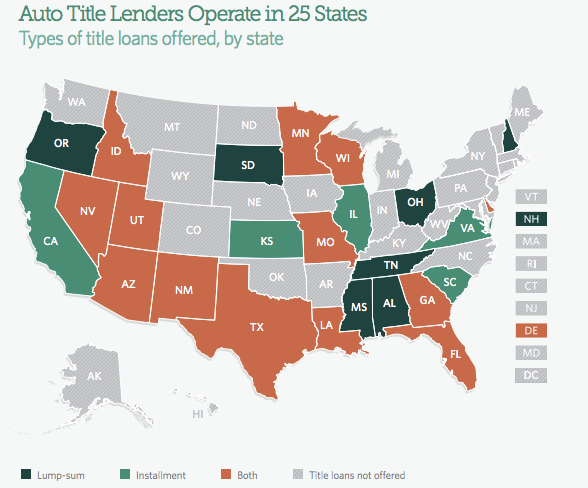

Report: Auto Title Loans Just As Bad, If Not Worse Than Payday Loans; Should Face Same Rules

Each year millions of consumers turn to high-interest, short-term loans to make ends meet. While you may be more familiar with payday lenders who charge triple-digit interest rates with the goal of trapping borrowers into taking out new loans to pay off the old ones, a new report finds that payday’s lesser-known relative, auto title loans, have equally destructive repercussions. [More]