FTC’s Auto Industry Crackdown Includes Deceptive Advertising, Fraudulent Add-Ons & Improper Loan Modifications Image courtesy of (bluwmongoose)

A two-country crackdown on auto dealers’ deceptive, fraudulent practices culminated in six enforcement actions brought by the Federal Trade Commission resulting in more than $2.6 million in judgements and consumer refunds.

The Federal Trade Commission announced today that Operation Ruse Control, an initiative to protect consumers when purchasing or leasing a car included 252 state and federal enforcement actions in the U.S. and Canada covering a plethora of cases of deceptive advertising, automotive loan application fraud, odometer fraud, deceptive add-on fees, and deceptive marketing of car title loans

In all, Jessica Rich, director of the FTC, said during a conference call that the enforcement efforts include both civil and criminal charges against auto dealers and financial companies.

“For most people, buying a car is one of the largest purchases they’ll make,” Rich said. “Car ads must be truthful, loan terms must be clear, and dealer practices must be honest. That’s why our partners are working together to crack down on deceptive marketing about car sales, leasing and financing.”

Deceptive Add-On Practices

For the first time, two of the FTC’s cases involve the agency using its authority to take action involving deceptive add-ons – the practice of a dealer or other third-party adding to the vehicle sales, lease, or finance agreement charges for other products or services.

In many cases, add-ons are buried in consumer contracts, meaning purchasers are often unaware they are paying hefty fees for services such as extended warranties, road service, and theft protection they may not want.

The FTC alleges [PDF] that California-based National Payment Network, Inc. violated the FTC Act by deceptively pitching consumers an auto payment program – both online and through a network of authorized auto dealers – that it claimed would save consumers money.

However, NPN failed to disclose that the significant fees it charged for the services – averaging $775 – often cancelled out any actual savings.

In all, consumers who signed up for the Biweekly Payment Program through NPN were often charged an enrollment fee of $399, followed by $2.99 processing free for each payment made. When consumers decided to withdrawal from the program they were charged a $25 cancellation fee.

The FTC’s second add-on case against New Jersey-based Matt Blatt dealerships stems from the dealerships’ actions of regularly selling NPN’s add-on services, while failing to disclose the fees associated with the payment program.

According to the complaint [PDF], since 2009 Matt Blatt dealerships have received a commission for each of the more than 1,000 consumers who enrolled in NPN’s add-on payment program.

Most consumers learned about the Biweekly Payment Plan after they selected a vehicle to buy at Blatt dealerships. At that time, the consumer signed legal paperwork closing the transaction with the company’s financing department, authorizing the add-on service.

Matt Blatt dealerships and NPN agreed to settle the FTC charges regarding the violations and are prohibited from misrepresenting that a payment program will save consumers money, unless the amount of savings is greater than the total amount of fees and costs charged in connection with the program.

Additionally, NPN will refund consumers more than $1.5 million and waive another $949,000 in fees currently owed by customers. Matt Blatt dealerships will pay $184,000 to the FTC.

No Truth In Advertising

In addition to complaints involving add-ons, a significant portion of Operation Ruse Control focused on dealerships’ use of deceptive advertising.

Rich said that deceptive advertising – including the promises of zero percent financing, and no down payments – was the most common issue FTC agents saw during the crackdown.

Three auto dealers – Florida-based Cory Fairbanks Mazda [PDF], Alabama-based Jim Burke Nissan [PDF] and California-based Ross Nissan [PDF] – agreed to settle FTC charges alleging they ran deceptive ads in violation of the FTC Act and the Truth in Lending Act.

According to the FTC complaints, the companies ran ads touting sales, lease or financing options that attracted consumers, but were cancelled in the fine-print disclaimers. In other cases, the dealerships’ disclaimers did not disclose relevant terms of the options, such as required down payments.

![The FTC included this advertisement for Cory Fairbanks Mazda as evidence of deceptive advertising by the dealership. [Click to enlarge]](../../../../consumermediallc.files.wordpress.com/2015/03/screen-shot-2015-03-26-at-11-58-31-am.png%3Fw=152&h=300)

The FTC included this advertisement for Cory Fairbanks Mazda as evidence of deceptive advertising by the dealership. [Click to enlarge]

However, further down in the advertisement, away from the sales price and below prominent contact information and in much less prominent print, the following information states that all prices are after $3,000 cash or trade equity plus all incentives and dealer add-ons.

“Must be present upon entering dealership. Not valid with other offers or discounts. Not valid on past sales. All lease payments are $3,000 down, 42 months, 10,000 miles per year plus tax, tag, and fees. All prices after $3,000 cash or trade equity plus all incentives and dealer add-ons.”

Thus, the FTC alleges in its complaint, the actual price of each of respondent’s advertised vehicles is $3,000 more than the dollar amount that is prominently displayed immediately below the vehicle.

Under the proposed settlement with the dealers, the FTC will prohibit the companies from misrepresenting the purchase cost or any other material fact about the price, sale, financing or leasing of a vehicle.

Worthless Loan Modifications

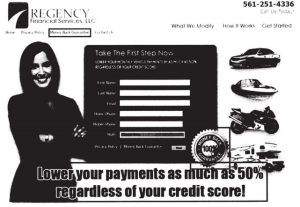

The final issue widely covered by the FTC involved the deceptive loan modification practices allegedly carried out by Florida-based Regency Financial Services and its CEO Ivan Levy.

According to the FTC complaint [PDF], the company and its executives allegedly charged consumer upfront fees to negotiate an auto loan modification on their behalf. However, in reality the company provided little to no service to the consumer.

Regency Financial Services advertised its loan modification process as being able to save consumers up to 50%.

At the FTC’s request, a U.S. District Court for Southern District of Florida temporarily halted Regency Financial Services practices and froze assets.

The case is ongoing, but the FTC plans to seek a permanent injunction to stop the company’s practices and refunds for consumers.

While the FTC’s complaints against dealerships and financial companies includes only civil cases, those brought by partnering agencies throughout the country also include criminal action that could result in executives named in the cases facing jail time.

Today’s action by the FTC is the agency’s second wave of Operation Ruse Control. Back in 2014, the Commission brought cases against 10 auto dealers for deceptive practices related to advertising.

FTC, Multiple Law Enforcement Partners Announce Crackdown on Deception, Fraud in Auto Sales, Financing and Leasing [Federal Trade Commission]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.