Here are email addresses you can use to launch an EECB (executive email carpet bomb) against ACS, a student lending company that’s a subsidiary of PNC bank.

Education

Don't Forget To Claim Your Student Loan Deduction

If you paid on student loans last year, don’t forget that you can deduct the interest paid up to $2,500 as long as your parents don’t claim you as a dependent, writes Kiplinger. “You can deduct up to $2,500 in student-loan interest paid in 2007 if your income for the year was $55,000 or less if single, or $110,000 or less if married filing jointly.” If you make under $70k single or $140k married, you can still take a partial deduction.

Sallie Mae Will Make Fewer Student Loans In 2008

Student loan lender Sallie Mae said today it plans on making fewer loans in the future “in the wake of federal legislation last year to reduce subsidies for student lenders,” reports Reuters.

Sallie Mae CEO Ends Conference Call With "Let's Get The Fuck Out Of Here"

Dodging tough questions about the student loan company’s fiscal well-being and strategy in the midst of the credit crunch, not to mention his recent sale of 97% of his company stock, Sallie Mae’s CEO ended a conference call yesterday with investors by cursing, reports WSJ:

In an apparent reference to investors’ anger, he said: “I can assure you, you will be going through a metal detector.” He ended the conference call by saying “Let’s go. There’s no questions. Let’s get the [expletive] out of here.”

../../../..//2007/12/13/a-private-student-loan-company/

A private student loan company agreed to change its ways after being sued by the NY AG for deceptive marketing practices. The company licensed school colors, logos, team names, and and designed its materials to look like the University itself was making the loans. [NYT]

The Subprime Meltdown Is The Tip Of The Credit Iceberg

The ongoing subprime meltdown is merely the first destructive wave of credit catastrophe to wash over Wall Street, according to Slate’s resident explainer. Americans drunkenly bandy credit around in several forms: mortgages are the most prevalent loans turning sour, but credit card debt, student loans, and auto loans are silently conspiring to threaten our macroeconomic well-being.

Citibank Charges Student Loans Late Fee From 2005

Sean writes:

When I went to check the statement on my wife’s student loan through CitiBank for November, I noticed a late fee listed. As we signed up to pay via direct debit for the interest rate deduction, we get no paper statements. I checked my records, and our last payment had been processed for the full amount, on the due date. I asked my wife to call and find out why we were being charged a late fee. The representative told her that it was to correct an error from 2005. There is no explanation on the site, and when my wife asked to speak to a supervisor, the supervisor told her that there were no plans to notify people being charged these fees. My wife had to specifically request that a letter be sent detailing these fees.

Verify Extra Payments Are Applied To Your Principal

The Chief Family Officer blog outlined her strategy for paying off student loans faster.

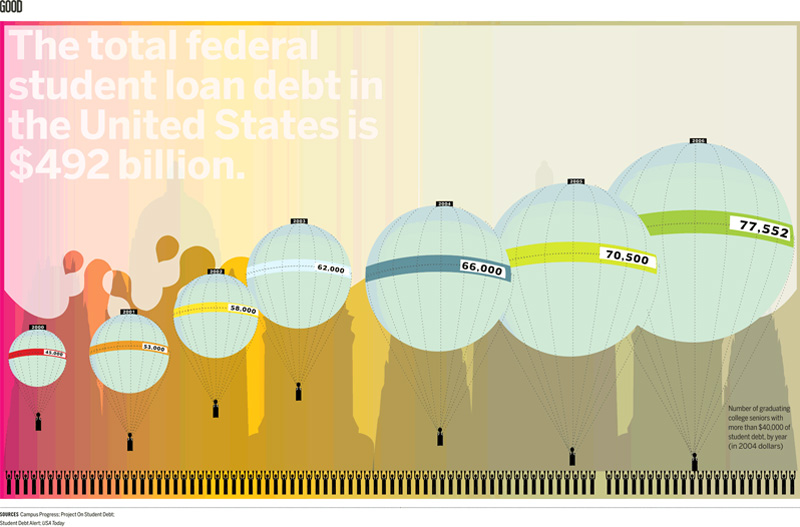

77,552 Of Graduating College Seniors Have $40,000+ In Student Debt

This graph from GOOD and FutureFarmers shows the number of graduating seniors with more than 40,000 in student debt by 2004.

Sallie Mae Sues Potential Buyers As Deal Evaporates

Back in April, we told you that Sallie Mae was going to be sold to JP Morgan Chase and Bank of America for around $25 billion. Now JP Morgan Chase and Bank of America want to bargain, and Sallie Mae is now suing its potential buyers in an attempt to force them to honor the original deal.

Sallie Mae’s potential buyers gave the nation’s largest student lender until Tuesday to consider their reduced buyout offer in light of what they said was “the new economic and legislative environment that faces the company.”

Bush Will Sign Bill Increasing Pell Grant Funding

In a not-too-surprising announcement after all the recent bad news about student loan firms—and in an apparent “victory” for both Bush and Congress—the White House said today that President Bush intends to sign into law a bill that reduces federal subsidies to those firms, including Sallie Mae, by $20.9 billion over the next five years, and will instead use that money to increase funding for Pell Grants (which recipients don’t have to pay back).

Department Of Education: Student Loan Oversight Is Overrated

Remember that whole student loan scandal, where lenders illegally gave gifts to financial aid officers? The Department of Education doesn’t! A damning GAO report claims that the DOE:

The Senate's New Student Loan Plan: Give Aid To Students, Not Corporations

Hey kids, good news! Student loans will become cheaper under a bill approved last week by the Senate. H.R. 2669, passed 78-17, will recast the Department of Education as Robin Hood, diverting money from lending companies to students.

Department Of Education Sends Warning Letters To 921 Colleges

The Department of Education wants you to know that they’ve sent warning letters to 921colleges and universities warning them not to limit students in their choice of lenders, according to the Chicago Tribune.

Jeff Baker, policy liaison at the Education Department’s federal student aid office, said a search of a student loan database showed that a vast majority of students at each of 921 campuses chose the same lender.

../../../..//2007/07/10/the-7-myths-of-college/

The 7 myths of college financial aid (p.s. WSJ is free online today) [WSJ via AllFinancialMatters] (Photo: elle_rigby)

Student Loan Consolidation Deadline Is July 1

Just a reminder to you recent grads, the loan consolidation deadline is July 1. Why is this important? Because if you wait to consolidate your loans until after July 1, you will pay more interest.

It's Time To Think About Loan Consolidation

We know you just graduated and you don’t want to think about your student debt. Really. We understand. Sadly, you need to think about it, and you need to think about it before July 1st.

Private Student Loans Are Potentially Evil

The New York Times has an article explaining some of the reasons that private loans are both more popular and more risky that they really ought to be.