It’s a tough economic climate to be graduating from school — and maybe an even tougher one for those of you trying to get financial aid. We’ve put together a list of some financial aid and student lending resources to help make things easier.

Education

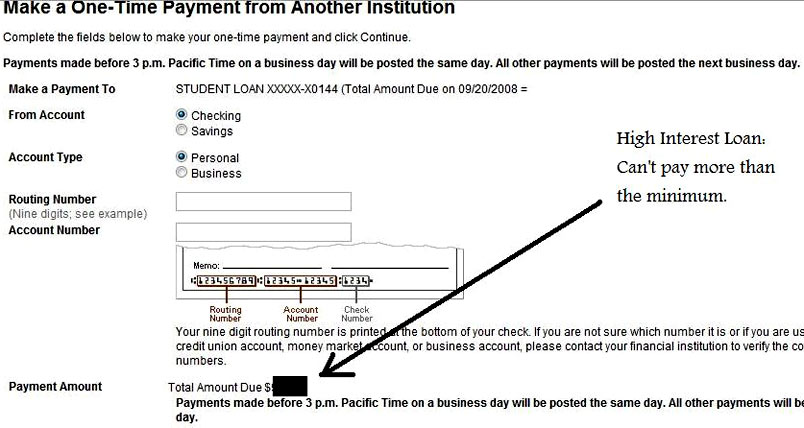

Citibank Won't Accept The Extra Money You Sent To Payoff Your Student Loans

We’re all about to see more money in our paychecks thanks to lower payroll taxes, but if you want to use the savings to payoff your student loans, you better act on the one day that Citibank will take your money. At least that’s what Citibank told reader Valori, who tried sending the bank a check with instructions to apply it towards the principal on her student loans. The bank instead applied it to her usual monthly payment and told her that the only way to pay down her principal was to “setup an automatic payment on the Citibank website to debit on the same day as [the] automatic payment is direct debited.” Does that seem easy to anyone?

Pre-Paid Cellphones Aren't Just For Losers Anymore!

Hey, did you know that people who don’t use their cellphone very often can save money by switching to a pre-paid cellphone plan? They’re not just for people who can’t get regular cellphones anymore! In fact, many smart, frugal people avoid contact hassles and save money by getting a pre-paid phone.

Use UPromise To Pay Down Your Student Loans

UPromise is a site from student lender SallieMae, and we always assumed that it was just for parents to save for their children’s inevitable college expenses, but the Wall Street Journal says that anyone can join and use the money to pay down their student loans… or whatever.

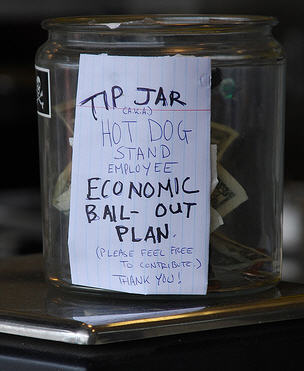

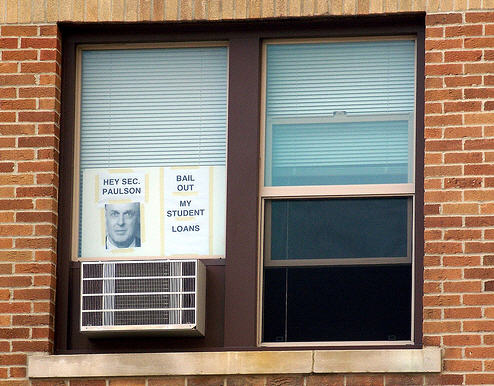

Stock Market Pleased By New Phase Of Bailout

Today the Federal Reserve announced the creation of a new special purpose entity that will buy consumer and business debt. Under the new plan, the Treasury will provide $20 billion dollars in of credit protection (from the Troubled Asset Relief Program) — and will absorb most of the losses, should they occur.

Help! Is Anyone Still Giving Out Private Student Loans!?

Reader Michael has some questions about how the credit crunch is affecting private student loans. Is anyone still lending?

Equifax Double-Reports Student Loan, Still Hasn't Corrected It 12 Attempts Later

So what exactly is the problem? After 12 online (and phone) disputes to Equifax and 14 calls (and faxes) to the Direct Loan Servicing Center, each party seems to blame the other.

Wells Fargo Forces You To Pay Off Loans Costliest Way Possible

According to reader Caleb, Wells Fargo seems to have recently crippled their loan repayment system in a way that makes it impossible for borrowers to pay off loans the way they want to. That is, unless you prefer to let your highest-interest loans ride for as long as possible while you pay off your lower-interest loans…

Get 75% Off Your ATT ETF By Switching To Pay-As-You-Go

If arguing for completely getting out of your AT&T early-termination-fee isn’t your thing, you can try doing what Felix did and get 75% off it.

Round 39: Sallie Mae vs eBay/Paypal

This is Round 39 in our Worst Company in America contest, Sallie Mae vs eBay/Paypal!

Citi Announces One Of Its 'Bold Steps': Stricter Rules On Student Loans

Two readers have forwarded us a second email sent out by Citibank today, but it’s not another vaguely worded PR blast from the CEO. Instead, this one announces that Citibank is adopting the zero-tolerance approach to late payments favored by the credit card industry—miss a payment due date and you’ll lose any interest rate discount(s) you currently enjoy.

Sallie Mae's 100+ Point FICO Drop Error Getting Fixed

Sallie Mae has publicly apologized for a coding error, potentially affecting around 1 million customers, that caused some consumers credit scores to drop over 100 points, and some consumers report that their dinged scores are already back up. If your score is not back to normal and you are in the middle of a transaction where your good credit is at stake, Sallie Mae said it will provide a credit reference letter. You can also call Sallie Mae customer service at 1-888-2-sallie. Sallie has pledged that the fix is in, but consumers can still take matters into their own hands by pulling their free credit report from annualcreditreport.com and disputing the incorrect information with Experian. Note, it’s against Federal law for creditors to report false information to credit bureaus, and consumers can sue violators up to $1,000.

FICO Scores Drop Over 100 Points After Sallie Mae Recode, Potentially Millions Affected

Consumers are complaining that a change in how Sallie Mae decided to recode some loans caused their credit score to drop by over a hundred points. That’s enough to make a $93,240 difference in a home loan’s total cost. Here’s what happened.

Bank of America To Stop Making Private Student Loans

Bank of America, the nation’s largest bank and one of our largest student lenders, today announced that it would stop making private student loans and instead “do more lending under a federally guaranteed program,” says the Wall Street Journal.

Sallie Mae Stops Student Loan Consolidation, Will No Longer Pay Origination Fees On Stafford Loans

Consolidation loans are no longer profitable for Sallie Mae, so it’s saying goodbye to them. SmartMoney points out that ultimately this shouldn’t matter for students taking out new loans, since the original point of consolidation—converting lots of variable rate loans into a nice predictable fixed rate loan—is no longer relevant (all federal student loans are now disbursed with fixed interest rates.) SmartMoney says if you still have variable rate loans you need/want to consolidate, check out the government’s consolidation offering—”You’re likely to pay the same consolidation rates you’d pay if you did so with Sallie Mae,” they write.

Sallie Mae Has No Idea Where Your $1500 Is

Then I finished my enlistment, was honorably discharged, and waited for the last payment to come in. It was 4 months late and when it got there (mid-December), it looked like it was $1500 MORE than what was left owed on my account. I called the Army and they confirmed that they had payed the correct amount they owed me, taking interest into account. The overpayment belongs to me. Yay, more free money!

Students And Parents, It's Time To Fill Out Your FAFSA

Tax time is also FAFSA (Free Application for Federal Student Aid) time for students and their parents. While the federal due date is June 30th, in some states, the FAFSA is due even before your taxes, so make sure to remember this important piece of paperwork.

Getting Back On Your Feet When You Have Lots Of Bad Student Loan Debt

Reader Jennifer sent the following letter to a few lawyers looking for some help with SallieMae. They told her that there was nothing she could do and to negotiate with the lender and to start making payments: