With many incoming college students unable to afford rising tuition costs, and low-cost federal loans only providing some assistance, private student loans have become a necessary evil for some in recent years. But those higher-interest loans are leading to increased levels of debt among young Americans. Lawmakers are once again promoting a long talked-about bill to protect students. [More]

Education

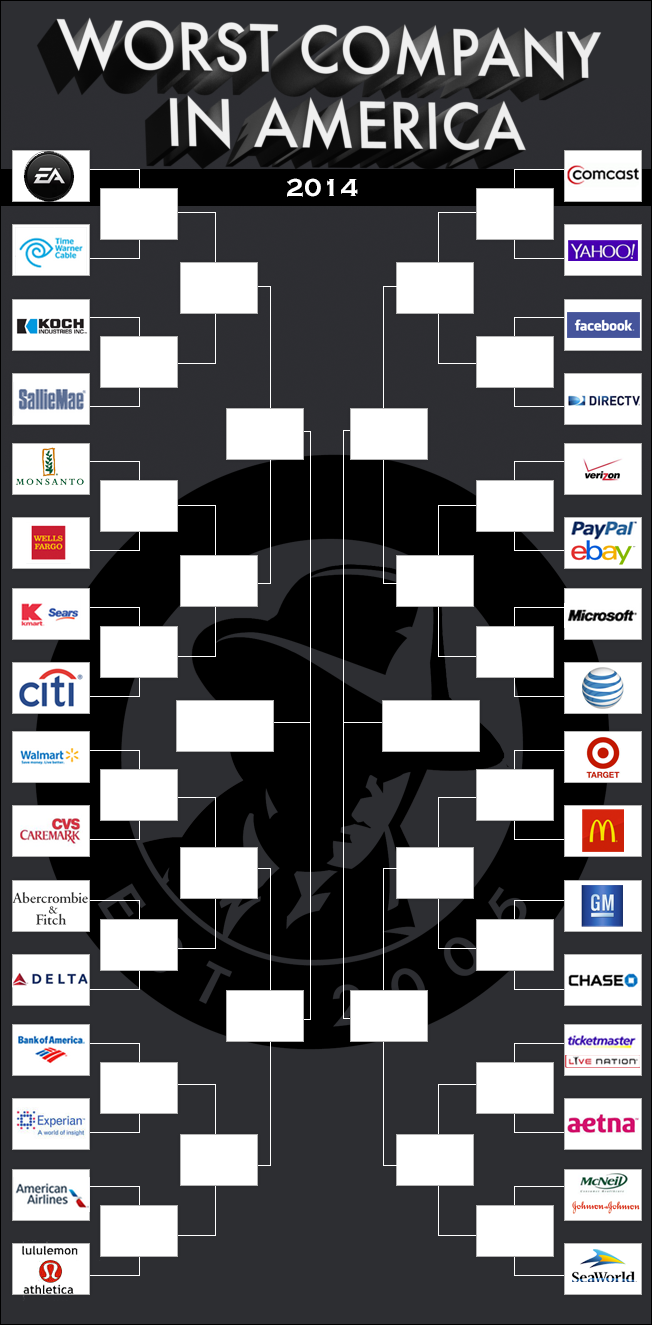

Walmart, Koch, McDonald’s All Move On To Round Two Of Worst Company Tournament

Two of today’s WCIA battles were dominated by household names, proving that being the biggest doesn’t mean you’re the best. Another showdown featured companies that aren’t necessarily on the tip of everyones’ tongues, but are no less hated than the big brand names. [More]

Have Fun Breaking Down This Year’s Worst Company In America Bracket

The above bracket will be updated at the end of each day of WCIA competition to reflect that day’s results.

——————

After going through all of your nominations, then having y’all rank the contenders and eliminate the chaff from the wheat, we’re proud to present the first round match-ups for this year’s Worst Company in America tournament! [More]

Here Are Your Worst Company Contenders For 2014 — Help Us Seed The Brackets!

After sorting through a mountain of nomination e-mails, we’ve whittled down the field of competitors for this year’s Worst Company In America tournament to 40 bad businesses. Here’s your chance to have your say on how these players will square off in the bracket, and which bubble teams will get left out in the cold. [More]

Proposed Rules Take Second Stab At Holding For-Profit Colleges Accountable For Graduate’s Success

The Department of Education is making a second attempt to rein in those for-profit colleges that benefit from financial aid to students without providing them the education needed to find gainful employment after graduation. But some consumer advocates say the proposed regulations don’t do enough to help students. [More]

Sallie Mae Wants Me To Pay Down Debt By Opening Up A Credit Card

On the surface, this e-mail that reader S. received from Sallie Mae doesn’t seem like a bad idea. It’s offering a new credit card, which maybe you were going to get anyway. You can use the card’s cash-back rewards to save for a loved one’s college education, or to pay off your own student loans. Yet it doesn’t sit right with S. [More]

Colleges Tight-Lipped On Revealing How They Divvy Out Financial Aid

When choosing a college to attend most teens and their families shop around a little. With tuition skyrocketing, many consumers look at financial aid offered by universities as a top priority when considering which institution to attend. Even with regulations on the books requiring schools to outline how financial aid is distributed, families are finding it nearly impossible to estimate their child’s worth to a school. [More]

Sallie Mae’s Federal Loan Business Is Now Navient. What’s A Navient?

Sallie Mae is the country’s largest originator and servicer of student loans and a regular contender in our Worst Company in America tournament. They’re about to become two much-hated companies, spinning off their loan servicing, loan management, and collections as a new company called Navient. [More]

CFPB Sues ITT Tech For Allegedly Exploiting Students, Pushing Predatory Loans

The Consumer Financial Protection Bureau filed a federal lawsuit against a well-known for-profit college chain, alleging the company exploited its students and pushed them into high-cost private student loans that were likely to end in default. [More]

Student Loan Debt Preventing Consumers From Buying First Homes

First-time home buyers accounted for only a third of the homes purchased over the last year. The below-average number is thanks in part to American’s growing student loan debt. With high monthly payments and increased credit risk, student loan debt is keeping some first-time home buyers from entering the housing market; a trend that doesn’t appear to be turning around anytime soon. [More]

Now The Feds Are Investigating Operators Of Everest, WyoTech & Heald Colleges

Last fall, the state of California sued Corinthian Colleges, Inc. — better known as the company that operates a number of the for-profit colleges whose ads dominate daytime TV commercial breaks — over allegations that it lied to students about job-placement stats and to investors about its graduates’ success rate. Yesterday, CCI revealed that it’s also being investigated by two federal agencies and can’t open any new locations for the time-being. [More]

51 Groups Call On President To Not Let For-Profit Colleges Weaken “Gainful Employment” Rule

Last summer, the Dept. of Education began the process of reviewing a new rule aimed at those educational institutions that failed to demonstrate their students could find gainful employment in the fields in which they had been trained. The for-profit college industry has managed to weaken the rule, but today more than 51 different groups — including advocates for consumers, veterans, and students — asked the President to help prevent this rule from becoming toothless. [More]

How To Not Suck… At Borrowing For College

(This is Part Two of a two-part feature on paying for an education. Last week’s HTNS column focused on the best way to save up for college.)

With the rising cost of college tuition, many families figure they’ll have to beg, borrow and steal to pay for the cost of higher education. If those are the only options available to you, we recommend borrowing. [More]

College Student Protests Tuition Hike By Paying With Singles

Like many schools around the country, tuition at the University of Utah has soared in the last decade. In-state students at this school are now paying more than double what students paid only a decade ago, with another 5% increase coming. In minor protest of these rate hikes, one Utah student chose to express his feelings by paying his tuition in singles. [More]

College Senior Hopes To Pay Off Student Loans By Selling Ads On Graduation Cap

A student at the University of Michigan-Flint looked into the crystal ball and saw visions of student loan debt. But what if he could figure out a way to pay off that pile of debt before he even enters the job market? And so the young man started a campaign to sell advertising space on the top of his graduation cap. [More]

Some Banks Reward Private Student Loan Borrowers With Refinancing Options

Recent college graduates face a number of barriers after getting their diplomas – finding a job, moving out on their own and paying back thousands of dollars in student loans. But now consumers struggling to pay back private student loans might find a bit of relief in new refinancing options from banks. [More]

How To Not Suck… At Saving For College

(This is Part One of a two-part feature on paying for an education. Part Two looks at the best way to borrow for college.)

Next to a home purchase, sending your kids to college may be the biggest expense of your lifetime. And like all things money, this one is easy to screw up. [More]