‘Know Before You Owe’ Act Aims To Provide Clear Disclosures For Private Student Loans

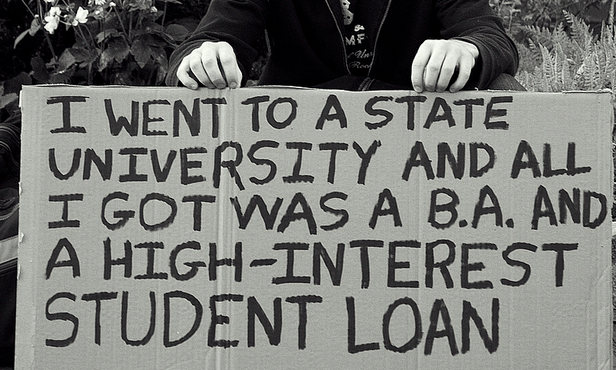

With many incoming college students unable to afford rising tuition costs, and low-cost federal loans only providing some assistance, private student loans have become a necessary evil for some in recent years. But those higher-interest loans are leading to increased levels of debt among young Americans. Lawmakers are once again promoting a long talked-about bill to protect students.

This week, Sen. Sherrod Brown from Ohio signed on as a co-sponsor and began promoting the Know Before You Owe Act, a bill that would require much fuller disclosure of the loan terms and the options, the Plain Dealer reports.

First introduced in the Senate January 2013 by Sen. Richard Durbin of Illinois and in the House by Jared Polis of Colorado, the bill could help prevent student loan debt from increasing as rapidly as it has in the past. Today, 71% of students leave college with an average of $29,400 in student loan debt.

The bill would require lenders to clearly state a student’s costs, provide an update to students at least every three months, and provide an annual update to the Consumer Financial Protection Bureau. And maybe most importantly, the bill would require lenders to provide loan information that is easily discernible to students.

With one-in-three students loans considered delinquent and often affecting a student’s ability to make purchases in the future, the bill would require schools and private lenders to disclose the differences between federal and private loan options.

Not surprisingly, the for-profit college industry — by far the largest beneficiary of private student loans and the educational sector with the highest rate of drop-outs and loan delinquency — is opposed to more transparency on student loans.

“What we really need is better disclosure, not more,” a spokesman for the Association of Private Sector Colleges and Universities, which represents for-profit schools, tells the Plain Dealer. “[This is] another piece of legislation to add to what we have now.”

Still, some student advocates say the bill could make or break a student’s future.

Lee Friedman, the chief executive officer of College Now Greater Cleveland tells the Plain Dealer that students and parents should know what kinds of employment options and other financial aid opportunities exist before they sign private loan papers.

Friedman contends the bill wouldn’t add to an overload of information for student, instead it could provide better transparency and easy to understand content.

“There’s no question there’s enough information available to all of us in this society for darn near anything,” he tells the Plain Dealer. “The problem is the quality of the information, the presentation of it… You shouldn’t have to be a lawyer”.

Concern for student information overload stems from the government’s consumer tools aimed to provide students with individual college cost estimates. Families can research information about potential colleges with the College Navigator, while the College Scorecard provides information about college affordability.

Additionally, the model financial aid award letter and college’s net-price calculators can help student understand the cost of college and what financial aid opportunities are available to them.

However, there has been much debate about what should be included in the College Navigator. Factors such as default and dropout rates can change significantly if viewed over different periods of time, especially for technical schools.

Viewed one way, a technical college may appear to be turning out well-trained technicians, barbers and stylists, but when looking at a different set of data the school could appear to have high dropout rates.

In any case, the products don’t seem to make much difference when it comes to the mounting debt and default rates college graduates and dropouts face.

In 2012, the Department of Education provided a report looking at the default rates of student three years into their student loan repayments.

When looking at students whose first loan payments came due in Oct. 2008 and Oct. 2009, the department found that 22.7% of those who had gone to a for-profit college had defaulted by Sept. 2011, double the 11% three-year default rate for students at public institutions and triple the rate (7.5%) for those who had gone to private, non-profit schools.

Stopping predatory student loans requires a law to force better disclosure, Sen. Sherrod Brown says [Plain Dealer]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.