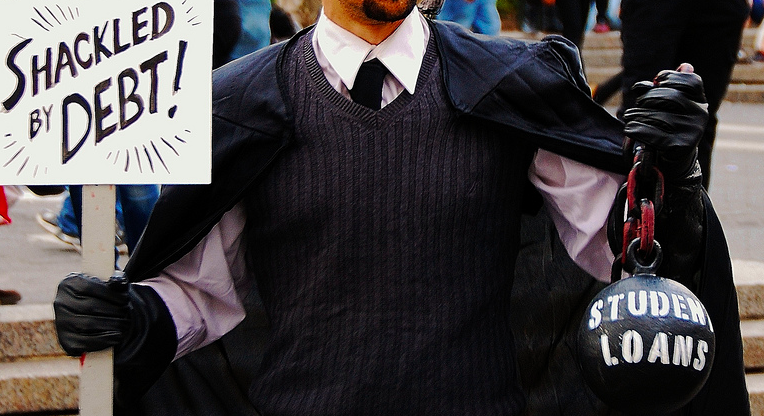

Students being crushed under the weight of mounting student loan debt have few options when it comes to receiving forgiveness for their debts, and bankruptcy is often the least obtainable – thanks in part to the nearly impossible to meet “undue hardship” standard. To see just how difficult and seemingly arbitrary this guideline is, all one needs to do is hear about a recent federal court case out of Maryland that determined a woman couldn’t escape her debt obligation because she had failed to make a good faith effort in repaying the loans despite the fact she’s unemployed, disabled and living below the poverty line. [More]

Education

Court Case Illustrates Just How Difficult It Is For Borrowers To Discharge Student Loans In Bankruptcy

CFPB Asks Google, Bing & Yahoo To Help Stop Student Loan Debt Scams That Imply Affiliation With Feds

The Internet is teeming with scammers, fraudsters, and hustlers determined to part consumers from their money, and as a $1.2 trillion venture, student loans often present an attractive avenue for these ne’er-do-wells. In order to better protect individuals from such schemes, the Consumer Financial Protection Bureau is enlisting the help of the country’s major search engines. [More]

CFPB Report Finds 90% Of Student Loan Borrowers Who Seek Co-Signer Release Are Denied

Last year, the Consumer Financial Protection Bureau brought our attention to a relatively new phenomenon in which more and more private student loan borrowers found themselves placed in automatic default – even if they were up-to-date on payments – when their co-signer died or filed for bankruptcy. While the agency and consumer advocates urged these borrowers to seek co-signer release from their lenders, a new report finds that’s simply hasn’t been possible. [More]

Congress Takes Another Stab At Undercutting Gainful Employment Rules Two Weeks Before Implementation

The Department of Education’s long-awaited gainful employment rules – aimed at reining in the for-profit college industry – go into effect on July 1. But just because there are only 14 days before implementation, doesn’t mean those opposed to the regulations are giving up their fight. [More]

Students At Closed Corinthian Colleges May Ask For Federal Student Loan Relief

Getting a student loan discharged is not easy. Even bankruptcy is not usually enough to shake off that debt. But recent students at schools under the Corinthian Colleges Inc. [CCI] umbrella (Everest, WyoTech, Heald) will get the chance to request that some of all their federal student loan obligation be lifted. [More]

Student Loans Are The New Robo-Signing Crisis

You may remember the term “robo-signing” from the recent financial crisis, where lenders would put homeowners in foreclosure without an actual person reviewing the documents, which is required in many states. The same thing is reportedly happening again with s different debt crisis: student loan lenders are robo-signing those, too. [More]

Judge Upholds Gainful Employment Rule, Throws Out For-Profit Industry Lawsuit

The Department of Education’s gainful employment rules, aimed at reigning in the for-profit college industry, came one step closer to its July implementation today as a judge threw out a for-profit industry lawsuit that attempted to further weaken the upcoming law. [More]

Oregon Testing Pay-Per-Mile System As An Alternative To State’s Gas Tax

With more fuel-efficient vehicles and hybrid cars hitting the roads every day and requiring less gas, some states are looking into how they can still collect enough money from drivers to keep maintain their roads and bridges. Oregon is one such state, with a new test program that allows volunteers to pay the state not for the amount of fuel they buy at the pump with a gas tax, but for how many miles they drive. [More]

Senator Calls For Investigation Into Three For-Profit College Chains, Restrictions On Future Campus Sales

The struggle to protect students from potentially harmful for-profit college chains continued today as Illinois Senator Dick Durbin urged the Department of Education to investigate the business practices of three of the country’s largest propriety education companies – ITT Educational Services, Career Education Corporation, and Education Management Corporation. [More]

Dept. Of Education Proposes Rules To Govern College Prepaid Credit & Debit Cards

College students’ federal aid has increasingly been put at risk by the cozy relationship between institutions of higher education and credit card issuers over the years. While consumer advocates and legislators have debated whether or not products like student IDs that double as credit or debit cards provide an actual benefit to students or if they’re just a way for schools and banks to rake in the big bucks, the Department of Education finally took steps today to ensure students are afforded proper protections from excess fees and other harmful practices with the proposal of regulations targeting the college debit and prepaid card marketplace. [More]

Legislator Demands Department Of Education Investigate For-Profit Chain ITT Technical Institute

Following the Securities and Exchange Commission’s decision earlier this week to file fraud charges against current and former executives with ITT Education Services – the operator of for-profit college chain ITT Technical Institute – for their part in concealing problems with company-run student loan programs, one legislator is calling on the Department of Education to further investigate the company. [More]

CFPB Wants To Hear Your Comments On Student Loan Servicing Practices

Outstanding student loan debt now totals more than $1.2 trillion in the U.S., and it’s only going to grow as college tuitions continue to outpace inflation. Meanwhile, student loan servicers aren’t exactly making it easy for borrowers to pay down that debt with confusing and inconsistent policies and an apparent reluctance to work with troubled borrowers. In an effort to see if the repayment process can be made less byzantine, the Consumer Financial Protection Bureau is asking for you to share your thoughts on the state of student loan servicing. [More]

Attorneys General Coalition Urges Dept. Of Education To Clarify Corinthian Students’ Options

A week after nine senators urged the Department of Education to provide support to the thousands of students affected by the closure of now-bankrupt Corinthian Colleges schools — Everest University, Heald College, and WyoTech — the top prosecutors in 11 states are adding their voices to the chorus encouraging the Dept. to protect students and clarity their options following the company’s final downfall. [More]

SEC Charges Current, Former Executives Of For-Profit Chain ITT Educational Services With Fraud

Back in September ITT Educational Services – the operator of for-profit college chain ITT Technical Institute – revealed it was facing increased scrutiny by several government agencies. That scrutiny turned to action this week as the Securities and Exchange Commission filed fraud charges against current and former executives with the company for their part in concealing problems with company-run student loan programs. [More]

Senators Urge Dept. Of Education To Provide Support To Students Affected By Corinthian Colleges Closure

Ever since now-bankrupt Corinthian Colleges Inc. began its downward spiral, consumer advocates, students and legislators have urged the powers that be to provide relief for students of Everest University, Heald College and WyoTech. Today, that plea continued as nine senators called on the Department of Education to provide support to the 16,000 students affected by the company’s final closure. [More]

Two Major For-Profit Education Chains Announce Closures, Sales Of Dozens Of Campuses

The for-profit education sector is getting a bit smaller after two of the largest proprietary college chains – Career Education Corporation and Education Management Corporation – revealed plans to close or sell dozens of campuses across the country. [More]

Senators Call For Attorney General Investigation Into Executives Of Corinthian Colleges

Bankrupt for-profit college chain Corinthian Colleges Inc. is already party to a number of state and federal investigations related to the alleged deceptive recruiting practices at its Heald College, WyoTech and Everest University campuses. Now, a group of senators are hoping to add another investigation to the roster. [More]

More Banks Are Offering Student Loan Refinancing, But Is It Really Safe & Beneficial?

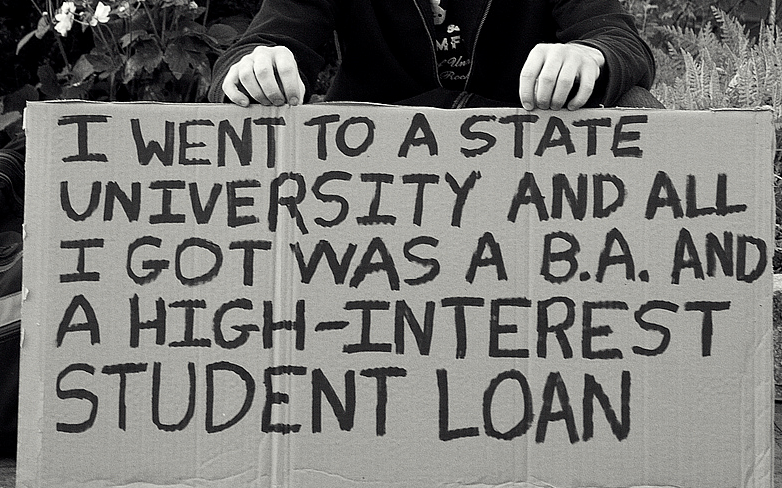

For the last several years legislators have repeatedly introduced a bill that would allow student loan borrowers to refinance their private and federal student loans to the lower interest rates at which new loans are currently being issued. Although the legislation hasn’t managed to make it into law, that hasn’t stopped banks and credit unions from creating their own refinancing programs to help alleviate the debt burden for student loan borrowers. [More]