Last May, investigations by the Department of Justice and the Federal Deposit Insurance Corporation into student loans servicing resulted in a $100 million fine against government-contracted servicer Navient for allegedly violating federal laws limiting the amount of interest that can be charged on servicemember student loans. Following those investigations, the Department of Education undertook a review that found its four servicers – including Navient – weren’t cheating military personnel. With such conflicting reports, members of Congress are now getting involved, calling for an investigation into the Dept. of Education’s review process. [More]

Education

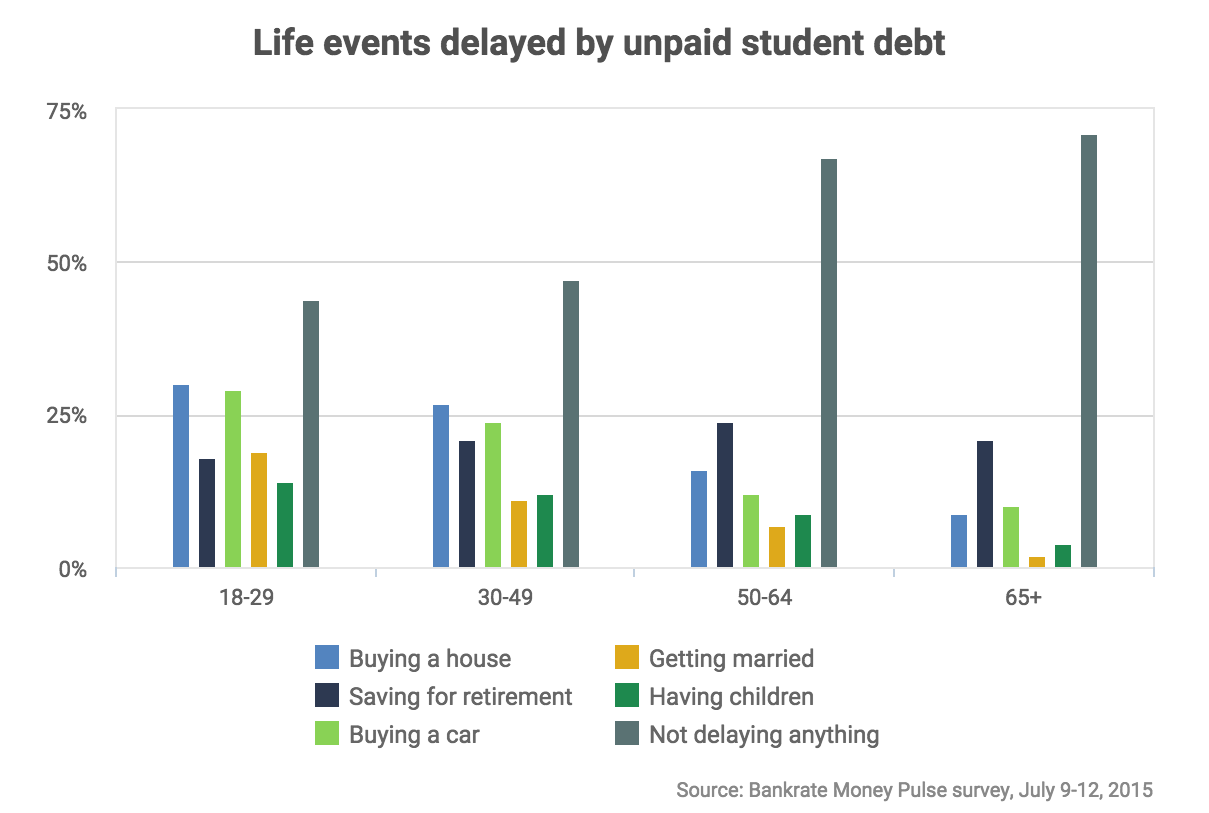

Student Loan Debt Causing Millennials To Delay Marriage, Kids, Home-Buying

We’ve written before about the idea of a “debt backpack,” this notion that young adults are graduating from college already burdened by debt. The more burdensome that backpack, the less able and likely they may be to not only make major financial investments — like a home, or a new car — but also might be putting off important personal milestones, including marriage and kids. The results of a new survey back up this theory and show the delaying effect that student loan debt has on Millennials. [More]

Why Do I Keep Seeing Commercials For Everest University?

If you’re sitting at home watching television on any given afternoon, you’re likely to see a few commercials touting the supposed convenience and benefits of attending a for-profit college. But with the recent, very public collapse of now-bankrupt Corinthian Colleges Inc — and the closure of many of its schools — you might be wondering why your Jerry Springer show is being interrupted with ads for Everest University. [More]

Citigroup Facing Federal Investigation Into Student Loan-Servicing Practices

Just last month federal regulators announced that an ongoing probe into potentially unscrupulous student loan-servicing practices resulted in nearly $18.5 million in refunds and fines from Discover Bank. Now, regulators appear to have Citigroup in their crosshairs, as the financial company announced it was party to an investigation. [More]

Prisoners Will Soon Be Eligible For Pell Grants To Finance Education

Twenty years after passing a law that banned prisoners from financing higher education with federal grants while incarcerated, the government is ready to begin investing in the education of inmates. [More]

Regulators Investigating University Of Phoenix’s Business Practices

Apollo Education Group, owners of the country’s largest for-profit college – University of Phoenix – is the latest target for federal regulators set on reining in the for-profit education industry for engaging in allegedly deceptive marketing practices. [More]

Former Corinthian College Students Seek To File $2.5B Claim Against Bankrupt For-Profit Operator

Former students of now-defunct for-profit education chain Corinthian Colleges continued their fight to recoup the money they spent on classes at the company’s Heald College, WyoTech or Everest University campuses, filing a $2.5 billion claim against the bankrupt educator.

[More]

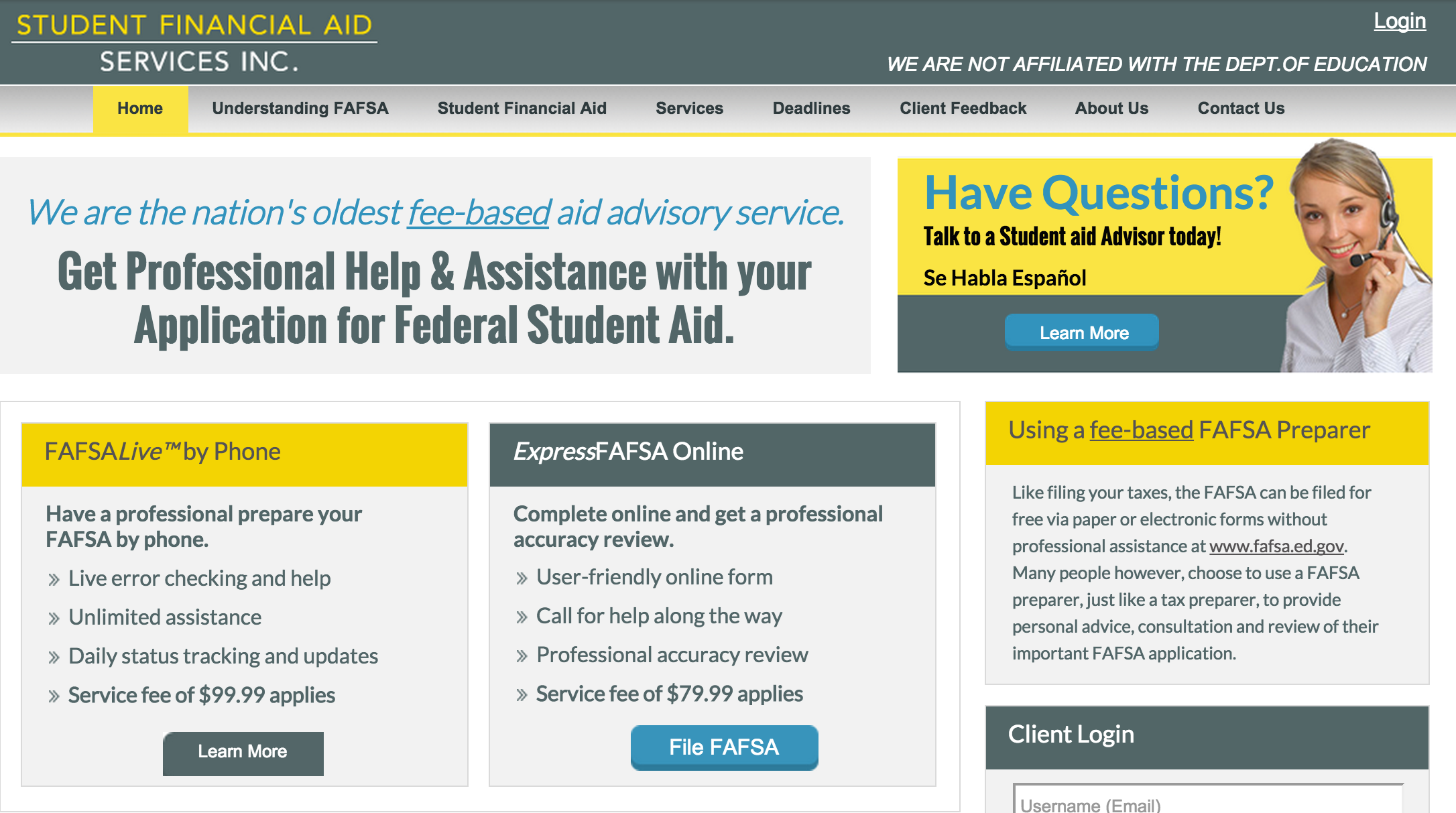

Former Operator Of FAFSA.com Penalized $5.2M For Illegal Billing

Five years ago, we told readers looking to fill out the Free Application for Federal Student Aid (FAFSA) to steer clear of FAFSA.com, as it was not the official Dept. of Education site for the FAFSA. Today, federal regulators announced a $5.2 million settlement with the company behind the now-defunct website for illegal billing practices. [More]

When Comparing Colleges, It Would Help To Know If A School Is Under Investigation

Many consumers thinking of pursuing a higher education weigh the pros and the cons of a specific college: tuition, convenience, available areas of study. Last month, the Department of Education announced it would make the college shopping experience a little easier for prospective students by creating a consumer-facing online college comparison system. While the tool will no doubt be helpful, consumer advocates warn that, as it stands, the system will be missing a vital information: whether or not schools are party to investigation, lawsuits or settlements over harmful and deceptive practices. [More]

Discover Bank Must Pay $18.5 Million Over Illegal Student Loan Servicing Practices

As federal regulators continue to probe potentially unscrupulous student loan servicing practices, the Consumer Financial Protection Bureau has ordered Discover Bank and its affiliates to pay nearly $18.5 million in refunds and fines for, among other things, overstating amounts due on student loans and failing to notify borrowers of their rights. [More]

![Students are spending less on college course materials even though they are still buying the same amount of textbooks and other items. [Source: NACS]](../../../../consumermediallc.files.wordpress.com/2015/07/couresmaterials.png?w=300&h=225&crop=1)

Increased Competition, New Options Means College Students Are Paying Less For Course Materials

Once upon a time, most college students had very few choices when it came to the textbooks and other course materials they were required to buy each semester: Pricey new books or not-quite-as-pricey used copies, and most of these were gone quickly. But now there are multiple online competitors for buying, renting, and reselling these materials and a new survey shows that students are paying a lot less. [More]

![[Source: Sallie Mae]](../../../../consumermediallc.files.wordpress.com/2015/07/fig2.png?w=300&h=225&crop=1)

Families Going Deeper Into Their Own Pockets To Pay For College

College spending continues to rise, but not all American families are taking measures to bring down the amount of their own money they have to spend to educate their children. [More]

Agreement Could Temporarily Halt Legal Action On Loans For Some Former Corinthian College Students

Former Corinthian College students left with piles of debt after the company closed its Heald College, Everest University and WyoTech campuses earlier this year are getting a bit more relief, as the Department of Education announced it would temporarily suspend some legal actions related to borrower’s defaulted loans. [More]

Oregon Becomes Second State To Offer Free Tuition To All Graduating High School Students

Thousands of recent high school graduates in Oregon now have the chance to attend community college without the worry of accumulating loads of debt they may never be able to pay back, as lawmakers in the state recently approved a bill to establish the second program in the country to offer students help in paying for college. [More]

New Jersey Legislation Would Create Student Loan Lottery To Let You Gamble Away Your Debt

While lottery proceeds may do an awful lot of good for state coffers, the odds of winning are microscopically small, and anyone who has lived in a poverty-stricken neighborhood has likely seen people who can’t afford to lose any money throwing away what little they have on a nose hair’s chance that they might win something. So why not apply that same model to the $1 trillion student loan debt problem? [More]

Military Personnel Face Student Loan Issues Despite Required Protections

The Servicemembers Civil Relief Act (SCRA) provides a number of protections for military personnel and their families when it comes to private and federal student loans. While these benefits aim to alleviate the burden servicemembers face when paying back their educational debts, a new report from the Consumer Financial Protection Bureau shows that many student loan servicers continuously fail to uphold their end of the SCRA requirements. [More]

Gainful Employment Rules Survive Another Hurdle, Judge Strikes Down For-Profit College Industry Lawsuit

Gainful employment rule: 2, for-profit education industry groups: 0. A federal judge struck down a second lawsuit to block new regulations aimed at reining in for-profit colleges set to take effect in just one week. [More]

Consumer Groups Urge CFPB To Provide Better Oversight, Rules Over Student Loan Servicing

Two months ago, the Consumer Financial Protection Bureau took the first steps in tackling issues within the student loan servicing arena by asking consumers and organizations to share their thoughts on the state of an industry that is tasked with recouping the more than $1.2 trillion in outstanding student loan debt in the U.S. Now, as the deadline to submit comments has come and gone, we know a bit more about just how the industry is perceived by those tasked with sticking up for consumers. [More]