Student Loan Defaults Increase For First Time In Five Years; 8.5M Borrowers Now In Default Image courtesy of bluwmongoose

For the first time in half a decade, the rate of education loan defaults among recent college students has risen, highlighting the struggle many recent graduates face when it comes to paying their educational debts.

A new report from the Department of Education found there was a slight increase in the percentage of borrowers who are defaulting on their student loans within three years of entering repayment. This is known as the cohort default rate.

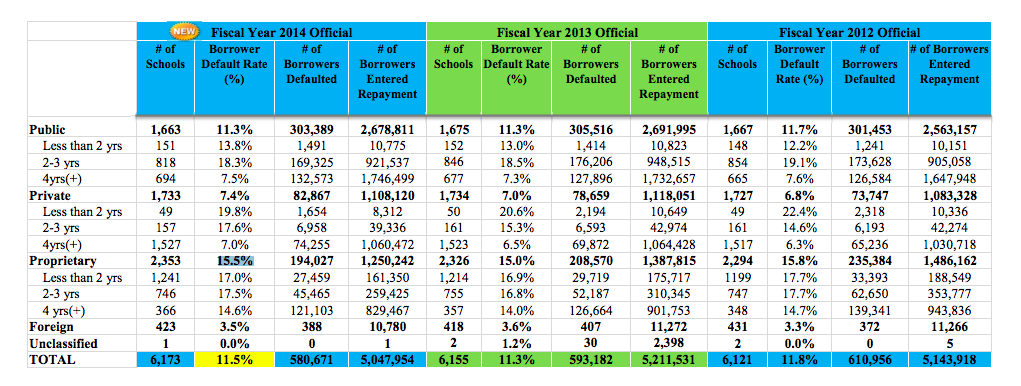

According to the report, among the more than five million borrowers who entered repayment in 2014, 11.5% (or 580,671) defaulted on their loans.

The new figure is up slightly from the 11.3% (or 593,182) of students who entered repayment in 2013 and subsequently defaulted in 2015.

This uptick in the default rate comes after several years of decreases. Three years ago, recent grads were defaulting at a rate of 11.8%, down from a rate of 13.7% in 2013.

By School Type

In all, the default rate remained steady for students who had enrolled in public schools, while it increased for students at private and for-profit colleges.

At public schools included in the report, 303,389 of the 2.7 millions students who entered repayment in 2014 defaulted, bringing the default rate to 11.3%, the same as in 2013.

At for-profit schools, 194,027 of the 1.25 million students defaulted, creating a cohort default rate of 15.5%, and increase from the 15% default rate recorded the year before.

Finally, at private schools the default rate jumped from 7% in 2013 to 7.4% in 2014 when 82,867 of the 1.1 million student defaulted.

More Defaults Than Ever Before

While the increase in defaults was only slight, the total number of borrowers currently in default has reached a new record: 8.5 million.

According to The Institute for College Access & Success (TICAS), in the first six months of 2017 alone 500,000 borrowers defaulted on their loans.

This, the organization contends, translates to more than 1-in-10 outstanding federal student loan dollars – $140 billion – in default.

“Now is the time to be improving student loan policies and increasing oversight and accountability,” Pauline Abernathy, TICAS executive vice president, said in a statement, noting that the Secretary of Education Betsy DeVos is doing the opposite by “resetting” rules intended to protect students who are duped by unscrupulous colleges and overhauling how the Department works to root out bad players in the student loan industry.

These measures could be especially devastating for students who attended for-profit schools, TICAS claims, as these schools account for a disproportionate share of student loan defaults.

Considering the borrowing and default rates of these students, the likelihood they will default at a for-profit college is three time higher than at a four-year public school, TICAS contends.

In Trouble

The Dept. of Education uses the cohort default to determine a school’s eligibility to receive federal financial aid funds. If a school’s CDR is too high, then students of that school are not allowed to participate in the programs.

Any school with a default rate of 30% or more for three consecutive years, or a 40% rate for one year, faces the loss of access to those federal programs.

This year, the Department identified 10 schools that had default rates high enough to lose eligibility for federal aid programs. Of those schools, nine were from the for-profit sector. Each school will have an opportunity to appeal the loss of funds.

Affected schools are:

• Larry’s Barber College in Chicago

• Southeast Kentucky Community and Technical College in Cumberland, KY

• United Tribes Technical College in Bismarck, ND

• Headquarters Academy of Hair Design in Minot, ND

• Long Island Barber Institute in Hempstead, NY

• Daymar College in Columbus, OH

• Cosmetics Arts Institute in Walterboro, SC

• Nashville Barber and Style Academy in Madison, TN

• Jay’s Technical Institute in Houston

• Culpeper Cosmetology Training Center in Culpeper, VA

While these schools do not represent the entire 8.5 million borrowers currently in default, TICAS points out that many of these borrowers likely attended for-profit schools that have since closed.

These borrowers may be entitled to loan discharges under the Borrower Defense rules. However, in June, DeVos hit pause on revamped Borrower Defense rules.

For students who attended a school that closed, the regulations provide a number of specific benchmarks for situations in which the previously seldom-used Borrower Defense process would be available to students.

For instance, in order for students to be eligible for relief, there would have to have been a breach of contractual promises between the school and the student; a state or federal court would have had to rule against the school regarding the educational services for which the loan was made; and the school would have had to make a “substantial misrepresentation” about the nature of its educational program.

Since January, however, the Dept. of Education hasn’t approved a single borrower defense claim, essentially leaving borrowers to pay for what would have otherwise been wiped away debts.

“It is unconscionable to subject students to the consequences of default when the law entitles them to have their student loans discharged,” TICAS vice president Debbie Cochrane said.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.