Auto Loan Debt Tops $1 Trillion For First Time; All Consumer Debt Nearing $12 Trillion

Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history.

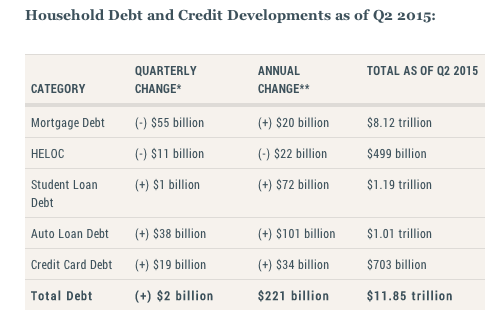

That’s according to a new report [PDF] from the New York Federal Reserve Bank, which found consumers’ overall indebtedness increased $2 billion in the second quarter of 2015.

In all, the report found that consumers took out $119 billion in auto loans from April to June of this year, an increase from the $95 billion in auto loans obtained in the first quarter of the year.

Auto loan originations for 2015 are currently on pace to surpass the record 17.4 million loans issues in 2000, the Los Angeles Times reports.

In addition to the increase in auto loans, the Household Debt and Credit Report for the second quarter of 2015, saw other increases in consumer debt.

Credit card balances increased by $19 billion, while student loan balances – which totaled $1.2 trillion in June – remained flat. On the flip side, mortgage balances and home equity lines of credit dropped by $55 billion and $11 billion, respectively.

Overall, the report found that consumer debt now totals $11.9 trillion for the first half of the year.

As for the negative impacts of debt, the report found that foreclosures reached a new low, with 95,000 new foreclosures in the second quarter, down from 112,000 at the same time last year.

“Persistently tight underwriting standards imply that new mortgages continue to be originated predominantly to the most creditworthy borrowers,” Wilbert van der Klaauw, Senior Vice President at the New York Fed, said in a statement. “The low rates of delinquency and new foreclosures reflect the higher quality of outstanding mortgage debt and improved economic conditions.”

Unfortunately, student loan borrowers continue to have difficulty meeting their obligations. About 11.5% of aggregate student loan debt is 90 days or more delinquent or in default, up just 0.4% from the first quarter.

Surge in car loans pushes auto debt above $1 trillion for first time [The Los Angeles Times]

Auto Loans Race Ahead, Foreclosures Plunge, and Overall Household Debt Remains Flat [Federal Reserve Bank of New York]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.