Now that the Great Recession has gone from “is it really over?” to “remember when?” more Americans are buying cars, pushing auto loan debt beyond the $1 trillion mark for the first time in U.S. history. [More]

consumer debt

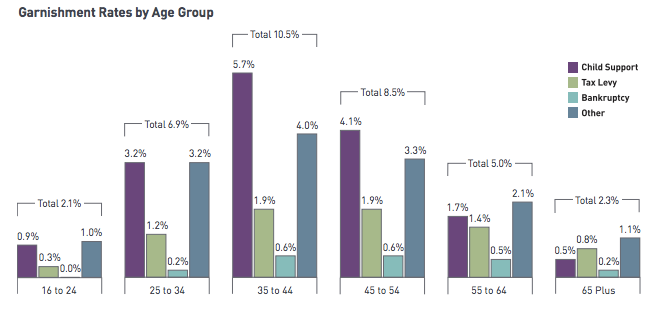

Report: Nearly Four Million Workers Had Wages Garnished For Consumer Debts In 2013

For most Americans every penny counts when it comes to their paycheck, but for some workers nearly a quarter of their wages are taken to pay for past debts in a process known as garnishment. The prevalence of this type of pay seizure grew significantly in the last few years leaving more consumers struggling financially. [More]

Sorry, Your House Isn't An ATM Anymore

For years homeowners have been using their soaring-in-value homes as ATMs, drawing money out to finance whatever they wanted. No more. Falling home prices mean that your house is no longer a source of cash.

12 Steps For Digging Yourself Out Of Debt

If you’re in debt and you don’t want to be, (and who wants to be?) you might want to take a look at Zen Habits 12-Step Get Out of Debt Program.

20% of Americans Fear They'll Never Escape Credit Card Debt

According to a new survey by Lending Tree, 20% of Americans fear that they will never escape their credit card and other non-mortgage related debt and will be stuck with it for the rest of their lives. That’s depressing. Elizabeth Warren at Credit Slips says:”Lending Tree tries to put a happy face on some of the data (most people “perceive themselves as some day being debt free”), but I didn’t feel any better when I read it.” Yeah, we don’t feel any better either.