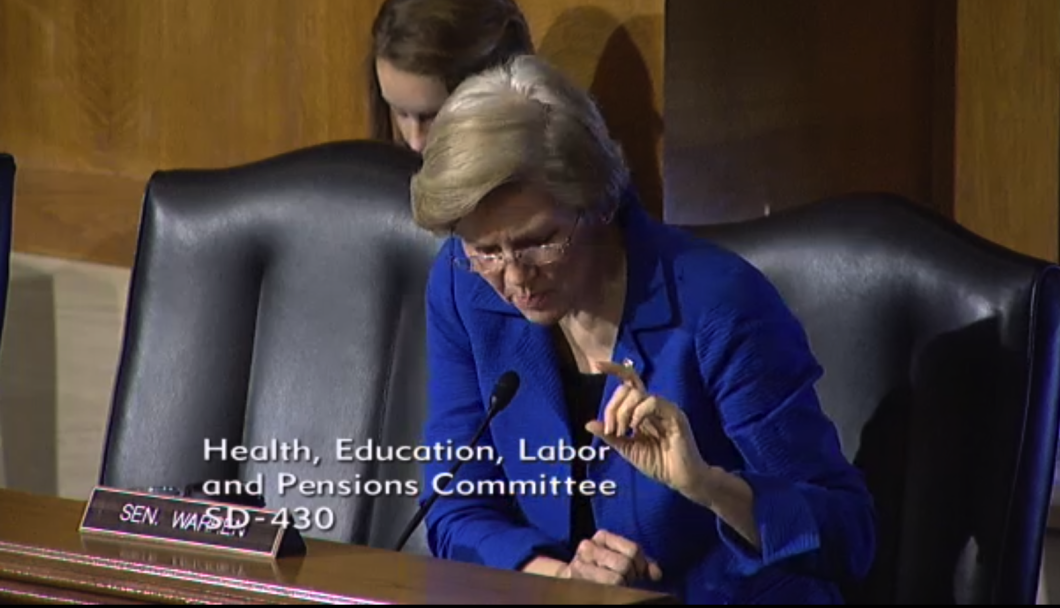

Sen. Elizabeth Warren Has Some Choice Words For Chase CEO Jamie Dimon

Earlier this week, JPMorgan Chase CEO Jamie “It sounds like Diamond” Dimon, was quoted as saying that Sen. Elizabeth Warren, an outspoken advocate of financial reform who helped create the Consumer Financial Protection Bureau before becoming a lawmaker, was clueless about how banks actually work. The Massachusetts senator says that Mr. Dimon doth protest too much.

Earlier this week, JPMorgan Chase CEO Jamie “It sounds like Diamond” Dimon, was quoted as saying that Sen. Elizabeth Warren, an outspoken advocate of financial reform who helped create the Consumer Financial Protection Bureau before becoming a lawmaker, was clueless about how banks actually work. The Massachusetts senator says that Mr. Dimon doth protest too much.

“I don’t know if she fully understands the global banking system,” said Dimon at a Chicago event earlier this week, according to Bloomberg.

On this morning’s “So, That Happened” podcast for Huffington Post, the senator said she is fully aware of how things work.

“The problem is not that I don’t understand the global banking system,” responded Warren. “The problem for these guys is that I fully understand the system and I understand how they make their money. And that’s what they don’t like about me.”

Warren has been a leading figure in the effort to reduce risk in the financial sector in order to prevent more “too big to fail” banks that need to bailed out when they do collapse. Her critics have accused her of being too reactionary and of pushing policies that unduly hurt banks.

The senator contends that she’s not against the notion of banks taking risks in the hope of financial gain. Her problem is when they do it with money that’s insured by taxpayer money.

“You want to get out there and take on risk? Okay, go do it,” she explains, “but don’t do it within the structure of a bank that gets backed up by the federal government.”

She points out what she sees as hypocrisy on the part of the federally guaranteed banks who cook up incredibly complicated banking structures and then “they come in and complain that ‘Whoa, regulations are tough’ and “Regulations are too complicated.'”

“There’s a way to fix that,” says Warren. “If banking is boring, the regulatory part can be boring too.”

The senator acknowledges that financial regulators are often two steps behind banks because they are waiting to react to questionable practices rather than pushes for structural changes that keep federally guaranteed banking “simpler and easier to follow for everyone.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.