In Wake Of Arbitration Report, Consumer Advocates Ask CFPB To Revoke Banks’ “License To Steal”

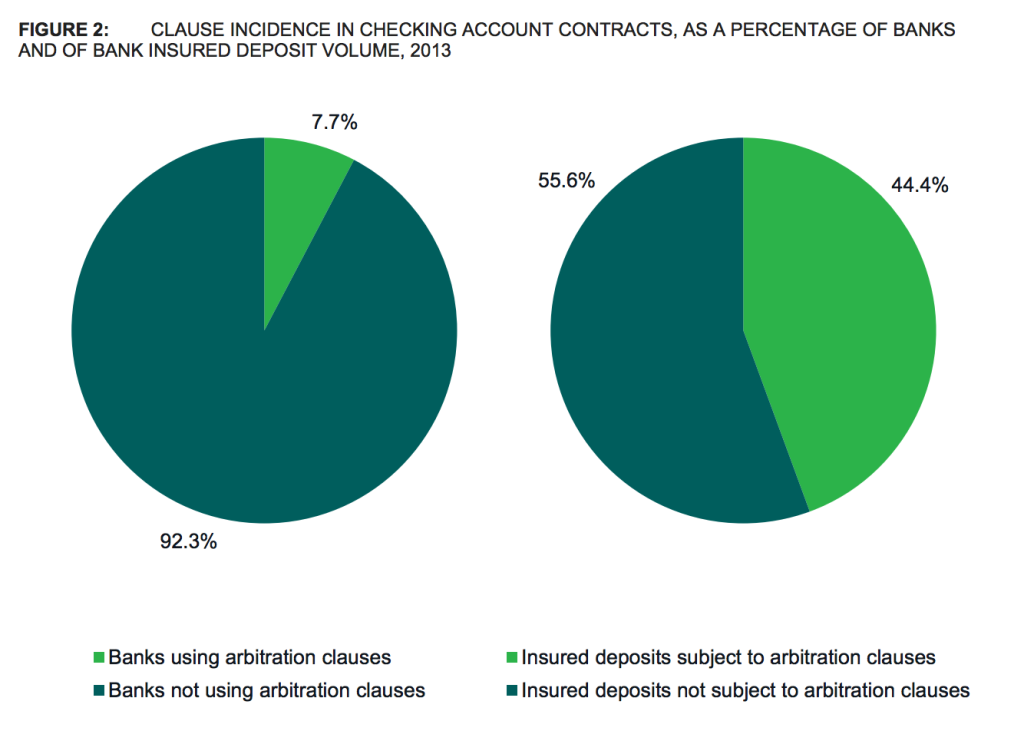

While fewer than 8% of all banks put arbitration clauses on deposit accounts, those few banks account for nearly half of all insured deposits in the U.S. (source: CFPB)

The CFPB report found that 75% of Americans don’t know if their credit card, checking account, student loan, or cellphone contract includes a forced arbitration clause. Even worse, of the tens of millions of consumers restricted by arbitration, fewer than 7% actually know that they no longer can sue these companies in open court.

Additionally, most arbitration clauses include a ban on class actions, even if the group of wronged consumers hope to seek joint arbitration. As the report pointed out, these bans have become an important tool for credit card companies who frequently cite their arbitration clauses as a way to preempt group litigation.

In recent years, these clauses have been repeatedly upheld by the nation’s highest court. First came the 2011 Supreme Court ruling in AT&T Mobility v. Concepcion, in which a narrowly divided court ruled that the inclusion of a few paragraphs of text in a cellphone contract that can’t be altered by the end user, but which is frequently altered by the wireless company, is a completely legal way to prevent consumers from joining together in a class action lawsuit.

In 2013, SCOTUS went even further in affirming the difficulty of challenging arbitration clauses. In the matter of American Express v. Italian Colors Restaurant, a group of AmEx-accepting merchants claimed that the only way they could afford to mount an antitrust lawsuit against the credit card giant was to pool their resources in a class action. On an individual basis, the costs would be too high and the rewards too little to justify the expense. But the SCOTUS majority held there was no “effective vindication” exemption, even if it allowed companies to break the law.

To the folks at Public Citizen, this effectively granted businesses a “license to steal” from their customers, at least in instances where it would be too expensive to prove a case in arbitration.

“The predatory practice is particularly severe in the consumer financial sector, where low-dollar abuses – such as illegal charges and add-on fees – are common,” explains Public Citizen in a statement. “Small-dollar illegal charges can lead to significant profits for companies because they affect large numbers of consumers. Class actions often are the only economically feasible way for consumers to seek remedies for these losses and systemic violations of the law.”

The group, along with several other advocates have called on the CFPB to follow up its report with meaningful action that makes arbitration a choice; not the only option.

“Basic legal protections have no meaning if companies can’t be held accountable under the law,” explains our colleague George Slover, senior policy counsel at Consumers Union. “We hope the CFPB will now use its authority to prohibit forced arbitration from being a pre-condition for getting a credit card or a bank account.”

National Consumer Law Center attorney David Seligman, says the CFPB findings on arbitration are “crystal clear.”

“These clauses are written by corporations to set up a secret and lawless process that prevents

consumers from holding corporations accountable for unlawful conduct” he says in a statement. “The CFPB should act quickly to ban forced arbitration in consumer financial contracts.”

The Financial Services Roundtable, which counts many of the nation’s largest banks and credit credit issuers among its members, has come out in defense of the process.

“Arbitration makes it possible for American consumers to resolve disputes in a cost-effective, fair and timely manner that often benefits all parties involved,” said FSR Senior Vice President of Legal and Regulatory Affairs Richard Foster. “This is an important tool for the customers of financial institutions that helps keep costs down and keeps financial products, including credit cards and checking accounts, affordable. While FSR is still reviewing the full report, we urge the CFPB to continue working with the industry to educate consumers about this important benefit.”

But, CU’s Slover has a counter argument: “Banks and other financial services companies claim that arbitration is somehow better for consumers than going to court. But if that were really true, the banks and lenders wouldn’t need to force consumers to agree to it.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.