Forget the Sixth Amendment, which guarantees the “right to a speedy and public trial” in criminal matters. And who needs that ancient Seventh Amendment and its fancy “right of trial by jury.” The U.S. Treasury Department has concluded that American consumers can not be trusted to thoughtfully exercise these Constitutional rights — at least not when doing so might be an annoyance to the financial services sector. [More]

mandatory binding arbitration

Treasury Dept. Says You Shouldn’t Have The Right To Sue Your Bank Or Credit Card Company

Wells Fargo CEO: We Can Block Customers From Filing Lawsuits Because We Promise To Not Screw Up Again

Imagine a teenager who has been repeatedly caught sneaking out with their friends to get drunk and pilfer garden gnomes from the neighborhood. The teen’s parents ask “Why should we trust you anymore?” and the best answer the adolescent nincompoop can provide is, “Because I started cleaning my room and I’m gonna pass that Geometry quiz, I think.” Now, replace that teen with Wells Fargo, and you’ll basically have the scene from this morning’s Senate Banking Committee hearing. [More]

Supreme Court Allows For Rare Win In Customers’ Lawsuit Against Samsung

The Supreme Court has a long history of ruling against consumers when it involves a company’s attempt to strip its customers of their right to a day in court, but this week the nation’s highest court decided to not hear an appeal in a lawsuit involving Samsung, marking a rare instance in which SCOTUS came down on the consumers’ side in this issue. [More]

Federal Appeals Court Is Okay With Uber Taking Away Customers’ Right To Sue

Like companies in just about every industry, the ride-hailing app Uber requires users to agree that they will take any disputes to an arbitrator rather than the legal system. And although you may never have noticed this clause, a federal appeals court has now ruled that customers receive “reasonably conspicuous” notice about the arbitration requirement. [More]

31 Senators Ask Trump Administration To Not Strip Nursing Home Residents, Families Of Their Legal Rights

Nursing homes and assisted living facilities in the U.S. have faced increasing criticism for shoddy care and bad business practices. At the same time, many of these facilities have begun using contractual language that explicitly prohibits residents or their loved ones from filing lawsuits when things go wrong. Now dozens of senators are calling on the Trump administration to rethink its decision to let this practice continue. [More]

House Votes To Strip Bank & Credit Card Customers Of Constitutional Right To A Day In Court

Because the Sixth and Seventh Amendments of the U.S. Constitution are apparently less important than making sure that banks, credit card companies, student loan companies, and other financial services be allowed to behave badly with impunity, the House of Representatives has voted to overturn a new federal regulation that would have helped American consumers hold these companies accountable through the legal system. [More]

Lawmakers Who Want To Hand ‘Get Out Of Jail Free’ Card To Banks Made Millions From Financial Sector Last Year

As expected, Republican lawmakers in both the House and Senate have introduced legislation that would overturn new rules intended to make sure that bank and credit card customers aren’t stripped of their right to file lawsuits in a court of law. Not surprisingly, many of the politicians pushing this pro-bank bill recently received significant financial support from the financial sector. [More]

GOP Moving Forward With Plan To Block New Legal Protections For Bank, Credit Card Customers

The Consumer Financial Protection Bureau recently finalized new rules that prevent banks and other financial institutions from stripping customers of their constitutional right to a day in court. As expected, bank-backed lawmakers in both the House and Senate are now planning to pass fast-track legislation that would undo these protections and make sure banks retain their “get out of jail free” card. [More]

AT&T, DirecTV Reportedly Overcharged Thousands Of Customers

When you get promised one rate and charged another, it’s frustrating. When it happens to thousands of customers getting service from the same company all at once, it’s probably a sign of a systematic problem. And one report now says thousands of AT&T and DirecTV customers have been complaining about exactly that for years. [More]

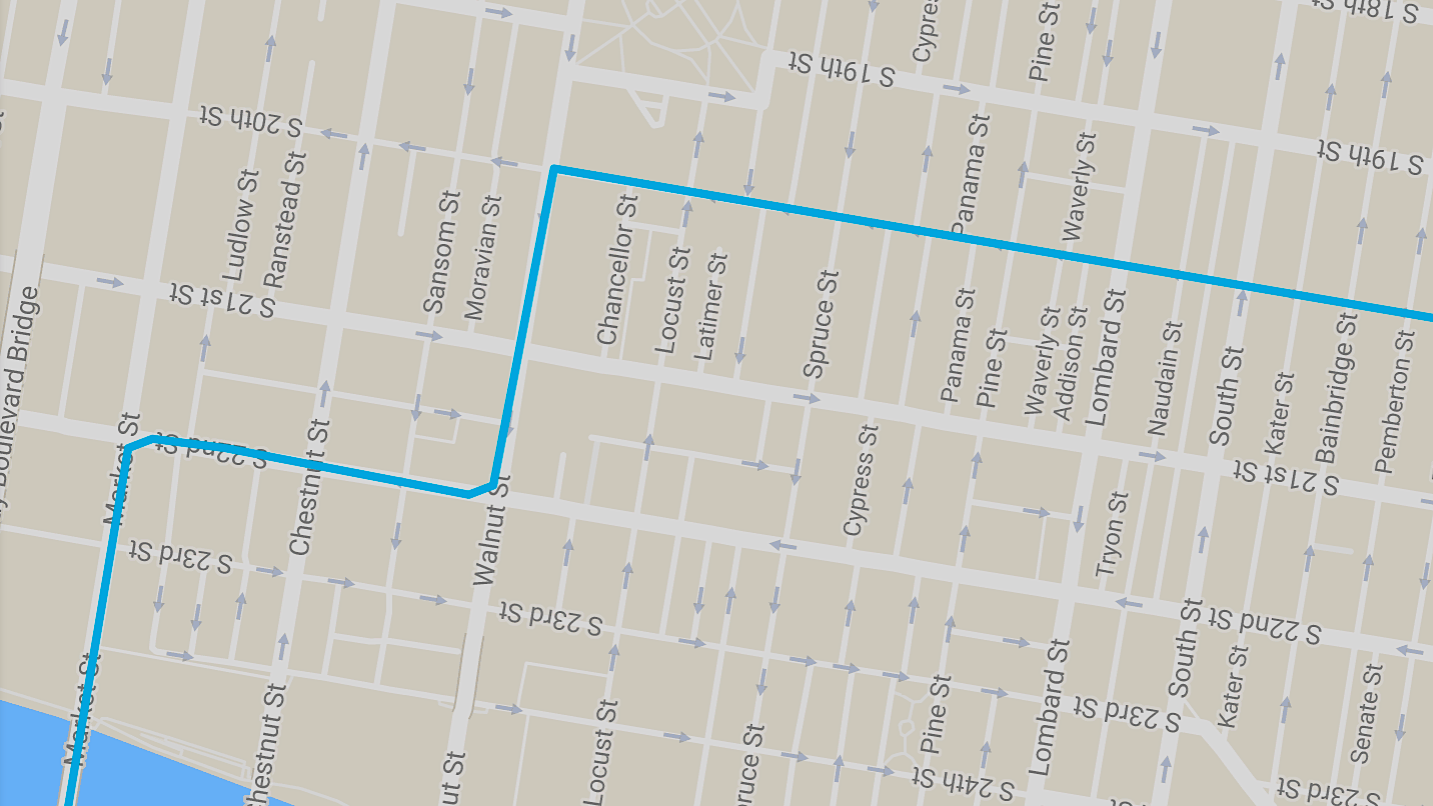

Judge Says Uber Can’t Use “Deficient” Sign-Up Process To Strip Users Of Their Right To Sue

Can Uber use some contractual language that users never actively acknowledge to force wronged customers out of the courtroom and break up class-action lawsuits? Currently, that depends on which federal judge you ask, with yet another court ruling that Uber may not be doing enough to tell users that they are giving up their right to a day in court. [More]

Customer Sues Charter For Selling Their Data Without Consent

It may become one of the defining questions of our age: Does your personal data become someone else’s asset as soon as you go online? One Charter customer says that he has a right to determine how his data is used, and that the cable/internet company failed to get his permission or disclose that it would be using this information for its own gain. [More]

Congress Set Up For Showdown Over Consumers’ Ability To Sue Corporations

A subject that many Americans don’t even know about — until it’s too late for them to do anything — is now shaping up to be a battleground between lawmakers in both the House and Senate, where two very different sets of legislation will go head to head to determine whether or not companies can strip their customers of their constitutional right to file a lawsuit in court — and their First Amendment right to speak freely. [More]

Wells Fargo Tries, Fails To Explain Why Customers Shouldn’t Be Allowed To Sue Over Fake Accounts

Wells Fargo has admitted that thousands of its employees opened fake, unauthorized accounts in customers’ names, but the bank is doing everything it can to prevent these wronged customers from having their day in court. We asked Wells Fargo to explain why it believes hundreds of thousands of Americans shouldn’t be allowed to exercise their constitutional right to sue. The bank’s response made little sense (unless you’re a Wells Fargo executive). [More]

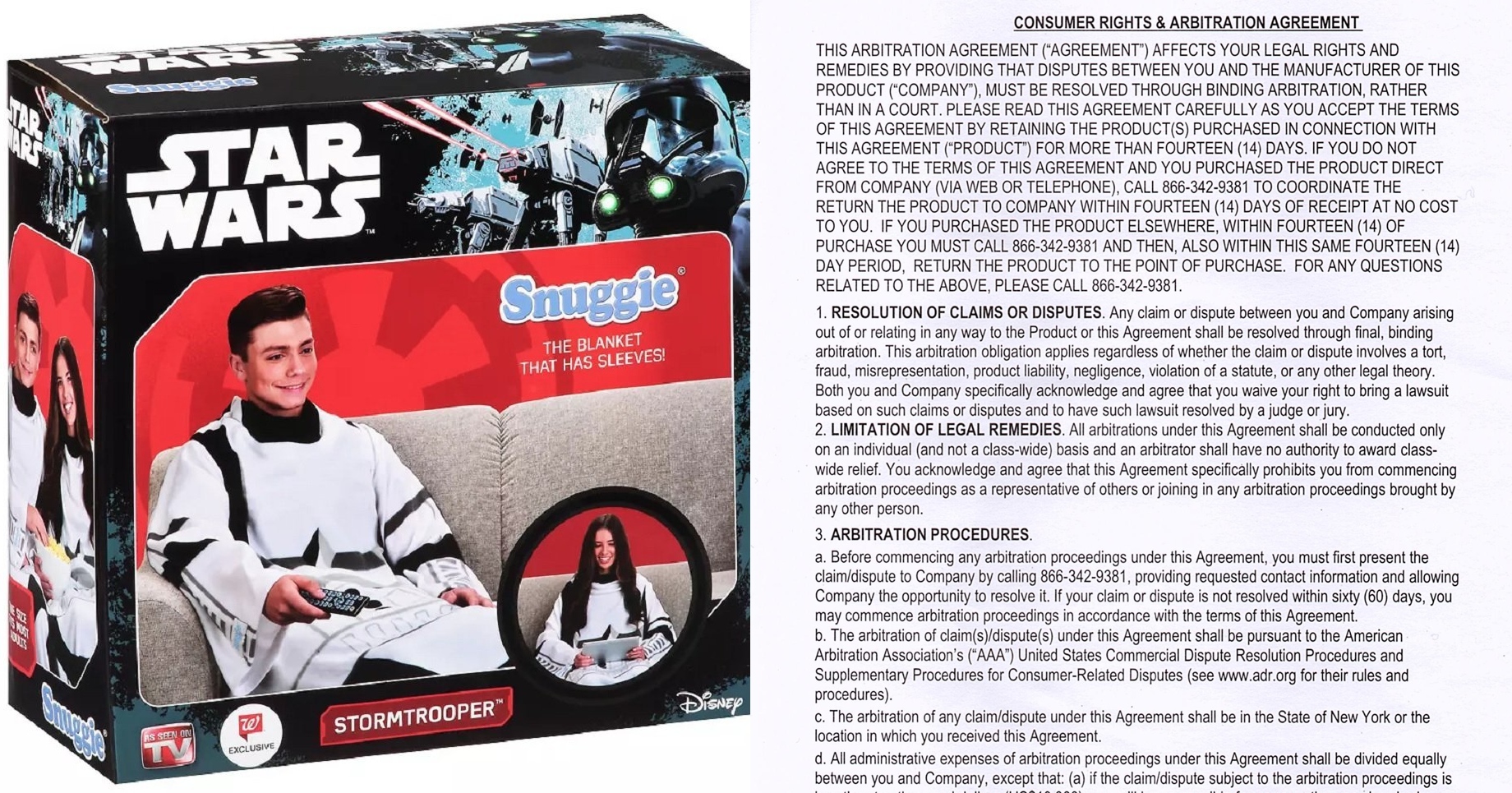

Appeals Court Says Samsung Can’t Use In-Box Warranty Booklet To Strip Customers Of Legal Rights

Last week, we used the example of a Stormtrooper Snuggie to show how easy it is for companies to take away customers’ constitutional rights with just a slip of paper placed inside the box. Now a federal appeals court has ruled that Samsung can’t use an in-the-box warranty booklet to derail a class-action lawsuit. [More]

Your New Stormtrooper Snuggie Comes With A Surprise: It Strips You Of Your Right To File A Lawsuit

Until the other day, Consumerist reader Jeff had completely forgotten about that cute Stormtrooper Snuggie someone gave him for Christmas. When he finally opened the box, there was the Star Wars-themed sleeved blanket, and a slip of paper giving him the bad news: He had, without doing a thing, given up his right to sue the Snuggie’s manufacturer. [More]

Did You Get A Gadget For Christmas? It’s Time To Opt Out Of Mandatory Arbitration!

Did you receive any fun gadgets as holiday gifts? If so, it’s time to check over that user agreement most people usually ignore to see if you have signed away your legal rights, or if you still have a chance to protect your right to a day in court. [More]

Wells Fargo Customers: Bank’s Contract Can’t Be Used To Allow Illegal Activity

Even though Wells Fargo has admitted that bank employees opened millions of fraudulent, unauthorized accounts in customers’ names, the bank has avoided or delayed class-action lawsuits over this fake account fiasco by citing terms in customer contracts that prevent account-holders from bringing lawsuits against Wells. However, one group of customers is arguing that the bank can’t use these contracts to shield itself from being held liable for illegal activity. [More]

Wells Fargo Fake Account Lawsuit On Hold While Bank Tries To Force Case Out Of Court

As we mentioned last week, Wells Fargo — the bank where employees opened millions of unauthorized accounts in customers’ names — has been trying to wriggle out of class action lawsuits involving the fake account fiasco by forcing each individual customer into private arbitration. This afternoon, the judge in one lawsuit put the case on hold until he decides whether or not Wells gets to play this “get out of jail free” card. [More]