Report Finds Auto Dealers May Be Charging Hispanic Customers More For Vehicle Add-Ons Image courtesy of andy briggs

If you’ve purchased a new car at a dealership, you’re probably familiar with the slew of possible options and add-ons for your vehicle — everything from tinted windows to extended service contracts. A new report claims that the price a customer is charged for these extras may be linked to their ethnicity.

The National Consumer Law Center today released a report [PDF], highlighting what dealers pay for auto add-on products and what they charge consumers.

It’s not a surprise that dealers mark up the prices on these products and services — they are, after all, trying to make a profit — but the report raises reasons to be concerned about the way that some dealers are passing these extra costs on.

The Markups

According to the report — based on analysis of a large national data set — dealers mark up add-on products by a far higher percentage than they mark up cars.

For example, one dealer sold over 1,000 window etching products — which cost the company $16 — for $189, representing a 1,081% markup.

When it came to Guaranteed Asset Protection (GAP) insurance, the report found that 38 dealers had average markups of 300% or more, while 38 dealers marked up service contracts by an average of more than 300%.

In addition to finding the excessive rates of markups, the report also found that dealers were inconsistent in what they charged customers.

One dealer was found to pay either $35 or $65 for its window etching products. Of the 600 products sold to customers in 2012, NCLC found that 213 of the customers were charged $199, while others were charged between $1 and $1,995.

Possible Discrimination

NCLC suggests that the inconsistent pricing for add-on products leads to pricing discrimination.

“Discrimination on the basis of race, sex, or other protected characteristics may be an invidious side effect of dealers’ capricious pricing structures,” the report states, adding that giving manager the discretion to charge different customers different prices for the same products is a recipe for abuse.

In some cases, dealers may base pricing for add-ons not on the product’s quality or wholesale price, but by what they perceive the customer is willing to pay or will notice.

To make matters worse, because customers don’t know what others are paying for the add-ons, there is no way for them to detect whether they are being charged more than others for the same products.

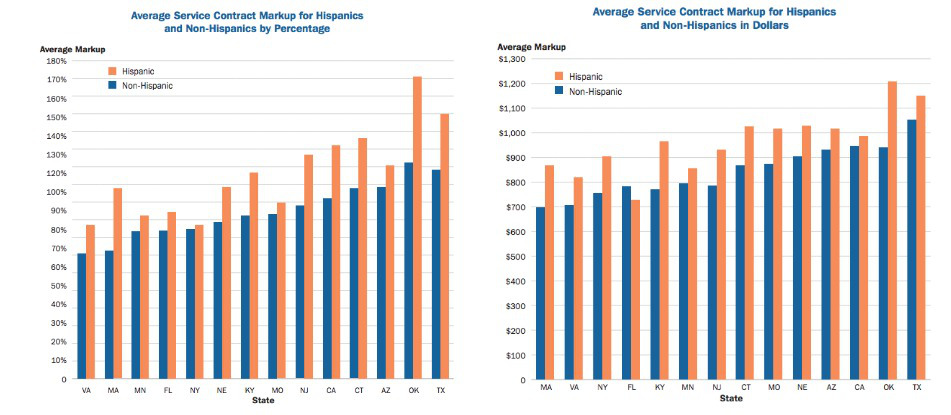

When it comes to possible pricing discrimination by race, NCLC found that Hispanic customers were charged higher markups for service contracts than non-Hispanic customers.

Although the data used by NCLC did not provide customers’ race or gender, the organization used a name recognition methodology to determine these characteristics.

In all, the report examined service contracts issued from Sept. 2009 through June 2015 in 48 states and the District of Columbia.

The report found that the average markup percentage was higher for Hispanics than non-Hispanics in 44 states.

In 14 states the markup was significant for both in absolute pricing and percentage.

“These differences in markups are particularly troubling since they involve the retail prices of service contracts, which are not determined or affected by credit scores,” the report states. “Thus, they cannot be explained by differences in buyers’ credit scores.”

Financing Differences

While dealers were responsible for making up the prices of add-on products, the report found that companies providing financing also play a role in costs.

NCLC found that potential creditors give dealers conditions about what sort of transactions they will accept.

In some cases, creditors will allow higher markups for add-on products in order to obtain more business.

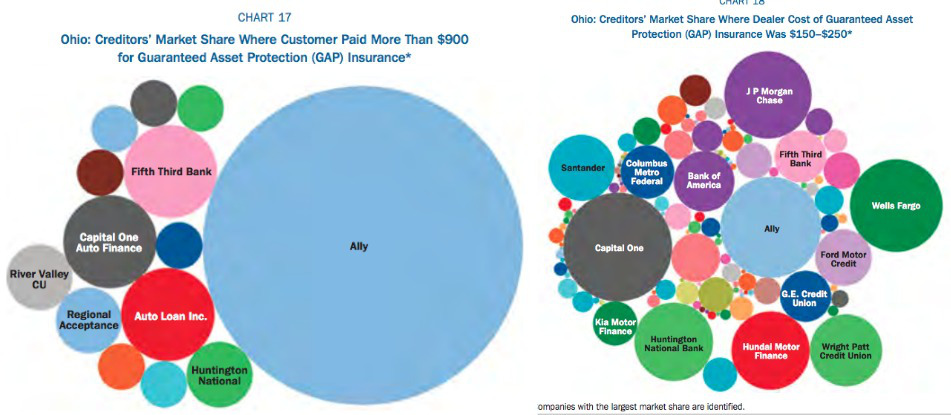

For instance in Ohio, NCLC found that Ally Bank financed just 10% of GAP insurance when the cost was $150 to $250. However, it financed 74% of these same deals where the customer price exceeded $900.

By financing higher loans for these add-on products, consumers, they are increasing the loan to value ration.

The higher loan to value results in more negative equity, which can hurt consumers because those who owe more than their car is worth will have a hard time trading it in or buying a new car.

Additionally, NCLC notes that higher loan to value rates have also been associated with higher default rates.

Can Things Change?

The NCLC report argues that the market for vehicle add-on products could be significantly more transparent, saying that dealers should be required to post the standard costs for these items — and that these posted prices should be non-negotiable, in order to prevent dealers from offering deals to some customers but not others.

The organization has also called on state and federal regulators to investigate possible discrimination in the pricing of add-on products and services.

Consumerist has reached out to the National Automobile Dealers Association for comment on the NCLC report and will update if we receive a response.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.