Bank Of America Doesn’t Want To Pay $1.27B For Countrywide’s “Hustle” Mortgage Scam

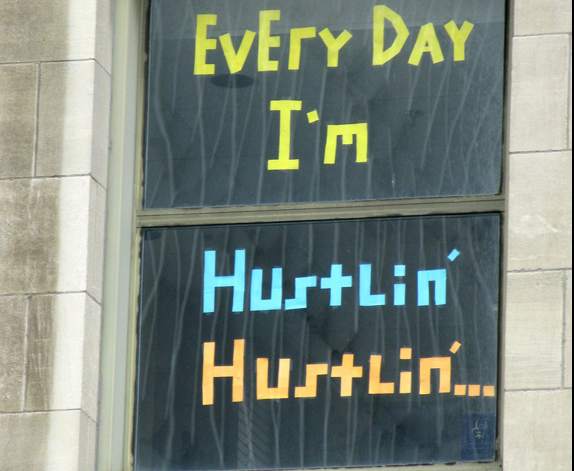

It was last October that a federal jury found BofA liable for the misdeeds of Countrywide’s High Speed Swim Lane (HSSL, aka “The Hustle”) program, which began in the final, doomed days of the housing bubble with the goal of approving as many loans as possible in order to quickly resell them to Fannie Mae or Freddie Mac before they realized the mortgages weren’t worth the Post-It notes on which they’d been written.

In order to expedite loan approvals, the Hustle removed the typical underwriting safeguards that would usually prevent a lender from making a bad loan. Additionally, the government charged that Countrywide misrepresented the quality of these loans when reselling them.

Nearly half of the Hustle loans resold to Fannie or Freddie turned out toxic, resulting in massive losses.

Earlier this summer, the judge in the case finally decided that BofA should have to pay $1.27 billion in damages, and Rebecca Mairone, the Countrywide exec who oversaw the program, is on the hook for $1 million.

Even after the verdict and penalty had been decided, BofA maintained that it shouldn’t be held responsible because the program ended before BofA acquired a failing Countrywide.

And in its appeal, the bank further argues that there was no actual evidence of fraud.

“The trial evidence, even viewed in the light most favorable to the government, did not prove fraud under this standard,” the bank’s lawyers wrote in a motion filed with the court this week, according to Reuters.

Federal prosecutors are expected to file a response on Sept. 18.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.