A nasty four-year legal battle between the Justice Department and Bank of America over a massive mortgage-related scam run by Countrywide Financial has come to a whimpering conclusion, with the DOJ opting to not appeal its most recent defeat in the case. [More]

countrywide

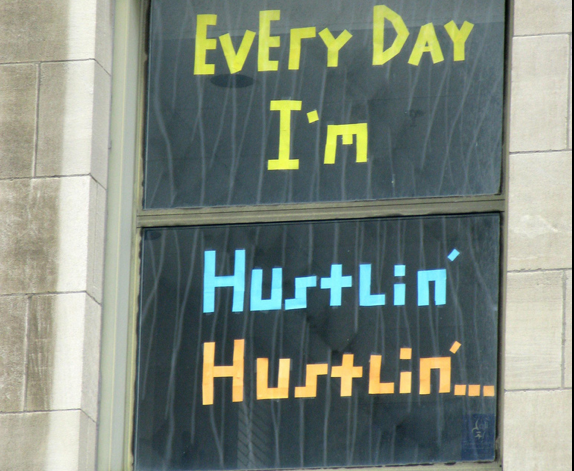

Feds Give Up Trying To Hold Bank Of America Accountable For Countrywide’s “Hustle” Mortgage Scam

Bank Of America Won’t Have To Pay $1.2 Billion For Countrywide’s “Hustle” Mortgage Scam

Nearly eight years after Bank of America bailed out Countrywide Financial, a federal appeals court has ruled that BofA should not have been held liable for Countrywide’s “Hustle” scam in which the company sold Fannie Mae and Freddie Mac a ton of poorly underwritten mortgages knowing that they were worthless. [More]

Former Countrywide Exec Who Helped Secure Bank Of America’s Billion-Dollar Settlement Gets $57M

Back in August, the Department of Justice announced a record-setting $16.65 billion settlement with Bank of America to resolve multiple federal and state claims involving the bank’s bad behavior leading up to the collapse of the housing market. Now, the former executive who became a whistle-blower to assist federal prosecutors in the matter is set to receive $57 million of the hefty settlement. [More]

Former Countrywide CEO Still Says He Did No Wrong, Still Refers To Self In Third-Person

It’s been a while since we’ve heard from Angelo Mozilo, the curiously orange-tinted former CEO of Countrywide Financial, the nation’s largest mortgage lender during the housing boom; a mansion built on a swampland of toxic loans given out to just about anyone who applied. And even though Countrywide, a Worst Company In America winner, had to be bailed out by Bank of America — a deal that has since cost BofA at least $40 billion in settlements, penalties, write-downs, and legal fees — and even though Mozilo’s sunny mug will forever be seen as the face of the mortgage meltdown, he still doesn’t really see the problem. He also continues to refer to himself in the third person. [More]

Bank Of America Doesn’t Want To Pay $1.27B For Countrywide’s “Hustle” Mortgage Scam

Between settlements, fines, legal fees, and loan reductions, Bank of America’s tab for its part in the mortgage meltdown is well over $50 billion, including last week’s record-setting $16.65 billion deal. And yet BofA is still trying to fight a nearly year-old jury verdict involving a scam by Countrywide Financial that sold off oodles of worthless home loans before the housing bubble collapsed. [More]

DOJ Finally Confirms Record-Setting $16.65B Settlement With Bank Of America

More than two weeks after it was first reported that the Justice Dept. and Bank of America were coming to terms on a record-setting deal worth nearly $17 billion, the two parties have finally confirmed the details of a settlement that will resolve multiple federal and state claims involving the bank’s bad behavior in the lead-up to the collapse of the housing market. [More]

Bank Of America Settlement Could Be Worth As Much As $17 Billion

Earlier this summer, when it looked like Bank of America and the Justice Dept. were reported to be on the brink of a settlement that would close the books on multiple cases involving the bank’s mishandling of toxic home loans in the run-up to the collapse of the housing market, it looked like BofA would be on the hook for around $12 billion. But now comes news that the deal could hit the bank for anywhere from $16-17 billion. [More]

Bank Of America Finally Ordered To Pay $1.27B For Countrywide’s “Hustle”

It’s been about nine months since a federal jury found Bank of America liable for the “Hustle,” a pre-bubble Countrywide Financial program that removed safeguards to the mortgage underwriting process, resulting in a mountain of toxic, worthless loans. Yesterday, the judge in the case finally decided how much BofA — and the former Countrywide exec in charge of the program — should pay. [More]

Prosecutors May Seek Larger Penalty For Countrywide Exec Behind “Hustle” Scam

Last fall, Bank of America and former Countrywide executive Rebecca Mairone were found liable in federal court over a Countrywide scam that had bilked bailed-out mortgage-backers Fannie Mae and Freddie Mac out of piles of cash by selling them worthless mortgages. Mairone was originally expected to face a $1.1 million penalty, but that was before she got a big bonus from her new gig. [More]

U.S. Wants To Add $1.23 Billion To Bank Of America’s Tab For Countrywide Scam

Back in October, a federal jury found Bank of America liable for a Countrywide Financial program that deliberately sold piles of worthless loans to Fannie Mae and Freddie Mac before the housing bubble went kaflooey. At the time, prosecutors had only sought $864 million in penalties, but now the Justice Dept. claims that number should be $2.1 billion. [More]

Bank Of America On Trial Over Countrywide’s “Hustle”

There are children in elementary school who were not yet born in 2007, when Countrywide Financial allegedly launched a program dubbed the “Hustle,” which removed virtually all the roadblocks in the mortgage approval process so the lender could write as many loans as possible and quickly sell them off to Fannie Mae and Freddie Mac for billions of dollars. Many of those mortgages proved toxic, and six years later, Bank of America has to answer in court for the bad behavior of the mortgage company it must now regret acquiring. [More]

On 5-Year Anniversary Of Mortgage Meltdown, Those Responsible Are Doing Just Fine

On Sept. 15, 2008, Lehman Brothers became the largest bankruptcy filing in the history of this country. It was the first domino of many to fall, followed by the likes of Bear Stearns, Merrill Lynch, Countrywide, Wachovia, Washington Mutual, and many other banks and investment firms that had bet too much money on the subprime mortgage market, only to have it collapse when people realized many of those bad loans would never be repaid. These events ripped apart the American economy and left people out of work for extended periods of time. But not most of the bankers responsible for the mess. [More]

Former Staffers: Bank Of America Rewarded Us For Lying To Homeowners, Losing Paperwork, Denying Modifications

In sworn statements provided for a lawsuit by homeowners against Bank of America, a half-dozen people who reviewed loan modification applications for BofA say the company encouraged staffers to lose applicants paperwork so that it could later be denied, putting homeowners at further risk of losing their homes. And if these people are to be believed, some folks out there may have lost their homes so that a BofA employee could get a Target gift card. [More]

Bank Of America To Shell Out Another $500 Million To Settle Another Investors’ Lawsuit

Nearly five years after swallowing the rancid slab of meat that was Countrywide Financial, Bank of America is still vomiting up hundreds of millions of dollars to settle lawsuits tied to that failed company’s misdeeds. The latest is a $500 million class-action settlement with groups that invested in Countrywide’s radioactive mortgages. [More]

Another Day, Another 9-Figure Settlement For Bank Of America

For most companies, a $165 million settlement would be huge news. For Bank of America, it’s like a paper cut on a guy that’s been swimming in the piranha tank all day. Not that we feel any sympathy. [More]

Investors Accuse Bank Of America Of Continuing Countrywide’s Bad Practices

Most of the $40 billion Bank of America has set aside to pay out over the mortgage meltdown can be blamed on malfeasance at Countrywide Financial. But some investors say that BofA’s hands are not totally clean in this mess — and that the bank has gotten off too easy thus far. [More]

BofA CEO: Cleaning Up Countrywide Mortgage Mess Is Like Climbing Mountain With 250 lbs. On Your Back

Before the economy nosedived, Bank of America was the aww-shucks upstart from North Carolina who was quietly making its play to become one of the world’s largest banks. Then things turned bad for mammomth mortgage-lender Countrywide and investment bank biggie Merrill Lynch, and BofA swooped in to save both. [More]

Bank Of America To Pay $11.6 Billion In Latest Countrywide Settlement

Like someone who thought they were buying a nice little fixer-upper at a bargain only to find that every ounce of the property is covered in lead paint and asbestos, Bank of America’s 2008 purchase of Countrywide Financial continues to eat away at the company’s coffers. [More]