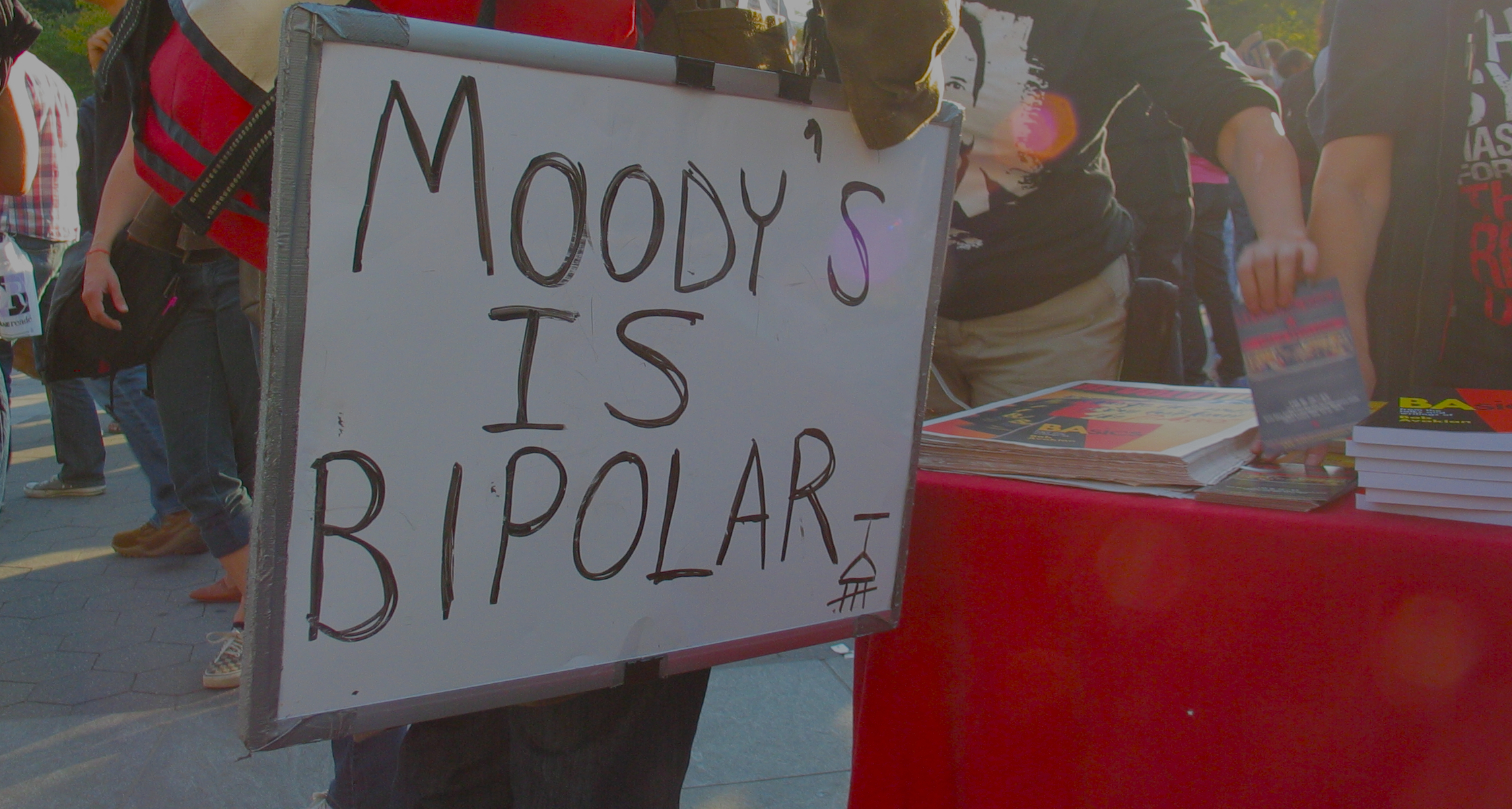

While much of the anger surrounding the mortgage meltdown was focused on shady mortgage lenders and investment banks, a less-discussed but nonetheless culpable party were the credit-rating agencies that rubber-stamped mortgage-backed securities that were sometimes worth about as much as a used lottery ticket. [More]

moody’s blues

DOJ, States To Sue Moody’s Credit Rating Agency For Role In Mortgage Meltdown

What drove the mortgage bubble in the years leading up to the 2008 financial crisis wasn’t just ill-prepared home-buyers signing on to subprime, adjusted-rate mortgages they couldn’t afford, or the lenders who effectively gave up on underwriting these loans so as to bundle and resell as many of them as possible. There were also credit rating agencies that gave these mortgage-backed bonds the seal of approval, even when they were worthless. [More]