Why Comcast Wants To Buy Time Warner Cable, And Why TWC Wants To Let Them

Commentary has been flying nonstop since Comcast announced its plan to buy Time Warner Cable. If the buyout goes through, there will be enormous repercussions in the TV and broadband industries, both for competitors and for consumers. Before the legal filings and federal approvals and consumer chaos all begin in March, though, it’s worth taking a step back to look at why this merger is being proposed, and why it’s happening now.

Commentary has been flying nonstop since Comcast announced its plan to buy Time Warner Cable. If the buyout goes through, there will be enormous repercussions in the TV and broadband industries, both for competitors and for consumers. Before the legal filings and federal approvals and consumer chaos all begin in March, though, it’s worth taking a step back to look at why this merger is being proposed, and why it’s happening now.

Why does Comcast want to buy Time Warner Cable?

Comcast is putting $45 billion into this deal. That’s a lot of money, even for a company as large as Comcast. (In comparison, they spent less than $17 billion to buy out NBCUniversal.) For such a large cost, Comcast must see a large potential gain.

From one perspective, the benefits are crystal clear:

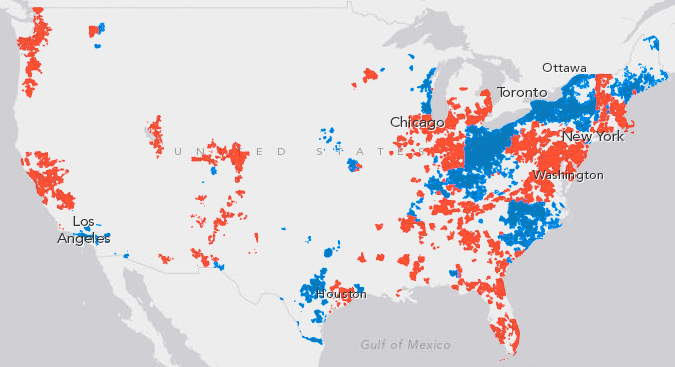

Fully interactive map at Mashable. Red is Comcast; blue is Time Warner Cable.

If the TWC purchase goes through without any major hitches, Comcast will be the dominant pay TV and broadband internet carrier down the entire East Coast from Maine to Florida, including all of the densely populated and lucrative markets in the northeast corridor. Comcast would also pick up Los Angeles and several of the biggest cities in Texas, as the above map from Mashable shows.

Comcast currently boasts roughly 20 million residential subscribers; TWC has approximately another 11 million. For $45 billion, Comcast can effectively increase its reach by a solid 50%, overwhelmingly dominate the competition, and instantly expand into states where they currently have no presence.

Some market analysts feel that financially speaking, the purchase is less than ideal for Comcast. But although the acquisition could cost the company some revenue in the short run, an immediate jump from 20 million to 30 million customers is clearly a situation with enormous potential for Comcast to make more money in the future.

Comcast gains economies of scale through expanding: as the press release points out, buying TWC will “generate significant cost savings and other efficiencies” for Comcast. The sheer size of the combined company would give it particular clout in negotiations with content providers to drop Comcast’s costs for access to networks and programming.

So why does Time Warner Cable want to let Comcast buy them?

At first glance, Time Warner Cable seems to be enjoying the best years in the company’s history. Since being spun off from Time Warner into a separate entity in 2009, the company’s been going nowhere but up. Their stock prices have gone from $26 and change in March 2009 to over $135 on the day before the Comcast merger was announced.

Despite the currently rosy finances, though, the long-term outlook for TWC is much less bright. The company itself is not currently well-poised for future growth, as executives might say. In fact, analysts looking at TWC since 2009 feel that the company has been subject to a series of unfortunate management events. They’re losing subscribers by the bucketful, with no sign of a let-up.

Why are the numbers dropping at TWC? Well for starters, a large percentage of their customers hate them. Passionately.

Time Warner Cable serves New York City and Los Angeles, the two biggest cities and media markets in the country, and it doesn’t do it well in either one. When CEO Rob Marcus stepped into the role on January 1, he stressed the importance of customer service, and that is indeed a place where TWC needs to improve: they rank at or near the bottom of customer satisfaction surveys for their phone, cable TV, and broadband subscribers.

Not only do TWC’s customers hate having to call in for anything, but they also hate paying lots of money for services that feel distinctly behind the times. Time Warner Cable has been slow to roll out offerings that other companies have leapt into, like cloud-based TV services, and Reuters writes that as of December 2013 the company had still not fully converted from analog to digital cable (a move Comcast began in 2008, and has since completed). Their broadband internet connection speeds and reliability have also lagged.

Public fights over content cost them more customers, like the 300,000 who fled or opted not to sign up in the wake of their battle with CBS last fall. High-profile problems like L.A. residents losing signal during the Super Bowl don’t help.

In the face of all that hostility from their customer base, it’s unsurprising that consumers jump to the competition when they have the option. As Reuters reported in December, as soon as Verizon FiOS became a TV and broadband option in New York, consumers started ditching TWC in record numbers. An analyst speaking with Reuters estimated that Time Warner Cable in New York City lost a whopping 45% of their subscribers to Verizon since 2008.

So while Time Warner Cable has been a good bet for investors in the last five years, without intervention from another company, the next five could be a different story altogether. And as for why TWC took Comcast’s deal and not Charter’s earlier offer? $45 billion is a lot more money than $37 billion, and the reported $60 million going to TWC’s management probably doesn’t hurt either.

Time Warner Cable isn’t on the brink of imminent failure, and doesn’t need a buyout to survive. TWC does need a new direction, though. Rob Marcus only took over the CEO position at the company last month; it’s too early to tell if his stated commitments to improving the company’s infrastructure and customer service could come to fruition. If the union with Comcast is approved, we’ll never find out.

Likewise, Comcast is doing just fine on its own, and doesn’t need TWC’s assets in its pocket to continue its growth. Buying out those assets, though, will certainly help the company find its “cost savings and other efficiencies.” Those cost savings could end up cutting consumers’ cable bills… but they’re just as likely to end up as bigger profits to line investors’ and executives’ pockets.

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.