Lawsuit Accuses Walmart Of Overcharging Taxes On Coupon Purchases

A Pennsylvania man’s purchase of two cans of shaving cream at Walmart has ballooned into a lawsuits against the nation’s largest retailer, which stands accused of not taking coupons into account when calculating sales tax.

A Pennsylvania man’s purchase of two cans of shaving cream at Walmart has ballooned into a lawsuits against the nation’s largest retailer, which stands accused of not taking coupons into account when calculating sales tax.

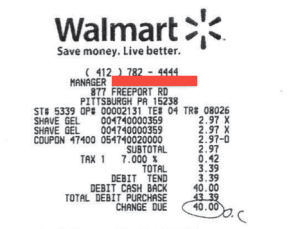

In June of this year, the plaintiff in the case [PDF] used a “Buy one, get one free” manufacturer’s coupon for some Gillette shaving gel at a Pittsburgh Walmart. At the cashier, the register scanned the coupon and $2.97, the cost of one can, was deducted from his total.

But the 7% sales tax was figured on the pre-discount subtotal of $5.94. Thus, as you can see in the receipt above, he was charged $.42 instead of the $.21 he would have been charged if the sales tax were only figured on the one can of shaving gel he had to pay for.

While different states have different laws about whether coupon discounts should be calculated in the sales tax, the lawsuit holds that this is in violation of Section 33.2 of the Pennsylvania Code which deals with the taxable portion of a purchase price.

Specifically, there is Section 33.2(b)(2), which details how certain discounts are to be handled when figuring the sales tax on an item (emphasis ours):

Amounts representing on-the-spot cash discounts, employee discounts, volume discounts, store discounts such as “buy one, get one free,” wholesaler’s or trade discounts, rebates and store or manufacturer’s coupons shall establish a new purchase price if both the item and the coupon are described on the invoice or cash register tape. An amount representing a discount allowed for prompt payment of bills which is dependent upon an event occurring after the completion of the sale may not be deducted in computing the tax. A sale is completed when there is a transfer of ownership of the property or services to the purchaser.

The Code then gives the following example from a fast food restaurant of how a BOGO coupon purchase should be handled with regard to taxes.

“A” purchases two hamburgers from “R” restaurant with a “buy one, get one free” coupon. The price of one hamburger is $1. “R” rings up $2 on the cash register. “R” enters a credit in the cash register for the amount of $1 resulting in an adjusted price of $1. The acceptance of the coupon by “R” establishes a new purchase price of $1 which is subject to 6¢ tax.

The complaint also cites a 2005 Tax Update from the Pennsylvania Dept. of Revenue, in which it clarifies:

“The regulations require a retailer to deduct the coupon amount from the taxable portion of the purchase price, if the cash register receipt describes both the item purchased and the coupon that applies to it.”

And because Walmart is entitled to a 1% discount on taxes paid to the state, the lawsuit alleges that the retailer is unjustly enriching itself by overcharging customers who use coupons.

The suit seeks an immediate injunction against Walmart’s alleged overtaxing. It also looks to establish a plaintiff class made up of consumers who made purchases with coupons at Pennsylvania Walmarts since June 2007, which the complaint estimates could be hundreds of thousands of consumers.

The case was originally filed in a common pleas court in Allegheny County, PA, but has since been removed — at Walmart’s request — to a U.S. District Court.

In spite of what seem like pretty clear state laws regarding taxes and coupons in Pennsylvania, Walmart defends the practice in a statement to KDKA-TV:

“Walmart’s current systems, with respect to the collection and remittance of sales tax, are in compliance with Pennsylvania’s tax laws. We have previously sought an opinion from the state which confirmed this.”

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.