Less than a week after a report alleged, and Wells Fargo admitted, to charging its auto loan customers for unnecessary and unwanted insurance, the bank has been subpoenaed by New York state banking and insurance regulators over the matter. [More]

delinquencies

Wells Fargo Subpoenaed Over Alleged Insurance Scheme That Resulted In 25,000 Vehicle Repossessions

Student Loan Debt Increased $77B In 2014, One In Nine Loans Now Past Due

Student loan debt reached an all-time high and delinquency rates continued to rise last year, according to a new report from the Federal Reserve Bank of New York found. [More]

Treasury Dept. Urges Student Loan Servicers To Do A Better Job, Try Incentives

Hot of the heels of a report from the Consumer Financial Protection Bureau detailing how loan servicers trick consumers into paying more, top officials with the Department of Treasury implored the industry to fix their often nefarious ways. [More]

Americans Are More Responsible With Credit Cards Than We’ve Been In A Decade

Times may have been tough on our wallets over the years, but somehow despite a recession and its ensuing after-effects, Americans have become a lot better at making their credit card payments on time. The amount of delinquencies on credit cards issued by banks is at its lowest level since 2001, according to a new report from a banking group. [More]

Being 30 Days Late On House Payment Can Knock 100 Points Off Credit Score

Usually very closed-mouth about how it calculates scores, FICO released a whole bunch of data about how being late on your mortgage payments affects your credit score. For instance, being 30 days later on a mortgage payment can chop your 780 credit score down to 670. And a short sale or deed-in-lieu of foreclosure will hurt your score just as bad as a foreclosure if the service reports it as having a deficiency amount or an unpaid balance. Yikes! Here’s some sexy tables with more details: [More]

86-Year-Old Receives Surprise $19k Bill From Macy's

Lorene Pounds is 86 years old and says she hasn’t shopped at Macy’s in years. That’s partly why she was surprised when Macy’s called her up and told her she was delinquent on her credit card account. The other reason she was surprised was they said she owed $19,791. [More]

New Record! 9.64% Of All Mortgages Delinquent!

The Mortgage Bankers Association has announced that 9.64% of all mortgages are now delinquent, and this delinquency rate breaks the record set last quarter. The records are based on MBA data dating back to 1972.

Banks To "Earn" $38.5 Billion From Overdrafts This Year

Consumers aren’t the only ones looking to save money and gain a little extra cash on the side. Banks are people too, you know! In the face of toxic assets and credit card delinquencies, they’ve come up with a plan to increase their revenue: New fees! Higher fees! Higher minimum balance requirements! Trickier overdrafts!

Credit Card Companies Are Warming Up To Reduced Payoff Deals

If you’ve fallen into a debt pit and can’t make your credit card payments, and now you’re watching them steadily mount with penalties, fees, and steep interest rates, consider negotiating a lower payment. The New York Times reports that while most card companies won’t admit it officially, they know when they’ve got a customer who can’t pay, and they’re much more willing to settle for a lower amount than they were a year ago.

U.S. Debt Collecting Being Outsourced To India

The New York Times looks at the blossoming foreign market for debt collection services, and describes a call center in India where the employees are reminded to bring up the 2008 stimulus checks when they call U.S. households, and where everyone claps three times when the first “deal” of the day is made (“”Rajesh, for $35 a month for three months,” the supervisor yells across the center.)

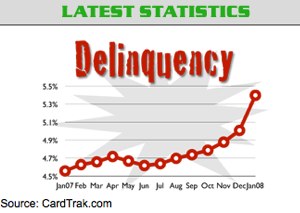

Late Payments On Credit Cards Highest In Three Years

CardTrack.com says “the percentage of people delinquent on their credit cards is the highest it’s been in three years,” according to CNN. Over the past year, U.S. consumers have charged “more than $2.2 trillion in purchases and cash advances.” The article gives the usual advice: Stop buying stuff!

Gas Company Abandons Plan To Report Delinquent Customers To Credit Agencies

Last fall, CenterPoint Energy—Minnesota’s largest natural gas supplier—announced it was considering reporting the payment histories of its customers to credit reporting agencies in an effort to reduce delinquencies.