Advanta Shuts Down Small Business Credit Card Accounts

UPDATE: Advanta Moves Up Credit Freeze Deadline, Still Doesn’t Notify Customers

Advanta, based in Spring House, Pa., is a company that provides credit cards to small businesses. A week ago, they announced that they are shutting down all credit cards to new charges on June 10—less than a month from the announcement. The reasons why, and an internal memo, inside.

According to a Philadelphia Inquirer article published on Sunday, Advanta has an interesting history:

Under Dennis Alter’s leadership since the early 1970s, the company shifted its focus from its original business of making installment loans to consumer credit cards, then to subprime mortgages, and then to small-business credit cards, growing aggressively each time and having to reinvent itself amid tough losses.

Facing a high default rate in a tough economic climate for all businesses, Advanta was in trouble. Last year, the company declined to apply for TARP funds, claiming that their capital and liquidity were just fine, thanks.

Now…well, not so much. The reason the credit lines have been shut down involves the early amortization of Advanta’s securitization trust. Let’s translate that into something resembling English. “Securitization” is, to oversimplify, the process of turning credit card debt into asset-backed securities which are in turn sold to investors. The asset, in this case, is the credit card loans that will be repaid in the future. Early amortization means that the principal of the bond will be paid back sooner than anticipated, in order to protect investors.

Back in the real world, this means that Advanta no longer has new investors’ money to turn around and lend to small business owners, and those small business owners are now left scrambling for a new credit card provider. “Shutting down the accounts will not accelerate payments required from cardholders on existing balances,” the press release helpfully explains. Isn’t that nice of them?

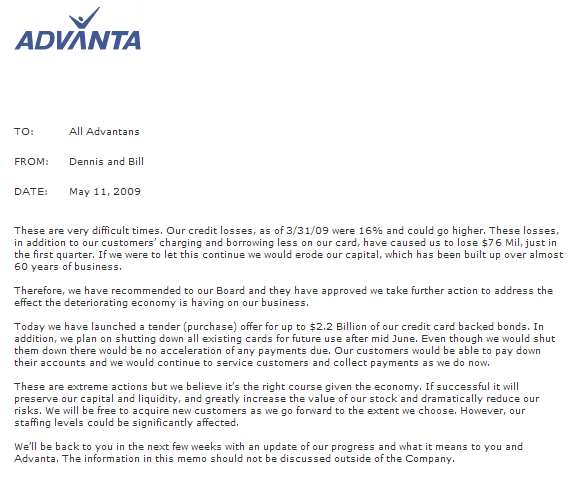

What’s in Advanta’s future? Re-invention in some form, if the past is any precedent. Here’s the memo that broke the news to company employees—I’m sorry, “Advantans”—provided by an anonymous source.

Has your business been affected by this? Let us know at tips@consumerist.com.

RELATED:

Video: How Credit Cards Become Bonds

Oh Noes It’s The “Shadow” Banking System

Advanta faces having to reinvent itself [Philadelphia Inquirer]

Advanta Announces Plan to Maximize Capital and Dramatically Reduce Risk [Press Release]

Credit Card Securitization Manual [FDIC]

Want more consumer news? Visit our parent organization, Consumer Reports, for the latest on scams, recalls, and other consumer issues.