If we’ve learned anything from Wells Fargo’s recent fake account fiasco, it’s that high-pressure sales tactics can lead to unethical and sometimes illegal behavior. But did similar sales quotas and incentives lead Morgan Stanley employees to push customers into unneeded loans? That’s a question regulators in Massachusetts aim to answer. [More]

securities

Morgan Stanley To Pay $2.6B To Settle Charges Of Selling Troubled Mortgages Leading Up To The Financial Crisis

The Department of Justice has struck a multi-billion dollar deal with Morgan Stanley in what is expected to be one of the last major steps in resolving investigations related to banks’ roles in the subprime mortgage crisis. [More]

Developers Spiking Homeowner Contracts With Hidden Resale Fee Covenants

Last April, Techdirt pointed out that a financial firm in Texas was trying to attach “private transfer fees” to homes, so that developers would get a little bit of each sale as it passed among owners in the years to come. It sounded crazy then–imagine having to pay royalties on clothes or furniture whenever you resold them–but the firm is aggressively expanding its plan and has signed up more than 5,000 developers across the country, reports the New York Times. If you buy a new house in the next decade, look for a “resale fee” covenant hidden in a separate document that might not be included in your closing papers or even require a signature. [More]

Did Paulson Violate The Fair Credit Reporting Act?

When the SEC announced its fraud complaint against Goldman Sachs, people noted that the penalties involved would involve money, not jail time. But an attorney writing for seekingalpha.com argued over the weekend that John Paulson, the hedge fund manager who worked with GS to create “synthetic derivatives,” accessed FICO scores to create his financial product and therefore violated the Fair Credit Reporting Act (FCRA)–which could mean a penalty as high as $1 billion, and even jail time if the FTC or Justice Department decides to go after him. [More]

SEC Wants Disclosures For Asset Backed Securities Written In Python

“Waterfall” provisions of asset backed securities are the rules that explain the flow of funds in the transaction, and they are are very hard to read. Blogger/professor Jayanth Varma calls them “horrendously complicated,” leading trustees to make mistakes or pull stunts that investors never expected. To remedy this, the SEC is proposing that the provisions be written in a programming language, filed on EDGAR, and made available as downloadable Python source code. [More]

Check For Unredeemed, Matured Government Bonds

A PR person just contacted us on behalf of the U.S. Treasury Department to point out that there are $16 billion in unredeemed bonds that are no longer earning interest. “Specifically, there are 40 million Series E savings bonds purchased between 1941 and 1978 that are over 30 years old and therefore have fully matured. They can be cashed out today for at least four times their face value.”

Hank Paulson Admits He Never Really Understood How Mortgage-Backed Securities Worked

Here’s more proof that the people who probably should have known how they were making all that housing bubble money never did—even those who personally made tens of millions off of it. The Business blog at The Atlantic notes a quote Hank Paulson, former Goldman Sachs CEO and Treasury Secretary, gave Newsweek: “I didn’t understand the retail market; I just wasn’t close to it.”

Battle Of The Most Hated Companies: Countrywide Sues AIG

Last year’s Worst Company in America winner, Countrywide Home Loans, has sued AIG for not paying their claim on losses from failed real estate loans that they had insured with the company.

Here's The Math Formula That Ruined Our Economy

Now if your kids ask you why they have to learn math, you can tell them, “Because if you don’t, you could ruin the global economy, you little beast.” Wired has just published an article that traces the entire clusterfrak back to a formula published in 2000 by a mathemetician working for JPMorgan Chase. Bankers loved its simplicity but completely misused it—despite warnings from academics that it was flawed—to turn pretty much every security into a triple-A, no-risk fabrication.

Why Did Everyone Buy This Stupid Toxic Debt? No One Understood It

Marketplace has the answer to one of the most troubling questions of our time. Why did people who are supposed to be smart buy all this stupid toxic risky debt? Apparently, it’s because they weren’t that smart, and they didn’t understand what they were buying or selling.

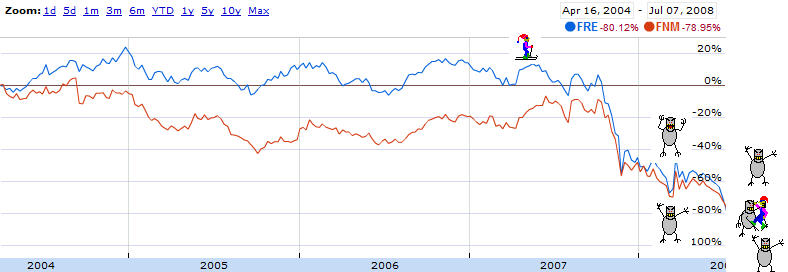

Mortgages Of The Apocalypse: Are Freddie And Fannie Going To Collapse?

Freddie Mac and Fannie Mae, the “government sponsored” enterprises that are supposed to bail us out of the current mortgage crisis, may be in danger of collapsing, according to William Poole, the former president of the St. Louis Federal Reserve, who told Bloomberg the companies are already “insolvent.”

3 Major Banks Start Fund To Shore Up Credit Market

Citigroup, Bank of America and JPMorgan Chase are joining forces to create a fund that will buy the debt from their mortgage-backed securities. The new group, assembled at the urging of the benevolent and mysterious Dr. Treasury Department, call themselves The Super Bank Friends. Their undying quest: fighting together to prevent the credit market from collapsing and creating a rift in the space-time continuum that would transport America back to 1929.