Yet another former Wells Fargo employee has come forward to talk about the high-pressure atmosphere created by the bank, where she says there were only two types of employees: those who sold customers on products they didn’t want, and those that were shown the door. [More]

wells fargo

Wells Fargo Employee: I Tried Talking Friends & Family Into Opening Accounts To Meet Sales Quotas

Former Wells Fargo Employees Sue Bank For $2.6B, Claiming Wrongful Termination

Days after lawmakers urged the Department of Labor to investigate Wells Fargo’s actions against employees after workers of the banking giant claimed they were fired and otherwise mistreated if they failed to meet strict sales quotas that ultimately resulted in the opening and closing of two million unauthorized consumer accounts, some former employees have come together to file a class action lawsuit against the company. [More]

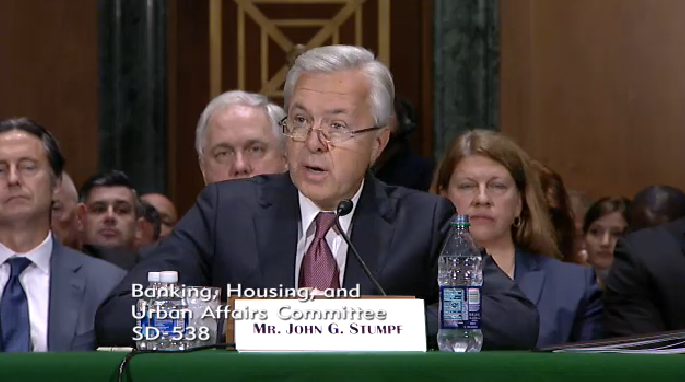

Senators To Wells Fargo CEO: Don’t Strip Wronged Customers Of Their Day In Court

Now that Wells Fargo is in the hot seat for allegedly pushing its employees to meet sales goals and quotas by opening millions of bogus accounts in customers’ names, will the bank use the anti-consumer terms of its customer contracts to get out of the inevitable class action lawsuits? A coalition of U.S. senators have written the bank’s CEO asking him to please not strip customers’ of their day in court. [More]

Senators Ask For Investigation Into Possible Wage, Hour Violations By Wells Fargo

To say that Wells Fargo has been having a bad few weeks might be an understatement: from being ordered to pay $185 million for the opening and closing of two million unauthorized consumer accounts to being party to federal investigations and being grilled on Capitol Hill. But it doesn’t look like things are going to get any easier for the company, as lawmakers are now urging a probe into whether it violated labor laws. [More]

Minnesota Vikings Let Wells Fargo Keep “Photobombing” Rooftop Signs After All

Maybe the Minnesota Vikings are feeling generous after a 2-0 start, but the NFL team is reportedly going to allow Wells Fargo to keep the two rooftop signs the bank allegedly erected to “photobomb” the Vikes’ new stadium — even though a court already ordered Wells to remove the signs. [More]

4 Things Former Wells Fargo Workers Revealed About Pressure To Meet Sales Goals

On Tuesday morning, Wells Fargo CEO John Stumpf will face the Senate Banking Committee to answer questions about how the bank’s high-pressure sales goals led a number of employees to fraudulently open up millions of unauthorized accounts. In advance of that hearing, a group of former Wells employees shared their insider views on this scandal. [More]

Wells Fargo Customers Accuse Bank Of Fraud, Negligence After Employees Open Fake Accounts

Now that Wells Fargo has admitted bank employees opened up more than two million unauthorized accounts, it’s no surprise that customers who may have been hit with fees and charges because of these bogus accounts are firing back at the bank with a lawsuit, but they might never get their day in court. [More]

U.S. Bank CEO Warns Employees: Make Fun Of Wells Fargo And You’re Fired

It’s been a (deservedly) bad month for Wells Fargo, what with the bank being ordered to pay $185 million in penalties because employees opened millions of bogus accounts, not to mention the ongoing Justice Department investigation. It would seem like a prime time for the competition to pile on the misery and steal away customers, but the CEO of U.S. Bank is demanding his staff not give into that temptation. [More]

Feds Investigating Wells Fargo After Employees Open 2 Million Fake Accounts

Financial regulators recently ordered Wells Fargo to pay $185 million to resolve allegations that the bank’s sales quotas and incentives pushed employees to open millions of unauthorized accounts, but that my not be the end of Wells’ troubles, with the U.S. Department of Justice now looking into the matter. [More]

Amazon No Longer Marketing Private Student Loans To Prime Members

Just a month after Amazon announced it would partner with Wells Fargo to offer Prime members a discount on private student loans, nearly all traces of the criticized program have disappeared. [More]

Airbnb Hosts Having Difficulty Refinancing Homes

Until recently, home loans generally covered two types of properties: primary residences or investments. That was before services like Airbnb allowed anyone with an extra room to make a bit of extra money by renting it out for short periods of time. This blurred line between “my house” and “my investment” is causing trouble for some homeowners when they go to refinance their mortgages. [More]

Why Are There Still So Many Bank Branches Everywhere? Because You Keep Going.

If you live in a certain kind of urban area, you see it all the time: those new mixed-use buildings go up, and on the ground floor of practically every single one there’s a bank branch or two. And if you thought to yourself, “Why are there so freaking many bank branches opening in an era when all the young folk living in those buildings bank by phone?” you’re not alone. But it turns out there’s an easy reason that bank branches keep proliferating: customers are using ’em. [More]