../../../..//2008/04/18/from-a-digg-comment-on/

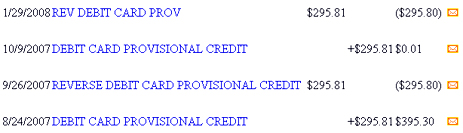

From a Digg comment on our post about a WaMu branch telling a man saying they didn’t have enough money on hand to let him withdraw $4200: “funny because i had the same experience at a Wamu. My wife had trouble cashing a $5000 check and we had to drive around to three branches until finally, after insisting continuously, that they finally cashed it!”