The scary headlines about WaMu’s stock slide have a few readers worrying if now is the time to pull their deposits. I’m a WaMu customer myself and I say no. For now, though I could be wrong, this just looks like more hot panic sweeping the market. First off, you’re FDIC-insured up to the first $100,000. You will get your money. Secondly…

washington mutual

The Fastest Way To Get A Human At Wamu

The quickest way to reach a human customer service rep at WamU: press 1, 6, and 2 on the successive menus. [TeresaCentric]

WaMu's Inability To Mail Letters Costs Man $3,400

Wamu’s fraud department has a problem sending letters. Just like another reader, Kristin, we posted about, Rob is having trouble disputing fraudulent charges on his account. He followed their every instruction, except to respond to the second letter WaMu sent out. How could Rob do such a foolish thing? Because it never showed up in his mailbox, a point, WaMu seems to think, is owing to, not their incompetence, but Rob’s general lassitude and weakness of character. Or something like that. Here’s Rob’s story…

WaMu Tells You To Stop Paying Your Mortgage And Apply For Help, Then Forecloses On You

WaMu, despite all their big talk about helping homeowners avoid foreclosure, is apparently too overwhelmed with a tsunami of defaulted loans to call their customers back, let alone help them stay in their homes. Meet Lori and Mark Pestana. They have a $275,000 fixed rate mortgage with WaMu as their servicer. In August 2007, the Pestanas could not make a payment on their loan. They considered dipping into their retirement savings, but WaMu’s website offered an alternative:

WaMu Online Banking Treats You Like A Criminal

With all the focus on the girl rocketing across the desert in a supersonic purple dildo, Washington Mutual forgot to mention one thing. When you sign up for a new account with them online instead of in person, be prepared to be treated like a criminal at every turn. Here’s Brett’s story of why he and his partner don’t bank with WaMu, and never will again…

Banks Put 8-Week Hold On IndyMac Checks

People who got their money from IndyMac are facing new challenges as other banks put extended holds on releasing the funds when the checks are deposited. WaMu is putting 8-week holds on the checks. Wells Fargo is putting holds on amounts over $5,000. If you deposit more than that, Wells Fargo will only let you have access to the first $5,000. The Office of Thrift Supervision is looking into whether this is ok or not. Good, we needed something like this, that panic wasn’t looking frothy enough.

WaMu: "It Is Not My Problem If You Did Not Plan To Pay Your Bills On Time"

WaMu goes out of its way to convince you that it is staffed by friendly, outgoing people who want to help you if something goes wrong. Their “About” page on the WaMu website says: “We’re informal, friendly and fun. We take our customers’ money seriously, but not ourselves.” We suspect that reader Drew would disagree with the whole “friendly” part of that sentence. He arrived home a day late from a business trip to Europe and was in a rush to pay his rent before it was due. He made it to the WaMu branch 5 minutes before it closed, but it was already locked.

Reach Washington Mutual Executive Customer Service

If you’re trying to get through to Washington Mutual and regular customer service isn’t helping you, give these numbers for Executive Customer Service, a very high-up customer service team with superpowers to solve customer problems at any and all levels, a try. Be calm, polite, professional, and able to state your case in 1-2 sentences. It’s a good idea to read this post on dealing with executive customer service first. The info really works, read this lady’s story about how contacting WaMu executive customer service saved her house from foreclosure.

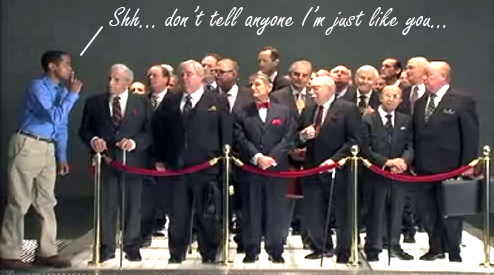

WaMu Banker Confessions, Part Two

Another Washington Mutual insider has stepped forward with a slew of tips to help save your ass from overdraft fees, check deposit holds, and talking to Filipino bankers. Details, inside…

WaMu Doesn't Care You Could Be Stranded In Himalayas With No Money

Lila got her Washington Mutual debit card pickpocketed while traveling in India. Naturally, her account was drained. She filed a fraud report with Washington Mutual and a got a temporary credit issued on the account while the case was investigated. Less than 3 days later, the credit was reversed without warning. It’s not WaMu’s policy to reverse provisional credits in these matters before 30 days have passed to investigate, and not without warning. None of the various reps and fraud personal could explain why this happened, nor could they give her her money back, nor could they connect her with anyone who would or could do anything. Supervisors are mysteriously never around. It’s a good thing she already had some Rupees in hand when the theft occured, or Lila could have been stranded in the Himalayas while WaMu reps were busy playing Snood. Her complaint letter, and our advice on how to be more effective, inside…

WaMu Backs Down, Returns The $1500 To Bill's Bank Account

Bill, whose small business checking account had been inappropriately drafted $1500, sent us the following email late last night:

Customer Gets Slapped With "Excessive Activity" Fee For Messing With Savings Account Too Much

It Takes Two Subpoenas And A Contempt Threat To Get A Response From WaMu

Washington Mutual will give you a copy of the check that you’ve been requesting for a year, but first you will need to subpoena them twice and attempt to have them held in contempt of court. That’s what one reader experienced when her employer, a law firm, needed a document from the megabank. As she puts it: “If a law firm with the power of a subpoena behind them can’t get WaMu to cough up a document in a timely manner without a massive amount of headache, I’d hate to see what the average consumer has to deal with.”

WaMu Reverses Decision To Exclude Subprime Losses From Executive Bonus Calculations

Activist shareholders forced big changes at a Washington Mutual stockholder’s meeting last week, especially the reversal of a much-criticized decision to exclude subprime losses when calculating executive bonus pay. Washington Mutual was one of the lenders cavorting the most eagerly in the refuse trough of subprime lending, and has endured some of the largest losses as a result. Other key shareholder wins included splitting the CEO and Chairman position, and the resignation of several key board members. Nice job, activist shareholders, way to wake the hell up long after the damage was done.