Whoever came up with the name “courtesy overdraft fee” is one smart cookie. They figured out a way to let you do something you don’t want to do, charge you a fee, and make it sound like they’re doing you a favor. WaMu is one of the few banks that let you…

washington mutual

WaMu And Wachovia Weren't On Texas-Ratio Deathwatch List

Back in July, after IndyMac went under, we posted a list of ten banks that could be “the next to go under.” Interestingly enough, as reader Irene noticed, neither Washington Mutual or Wachovia, two major, sub-prime mortgage saddled, banks that got taken over recently, made the list. The list was based on analyzing the banks’ “Texas-Ratio,” basically the ratio of loans they’ve made to capital they had on hand. None of the banks on the Texas-Ratio watch list, like “The State Bank of Lebo” of Lebo, KS, or “First Priority Bank” of Bradenton, FL, can be found on another list either: the list of banks you’ve heard talked about in the news. Well here’s a newsflash that the media elite passed over while buffing their loafers with their fancy college degrees: The State Bank of Lebo now has an ATM. It’s inside Casey’s General Store. Put that in your pipe and smoke it!

WaMu CEO Could Get $18 Million+ For 3 Weeks Work

For three weeks, Alan Fishman was the CEO of WaMu before it went bust. For his excellent stewardship during these turbulent times, Fishman is eligible for at least $18 million, thanks to his signing bonus. Not blaming the guy, the place was screwed well before he got there, but, man, $6,000,000 a week, not a bad gig, eh?

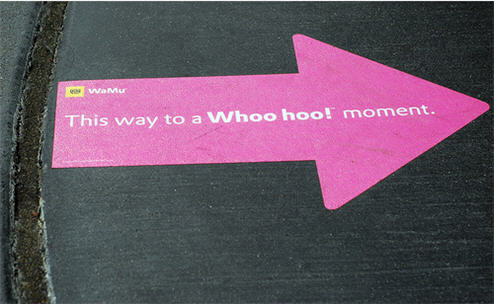

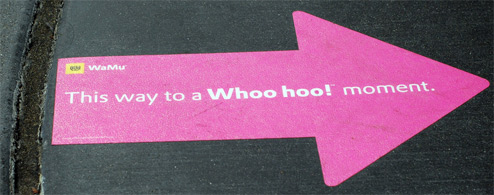

VIDEO: WaMu Ad Has New, Dark, Meaning

Now that Washington Mutual completely imploded on its garbage-pile avalanche of home mortgages, this old WaMu commercial from August 2006, starring Scott Adsit pre-30 Rock, takes on a new, darker, meaning…

Insiders: Probable 1-Year Timeline For Customers In WaMu To Chase Transfer

One of our commenters, mavrick67, who says they have over 20 years banking experience and have witnessed 8 takeovers throughout the years, provided a timeline as to what you can expect.

WaMu Customers, Office of the Comptroller of the Currency Is Your New Regulator

As an aside, WaMu’s charter was under the Office of Thrift Supervision (OTS). Chase’s bank regulator is the Office of the Comptroller of the Currency (OCC). Whether being a Chase customer was your choice or not, if you ever have a major complaint about Chase regarding what you feel is on the bank’s part malfeasance, you’ll want to send it to the OCC.

Now That The Largest Bank Failure In U.S. History Is Over, Is Wachovia Next?

The collapse of Washington Mutual and the FDIC-engineered fire sale to JPMorgan Chase has people worried — about Wachovia. Wachovia’s stock is down 45% for the week, and 27% today as bailout talks stalled in Washington and WaMu held a garage sale at the FDIC.

WaMu Fails, Feds Seize It, JP Morgan Buys It, Your Accounts Are Ok

The Feds seized Washington Mutual and JP Morgan bought it, but don’t fret, all your accounts ok. Online banking is completely functional. If you held WaMu stock, on the other hand, it’s now effectively worthless. Depositors began fleeing WaMu on September 15, the day Lehman Brothers filed for bankruptcy. In all, they took out about 9% of WaMu’s deposits, or $16.7 billion. Regulators say this left WaMu without enough capital to keep functioning. The shakedown and bailout continues apace. What new surprises will the government bring us today, Monday, or even over the weekend? At least this one didn’t require taxpayers to foot the bill.

WaMu Downgraded To Even Junkier Junk, Still Looking For A Life Preserver

The Wall Street Journal is reporting that WaMu is courting several private equity firms about a potential takeover after their debt was downgraded even further into junk status by Standard & Poor’s. Once merely “junk,” WaMu is apparently, “so junky we are not even kidding around about it anymore.”

WaMu Lent $24.5 Million To One Shady Family Of ID Thieving House Flippers

If you’re expecting this story to be about the worst bunch of shady house flippers from the height of the credit boom, you’ll be disappointed. This story is about a family that took WaMu for huge amounts of money by buying homes and selling them to their friends and other family members for grossly inflated prices — and pocketing the profit while the homes fell into foreclosure. They did this as the California real estate market was imploding, and after WaMu had announced that it had tightened its lending standards.

../../../..//2008/09/18/passed-by-a-wamu-on/

Passed by a WaMu on my lunchbreak as I wait to see if I will have jury duty – the place looked no busier than a normal bank during lunch hour. No runs on the bank here in Brooklyn so far.

WaMu Direct Deposit Customers: Print Your Statements

For Washington Mutual direct deposit customers, to protect yourself no matter who takes over and how good they are at handling WaMu’s computer systems, Carmen Wong Ulrich, host of CNBC’s personal finance show “On The Money,” wants you to hit Print. When that direct deposit hits your account, she wants you to go to your WaMu online banking account and make a printout of your statement. That way if it somehow gets lost in the shuffle, “go right up to the bank with your paperwork.” It would probably get eventually sorted out anyway, but this way can help expedite things, just in case.

Wrigley Field Unloads WaMu Swag On Fans Before Its Too Late

My husband and I were at the Cubs/Brewers game at Wrigley Field last night. At the door we were surprised to be given WaMu promotional string backpack/bags. This was in addition to the announced promotion, Carlos Zambrano bobbleheads.

Favorite Comment Of The Day

laserjobs: The way things are going the FDIC will probably end up with WaMu. So as long as you are under the FDIC limits you will probably be with the safest bank around soon: WaMu Federal.

WaMu Begins To Sell Itself

WaMu has begun to try to sell itself. So far, no takers. If no one buys it, one of two things will happen. Either it will be placed into a conservatorship, like IndyMac, or form a bridge bank, a kind of temporary bank. So the question for depositors is: wait to find out who your new masters are, or pull out now and decide for yourself?

Regulators Seek WaMu Suitor

Regulators are trotting around Washington Mutual trying to get banks interested in buying it. It’s sort of like in the old days when the local beauty queen, last scion of the largest landowner in the county, would get maimed in a horrible combine accident and the town elders would trot her catatonic body around to arrange a marriage so all her fields wouldn’t turn fallow and destroy the local economy for years to come. Wasn’t that given treatment in Faulkner? As I Lay Hemmoraghing Equity?

WaMu's Stock Bumps Upwards

WaMu’s stock is up this morning after the new CEO said the S&P rating downgrade to junk was based on “market conditions” and not their financial condition, and an unsourced Daily Mail article said Chase was going to bid for the beleaguered thrift.

Chase to WaMu Customer: "God Bless Your Soul"

I went into a Brooklyn Chase today to see if, in the wake of the concerns about them going bust, Washington Mutual customers were switching over. I went up to the manager and said, “I’m a WaMu customer —” “—God bless your soul,” he interjected.