The balls of the famous Wall Street bull got painted blue today. Before they were cleaned, a Gothamist reader snapped this pic. In terms of the creative comic output it’s sparked, this may be the funniest economic meltdown ever. [More]

wall street

5 More Wall Street Dudes Who Deserve A Punch In The Face

WallStreetFighter has listed 5 more Wall Street dudes that deserve the old “Dick Fuld” right in the face. Guess which Wall Street loser is most punchable?

Lehman Brothers CEO Got Punched In The Face

Dick “It Wasn’t My Fault” Fuld, the CEO of bankrupt investment bank Lehman Brothers, (seen here being heckled after testifying on Capitol Hill) was apparently punched in the face while working out in Lehman gym on the Sunday following the bankruptcy, according to CNBC’s Vicki Ward.

"Funny" Economic-Meltdown-Themed Marketing Fails To Impress Consumers

The Wall Street Journal says that big discounts and hilarious bailout-themed marketing has failed impress consumers, and retailers are expecting sales to worsen before they get better. Restoration Hardware launched a “bailout” themed promotion offering $100 off purchases of $400 or more at the home furnishings chain, while Steve Madden posted signs depicting “a declining stock chart and implored shoppers to “Sell Stocks, Buy Shoes.”

Not So Fast: Judge Blocks Wachovia Sale To Wells Fargo, Citibank Rejoices

Tsk tsk, Wells Fargo. You should’ve known that stealing Citibank’s unspoiled bride at the alter was going to draw a bitter legal challenge. Late last night, Citibank’s team of repo-lawyers claimed a partial victory, announcing that a New York judge has agreed to block Wachovia’s sale. Citibank is also demanding $60 billion from Wells Fargo for interfering with the deal.

../../../..//2008/10/03/those-of-you-interested-in/

Those of you interested in watching the bailout bill debate in the House can see it streaming on CSPAN, or read a liveblog on the NYT.

Giddyup! Wells Fargo Rides In And Steals Wachovia From Citibank!

Attention Wachovia customers: Wells Fargo just rode on on that stagecoach thing of theirs and stole your bank from Citibank, says the NYT. Rather than pick apart the pieces of Wachovia, Wells Fargo is going to buy the whole darn thing.

Learn About Past Recessions With This Cool Interactive Graph

So you’re probably sitting around thinking, “I want to know more about stagflation, but I want to have fun clicking stuff on the internet, too.” Right? No? Who cares. We’re still going to direct your attention to this neat interactive graph from the Harvard Business Review.

../../../..//2008/10/01/in-one-brain-melting-two-minute-clip/

In one brain-melting two-minute clip, watch all the media frenzy, punditry, and cable-news excitement of the financial meltdown, courtesy of CNN’s own Rick “The Twitter Board Is Blowing Up!” Sanchez. [YouTube]

10 Things To Expect From The New Post-Apocalyptic Economy

Kiplinger’s has put together a list of 10 things that you, fair consumer, can expect from our new post-wall-street-apocalypse economy. Should you be scared? Maybe.

Understanding The Money Meltdown In 10 Easy Links

After reading these 10 links, the I Will Teach You To Be Rich blog believes they will make you smarter than 99% of other people about the financial crisis, what it means, and what to do about it. [I Will Teach You To Be Rich]

How Not To Panic About The Stock Market

Seeing the greatest single-day point drop in the Dow is probably not the kind of history anyone wants to be living through right now. The failure of the bailout bill to pass caused a big freakout in the market, which thought we were going to get a bailout today. But before you click the button to transfer all your investments to 0% return T-bonds (aka I give up on investing), first ask yourself if that’s really in line with your long-term investment goals. Secondly, realize that point-wise it might the greatest drop, but it’s not the greatest drop percentage-wise. In other words, we’ve been here, and bounced back, before. If you’re decades away from retirement, today’s plunge is a buying opportunity. Here are some thoughts about fighting the urge to panic.

Congressional Negotiators Strike Bailout Deal

Congressional negotiators agreed in principle last night to a $700 billion bailout package. The bill is currently being transformed into draft legislation that can be voted on tonight tomorrow.

BREAKING: Congress Has A Bailout Plan

CNN says that a deal has been reached — sort of. A bipartisan counterproposal to Bush’s $700 billion bailout plan has been drafted. The plan calls for caps on executive pay, and provides oversight on the Treasury’s actions.

Poll: Do You Support The Bailout?

Lawmakers are hashing out the details of a huge taxpayer-funded bailout of Wall Street in an attempt to keep afloat the system of banks whose willingness to lend drives this economy’s growth. Constituents have flooded their representatives phone lines and inboxes with with their heated reactions. What do you think?(Photo: Getty)

Treasury Says It Will Agree To Cap Wall Street Executive Pay

One of the major sticking points of the inevitable Wall Street bailout was executive pay — but the New York Times says that Treasury Secretary and former CEO of Goldman Sachs, Henry M. Paulson Jr., has agreed to compensation caps for the executives of firms that benefit from the bailout.

What Else Can $700 Billion Buy?

A while back the New York Times was concerned about the cost of the Iraq War and published some estimates of what else we could have bought with that money. We didn’t find that very interesting at the time, but now, while trying to wrap our minds around just how effing huge the $700 billion proposed bailout of Wall Street really is, we decided to revisit that article. Here’s what you can buy for less than $700 billion, according to the New York Times.

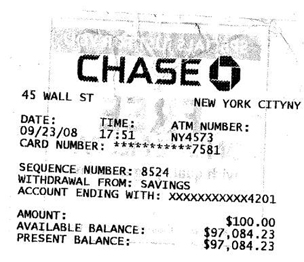

Found Wall Street ATM Receipt Shows $97,084.23 Balance

With all the concern about unemployed Wall Street sloggers and whether they’ll be able to keep up their leveraged lifestyle, or even get an apartment, this ATM receipt a reader’s coworker found sitting in a Wall Street ATM with a balance of $97,084.23 shows there’s at least one person who is going to be okay. Plus, this guy knows what he’s doing; note how the balance is just under the $100,000 limit for full FDIC coverage.