If you’re looking to see the collapse of Bear Stearns explained using the British defeat at Gallipoli as an example of disastrous overconfidence, you can do no better than Malcolm Gladwell‘s new piece in the New Yorker. Be forewarned, however, that Wall Street apparently thinks it’s a load of crap.

wall street meltdown

Bank Of America CEO: We Had To Acquire Merrill Lynch To Save The Economy

Are you a Bank of America shareholder who is angry at CEO, (and former chairman of the board) Ken Lewis for going ahead with the Merrill Lynch deal? Well, you’re just mean. It wasn’t his fault. At least, that’s what he’s just testified before the House Committee on Oversight and Government Reform.

Does Anyone Have $34 Billion For Bank Of America?

Kenneth Lewis is probably having a pretty crappy day. The government just told him that he needs to find $33.9 billion in order to “withstand any worsening of the economic downturn.” Anybody got any spare change?

Treasury Secretary Is Cool With Firing Bank CEOs

Hey, bank CEOs! Need “exceptional” help from the U.S. Government? Get ready to be fired. Treasury Secretary Tim Geithner told “Face the Nation” that he was open to firing bank CEOs in much the same way that GM chief Rick Wagoner was recently shown the door.

NY AG To Find Out Who Got The Merrill Bonus Money "By Whatever Means Is Necessary"

The NY AG has served Bank of America with a subpoena after they refused to release the names of the individuals who received over $3 billion in bonuses while Merrill Lynch was hemorrhaging money.

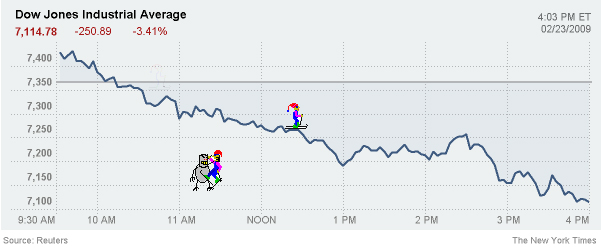

Freak Out Continues: Markets Close At Lowest Level Since 1997

Bad day on Wall Street today, folks. The S&P 500 closed at the lowest level since April 1997.

Don't Miss Frontline's "Inside The Meltdown" Tonight

Tonight at 9 eastern Frontline’s new documentary “Inside The Meltdown” will debut on PBS and online. We’ve only seen the trailer, but the press release makes it sound like the scariest documentary in the history of the universe.

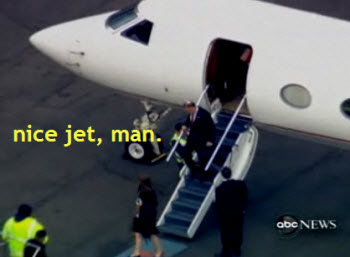

Gee, How Much Does A Bailed Out Executive Make, Anyway?

The New York Times is reporting that the Obama administration announced a $500,000 pay cap that prohibits bonuses for any companies that take additional taxpayer assistance.

Lehman Brothers CEO "Sold" $14 Million House To His Wife For $100

Dick Fuld is in the news again — this time for selling a $14 million Florida house to his wife for $100. No one is quite sure why he felt he needed to do this, but some are speculating that he may be trying to hide assets from Lehman Brothers shareholders in case they are getting ready to sue to him.

Citibank Teaches Us How To Destroy A $244 Billion Banking Institution

Only two short years ago, Citibank was worth $244 billion. Now, after its stock lost half of its value in just the past week, the bank is estimated to be worth $20.5 billion. What happened? The New York Times attempted to answer that question Saturday, and it pointed the finger at the usual suspects — conflicts of interest between those who were supposed to manage risk — and those who stood to benefit from making risky bets.

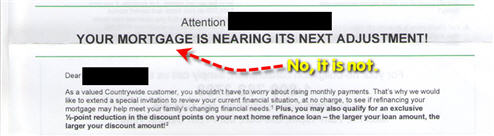

Countrywide To Fixed Rate Customer: Your Mortgage Is About To Adjust!

Countrywide either doesn’t know, or doesn’t care that reader Graham has a fixed rate mortgage, because they keep sending him “notices” that his mortgage is about to “adjust.”

10 Things That Are Going Right For Consumers

Kiplinger’s is more optimistic than we are, so they had the cheerful idea to put together a list of 10 things that are going right for consumers — despite the financial apocalypse. Hooray!

Treasury Expected To Pump $250 Billion Into Banks In Exchange For Stocks

The Treasury Department is expected to announce that it will be pumping $250 billion into banks both large and small tomorrow… and the FDIC is expected to offer an unlimited guarantee on bank deposits in accounts that do not bear interest.

Government May Begin Buying Bank Stock Within Weeks

As it is now apparent that the credit crisis has spread to the global economy and has not been contained in any way, the Bush Administration is considering an option included in the $700 billion dollar bailout package that would allow them to invest directly in banks — buying preferred stock in exchange for a “cash injection.” White House spokesperson Dana Perino said taking partial ownership of banks and other moves associated with the financial rescue plan would not be “part of [Bush’s] natural instincts,” according to the NYT, but acknowledged that the situation has gotten sufficiently dire as to warrant a change of heart.

Backlash: Outrage Forces AIG To Cancel Second Pricey Hotel Party

AIG has decided to cancel a second pricey hotel party for their brokers after receiving another loan from the Federal Reserve for $37.8 billion dollars. AIG defended throwing a $400,000 week long bash for its top independent insurance agents and some AIG employees immediately after the bailout — claiming that these events were “standard industry practice” and that they must continue. They announced that they would go ahead with another event at the Half Moon Bay Ritz-Carlton in northern California. 50 AIG employees were expected to attend.

Bailout Plan Gets Tax Cuts And Other "Sweeteners" To Help It Pass

Despite the fact that unprecedented outcry from taxpayers overwhelmed the servers hosting the Web sites of the House and its members, forcing administrators to limit e-mails from the public for the first time ever, the steady push toward a bailout plan continues. The newest version of the plain contains what CNN is calling “sweeteners” — tax cuts and health care reforms that are meant to appeal to the holdouts.

March Madness-Style Bracket Makes Bank Mergers Fun

TechCrunch has posted this “March Madness” style bracket of the recent financial meltdown. It was reportedly created by a general partner at Sansome Partners named Mark Slavonia, says TC.